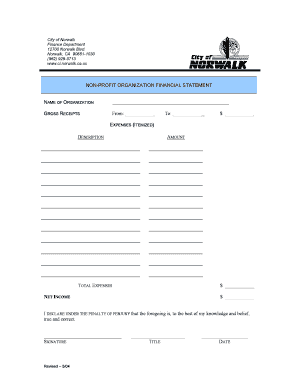

Non Profit Financial Statement Form

What is the Non Profit Financial Statement

A non profit financial statement is a formal record that summarizes the financial activities and position of a non profit organization. This document typically includes key components such as the statement of financial position, statement of activities, and statement of cash flows. These elements provide insights into the organization’s financial health, detailing revenues, expenses, assets, and liabilities. Understanding this statement is crucial for stakeholders, including donors, board members, and regulatory bodies, as it reflects the organization’s ability to fulfill its mission and manage its resources effectively.

Key Elements of the Non Profit Financial Statement

Several critical components make up a non profit financial statement, each serving a unique purpose:

- Statement of Financial Position: This section outlines the organization’s assets, liabilities, and net assets at a specific point in time, offering a snapshot of financial stability.

- Statement of Activities: This part details the revenues and expenses over a period, showing how funds are generated and spent, which is vital for assessing operational efficiency.

- Statement of Cash Flows: This statement tracks the flow of cash in and out of the organization, helping to understand liquidity and cash management.

- Notes to Financial Statements: These provide additional context and explanations regarding accounting policies, specific transactions, and other relevant information.

Steps to Complete the Non Profit Financial Statement

Completing a non profit financial statement involves several key steps to ensure accuracy and compliance:

- Gather Financial Data: Collect all relevant financial records, including receipts, invoices, and bank statements.

- Classify Transactions: Organize transactions into appropriate categories, such as revenue, expenses, assets, and liabilities.

- Prepare Individual Statements: Draft the statement of financial position, statement of activities, and statement of cash flows based on the classified data.

- Review and Adjust: Conduct a thorough review to identify discrepancies and make necessary adjustments to ensure accuracy.

- Finalize and Approve: Present the completed financial statement to the board for approval before distribution to stakeholders.

Legal Use of the Non Profit Financial Statement

The non profit financial statement serves various legal and regulatory purposes. It is often required for compliance with federal and state regulations, particularly for tax-exempt status under IRS guidelines. Organizations must ensure that their financial statements adhere to Generally Accepted Accounting Principles (GAAP) to maintain transparency and accountability. Additionally, these statements may be subject to audits, which require accuracy and completeness to avoid penalties or loss of tax-exempt status.

IRS Guidelines

The Internal Revenue Service (IRS) has specific guidelines regarding the financial statements of non profit organizations. These guidelines dictate how organizations must report their financial activities, including the requirement to file Form 990 annually. This form provides the IRS with detailed information about the organization’s financial health, governance, and compliance with tax laws. Adhering to these guidelines is essential for maintaining tax-exempt status and ensuring continued support from donors and grant-making entities.

Form Submission Methods

Non profit organizations can submit their financial statements through various methods, depending on the requirements of stakeholders and regulatory bodies. Common submission methods include:

- Online Submission: Many organizations choose to file their financial statements electronically through designated platforms, which can streamline the process and reduce paperwork.

- Mail: Physical copies of the financial statements can be sent to relevant authorities or stakeholders, ensuring that all necessary documentation is provided.

- In-Person Submission: Some organizations may opt to deliver their financial statements in person, particularly when meeting with donors or regulatory representatives.

Quick guide on how to complete non profit financial statement

Effortlessly prepare Non Profit Financial Statement on any device

Digital document management has become increasingly popular among companies and individuals. It presents a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents quickly without interruptions. Handle Non Profit Financial Statement on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Non Profit Financial Statement without hassle

- Obtain Non Profit Financial Statement and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Enclose key sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional pen-and-ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Adjust and eSign Non Profit Financial Statement and guarantee seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How can airSlate SignNow benefit my non profit organization financial management?

airSlate SignNow offers streamlined document management that is essential for non profit organization financial operations. By digitizing your signing process, you save time and reduce paperwork, allowing more focus on your financial goals. Embrace efficiency and transparency in your financial dealings with our user-friendly solution.

-

What pricing options are available for non profit organizations using airSlate SignNow?

We understand the budget constraints often faced by non profit organizations. That's why airSlate SignNow offers special pricing tailored for non profit organization financial needs. Contact our sales team to learn more about discounts and offers that can help your organization save costs while benefiting from our platform.

-

What features does airSlate SignNow include for non profit organization financial tasks?

airSlate SignNow includes a variety of features such as customizable templates, secure eSigning, and automated workflows tailored for non profit organization financial tasks. These tools enable you to create, send, and store financial documents efficiently. The ease of use ensures your team can quickly adopt these features without extensive training.

-

Is airSlate SignNow compliant with regulations for non profit organization financial transactions?

Yes, airSlate SignNow complies with all necessary regulations for non profit organization financial transactions. Our platform follows strict security protocols to protect sensitive financial information, ensuring that your organization meets compliance standards effortlessly. This assurance allows you to focus on your mission while we handle security.

-

Can airSlate SignNow integrate with other tools used by non profit organizations for financial management?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and financial management software commonly used by non profit organizations. Whether it's QuickBooks or Salesforce, our integrations streamline your workflow, making it easier to manage your non profit organization financial processes without disruption.

-

How does airSlate SignNow improve collaboration within non profit organizations for financial projects?

Collaboration is key within non profit organization financial projects, and airSlate SignNow enhances this by allowing multiple users to access and sign documents in real-time. Our platform ensures that all team members can contribute and stay aligned on financial matters, increasing accountability and promoting teamwork. Simplified communication leads to better financial outcomes.

-

What security measures does airSlate SignNow implement for non profit organization financial documents?

Security is a top priority for airSlate SignNow, especially regarding non profit organization financial documents. We use advanced encryption methods and secure access protocols to ensure that all your sensitive financial data remains protected. Additionally, regular audits help us maintain compliance with the highest security standards, giving you peace of mind.

Get more for Non Profit Financial Statement

Find out other Non Profit Financial Statement

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template