2441 Form 2014

What is the 2441 Form

