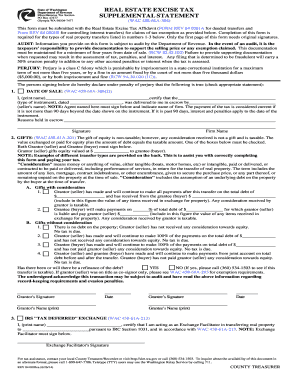

Real Estate Excise Tax Supplemental Statement Form

What is the Real Estate Excise Tax Supplemental Statement

The Real Estate Excise Tax Supplemental Statement is a crucial document used in Washington State for reporting the sale of real property. This form is essential for ensuring compliance with state tax regulations when transferring ownership of real estate. It provides detailed information about the transaction, including the sale price, property description, and the parties involved. This statement helps the state assess the appropriate excise tax due on the sale, which is based on the sale price of the property.

How to use the Real Estate Excise Tax Supplemental Statement

Using the Real Estate Excise Tax Supplemental Statement involves several steps to ensure accurate reporting of the property sale. First, obtain the form from the appropriate state or local authority. Next, fill out the form with accurate details about the transaction, including the seller's and buyer's information, property details, and sale price. Once completed, the form must be submitted along with the necessary payment for the excise tax. It is important to keep a copy of the submitted form for your records.

Steps to complete the Real Estate Excise Tax Supplemental Statement

Completing the Real Estate Excise Tax Supplemental Statement requires careful attention to detail. Follow these steps:

- Obtain the form from your local county assessor's office or online.

- Enter the seller's and buyer's names, addresses, and contact information.

- Provide a detailed description of the property, including the address and parcel number.

- Indicate the sale price of the property accurately.

- Sign and date the form to certify the information is correct.

- Submit the form to the appropriate local authority along with the excise tax payment.

Legal use of the Real Estate Excise Tax Supplemental Statement

The Real Estate Excise Tax Supplemental Statement is legally binding and must be filled out accurately to avoid penalties. It serves as a formal declaration of the property transfer and the associated tax obligations. Failure to submit this form or providing false information can result in fines or legal repercussions. It is essential to adhere to the guidelines set forth by Washington State law to ensure compliance and protect both the buyer's and seller's interests.

Key elements of the Real Estate Excise Tax Supplemental Statement

Several key elements are vital to the Real Estate Excise Tax Supplemental Statement. These include:

- Property Information: Accurate details about the property being sold, including its legal description.

- Sale Price: The agreed-upon price for the transaction, which determines the tax amount.

- Parties Involved: Information about the seller and buyer, including names and addresses.

- Signature: Required signatures from both parties to validate the transaction.

Form Submission Methods

The Real Estate Excise Tax Supplemental Statement can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Many counties offer online portals for electronic filing.

- Mail: The completed form can be mailed to the local tax office.

- In-Person: You may also submit the form in person at your local county office.

Penalties for Non-Compliance

Failure to comply with the requirements of the Real Estate Excise Tax Supplemental Statement can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to ensure that all information is accurate and submitted on time to avoid these consequences. Understanding the importance of this form can help both buyers and sellers navigate the real estate transaction process smoothly.

Quick guide on how to complete real estate excise tax supplemental statement

Effortlessly Prepare Real Estate Excise Tax Supplemental Statement on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Real Estate Excise Tax Supplemental Statement on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

How to Modify and eSign Real Estate Excise Tax Supplemental Statement With Ease

- Obtain Real Estate Excise Tax Supplemental Statement and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and then click the Done button to finalize your changes.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors necessitating new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Real Estate Excise Tax Supplemental Statement and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of airSlate SignNow in managing tax estate documents in Washington?

airSlate SignNow offers a streamlined solution for managing tax estate documents in Washington. It allows users to easily send, receive, and eSign important documents, ensuring compliance with local regulations. This efficient process helps to reduce delays and minimize the risk of errors associated with traditional methods.

-

How can airSlate SignNow help with estate tax filing in Washington?

Using airSlate SignNow can simplify the estate tax filing process in Washington by facilitating the electronic signing of documents. Users can quickly gather necessary signatures and share documentation securely, enabling timely submissions. This ensures that you meet the critical deadlines imposed by tax authorities without any hassle.

-

What features does airSlate SignNow offer for tax estate management in Washington?

airSlate SignNow provides essential features such as customizable templates, cloud storage, and secure eSignature capabilities for handling tax estate documents in Washington. These tools make it easier to prepare, sign, and track all necessary documentation. Additionally, the user-friendly interface supports both individuals and businesses in managing their estate tax needs efficiently.

-

Is airSlate SignNow affordable for small businesses dealing with estate taxes in Washington?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing estate taxes in Washington. With various pricing plans available, you can choose an option that suits your budget while still benefiting from comprehensive features. This affordability makes it accessible for all types of businesses looking to streamline their tax estate processes.

-

What integrations does airSlate SignNow offer for tax estate planning in Washington?

airSlate SignNow integrates seamlessly with various software solutions that are commonly used in estate planning and tax management in Washington. You can connect it with popular CRM systems, document management tools, and accounting software to enhance your workflow. These integrations ensure that your data remains organized and easily accessible during the tax estate process.

-

Can airSlate SignNow help expedite the estate tax process in Washington?

Absolutely! airSlate SignNow can signNowly expedite the estate tax process in Washington by reducing the time it takes to collect signatures and distribute documents. The ability to track the status of each document in real-time further enhances efficiency, allowing for quicker preparation and filing of estate tax forms.

-

How does airSlate SignNow ensure the security of tax estate documents in Washington?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive tax estate documents in Washington. The platform utilizes advanced encryption and authentication measures to protect user data and ensure that only authorized individuals can access sensitive information. This commitment to security helps users feel confident in managing their estate tax matters digitally.

Get more for Real Estate Excise Tax Supplemental Statement

Find out other Real Estate Excise Tax Supplemental Statement

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online