Form 1120f 2015

What is the Form 1120-F

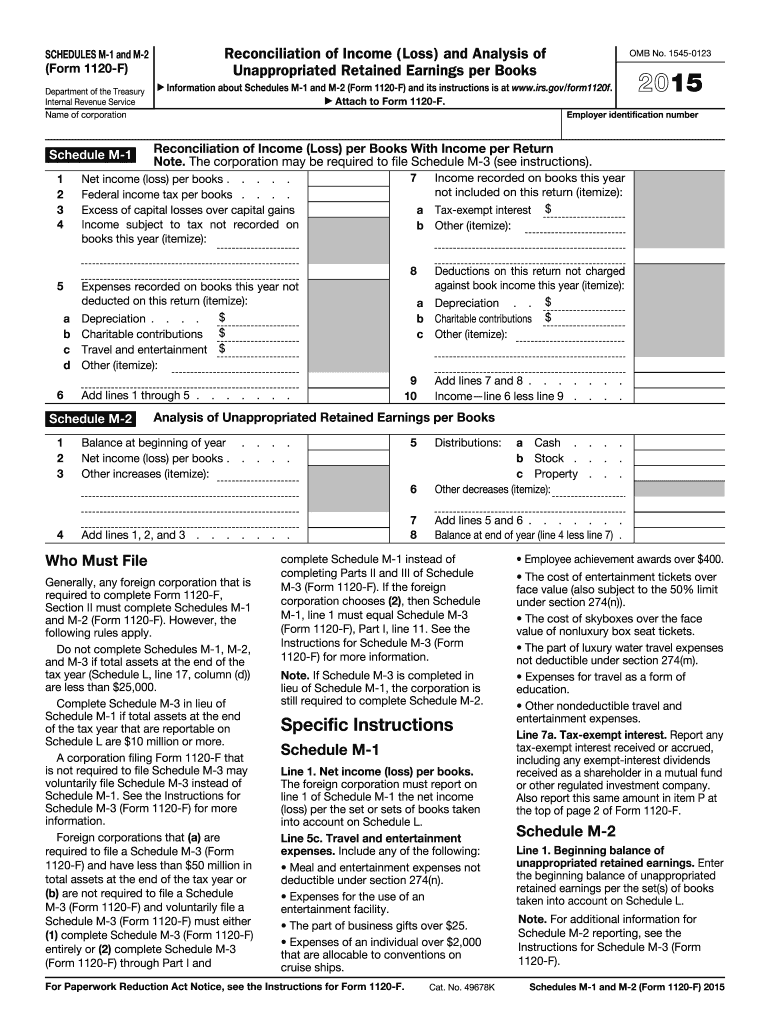

The Form 1120-F is a U.S. tax form specifically designed for foreign corporations to report their income, gains, losses, deductions, and credits. This form is essential for foreign entities engaged in a trade or business within the United States. It allows the Internal Revenue Service (IRS) to assess the tax obligations of these corporations, ensuring compliance with U.S. tax laws. Understanding the purpose of Form 1120-F is crucial for foreign corporations to avoid potential penalties and ensure accurate tax reporting.

Steps to Complete the Form 1120-F

Completing the Form 1120-F involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, follow these steps:

- Enter the corporation's identifying information, including name, address, and Employer Identification Number (EIN).

- Report income from U.S. sources, including effectively connected income and fixed or determinable annual or periodic income.

- Deduct allowable expenses, such as operating costs and taxes paid.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax liability based on the applicable corporate tax rates.

- Complete any additional schedules or forms as required, depending on the corporation's activities.

- Review the form for accuracy before submission.

How to Obtain the Form 1120-F

The Form 1120-F can be obtained directly from the IRS website or through various tax preparation software. It is available as a downloadable PDF, which can be filled out electronically or printed for manual completion. Ensure you are using the most recent version of the form to comply with current tax regulations. Additionally, tax professionals and accountants can provide assistance in obtaining and completing the form accurately.

Filing Deadlines / Important Dates

Filing deadlines for Form 1120-F are crucial for compliance. Generally, the form is due on the 15th day of the sixth month after the end of the corporation's tax year. For corporations operating on a calendar year basis, this means the form is typically due by June 15. If additional time is needed, foreign corporations can file for an automatic six-month extension using Form 7004. It is important to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Legal Use of the Form 1120-F

The legal use of Form 1120-F is governed by U.S. tax laws, which require foreign corporations to report their income accurately. The form must be filed by any foreign corporation engaging in a trade or business within the United States, as failure to file can result in significant penalties. Additionally, the form must be signed by an authorized officer of the corporation, affirming the accuracy of the information provided. Compliance with IRS regulations is essential for maintaining legal standing and avoiding legal repercussions.

Key Elements of the Form 1120-F

Several key elements are essential for completing the Form 1120-F accurately. These include:

- Identification Information: This includes the corporation's name, address, and EIN.

- Income Reporting: Detailed reporting of all income sourced from U.S. activities.

- Deductions: A comprehensive list of allowable deductions to reduce taxable income.

- Tax Calculation: The application of appropriate tax rates to determine tax liability.

- Additional Schedules: Depending on specific activities, additional forms may be required.

Quick guide on how to complete 2015 form 1120f

Complete Form 1120f effortlessly on any device

Online document management has become increasingly favored by enterprises and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the correct form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly and without delays. Manage Form 1120f on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented operation today.

How to edit and eSign Form 1120f with ease

- Find Form 1120f and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight essential sections of your documents or obscure sensitive information using tools specifically designed for that by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your adjustments.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Leave behind concerns about lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 1120f and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 1120f

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 1120f

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is Form 1120f and who needs to file it?

Form 1120f is a U.S. tax form used by foreign corporations to report their income, gains, losses, deductions, and credits. If your business is a foreign corporation engaged in a trade or business in the U.S., you are required to file Form 1120f. It's essential to understand the requirements to ensure compliance with U.S. tax laws.

-

How can airSlate SignNow help with submitting Form 1120f?

airSlate SignNow simplifies the process of preparing and submitting Form 1120f by providing a seamless platform for eSigning documents. With our user-friendly interface, you can easily manage your Form 1120f and ensure that all required signatures are collected efficiently. This helps streamline your filing process and keeps your documents organized.

-

What features does airSlate SignNow offer for managing Form 1120f?

airSlate SignNow offers features like document templates, custom workflows, and real-time tracking to enhance your Form 1120f management. You can create reusable templates for your tax forms, set reminders for important deadlines, and track who has signed or viewed your documents. These features help ensure that your Form 1120f is filed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for Form 1120f?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs, making it a cost-effective solution for managing Form 1120f. Our plans are designed to fit various budgets, and you can select a plan that includes features tailored to your document signing and management needs. Plus, a free trial is available to assess our services before committing.

-

Can I integrate airSlate SignNow with other software while preparing Form 1120f?

Absolutely! airSlate SignNow supports integrations with various software applications, including CRMs and accounting tools, which can help streamline the preparation of Form 1120f. These integrations allow you to import data directly into your documents, reducing manual entry and improving accuracy in your filings.

-

What benefits does airSlate SignNow provide for filing Form 1120f?

Using airSlate SignNow for filing Form 1120f offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform ensures that your sensitive tax information is protected with encryption and secure storage, while also providing an easy-to-navigate interface that speeds up the signing process.

-

How do I get started with airSlate SignNow for Form 1120f?

Getting started with airSlate SignNow for your Form 1120f is simple. You can sign up for an account on our website, choose a pricing plan that suits your needs, and explore the available features. Once you're set up, you can start creating, sending, and eSigning your Form 1120f documents seamlessly.

Get more for Form 1120f

- Standing order form december 2019

- The director workforce opportunities amp residency cayman p form

- Get the specifications for substitute forms p60 p60

- Applications for subscriptions to be allowed as a tax govuk form

- Trust and estate tax return 2020 use form sa9002020 to file a tax return for a trust or estate for the tax year ended 5 april

- Tax return 2020 use form sa1002020 to file a tax return report your income and to claim tax reliefs and any repayment due youll

- Resideence remittance basis etc 2020 use the sa109 2020 supplementary pages to declare your residence and domicile status and form

- 2020 form 3520 a annual information return of foreign trust with a us owner under section 6048b

Find out other Form 1120f

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile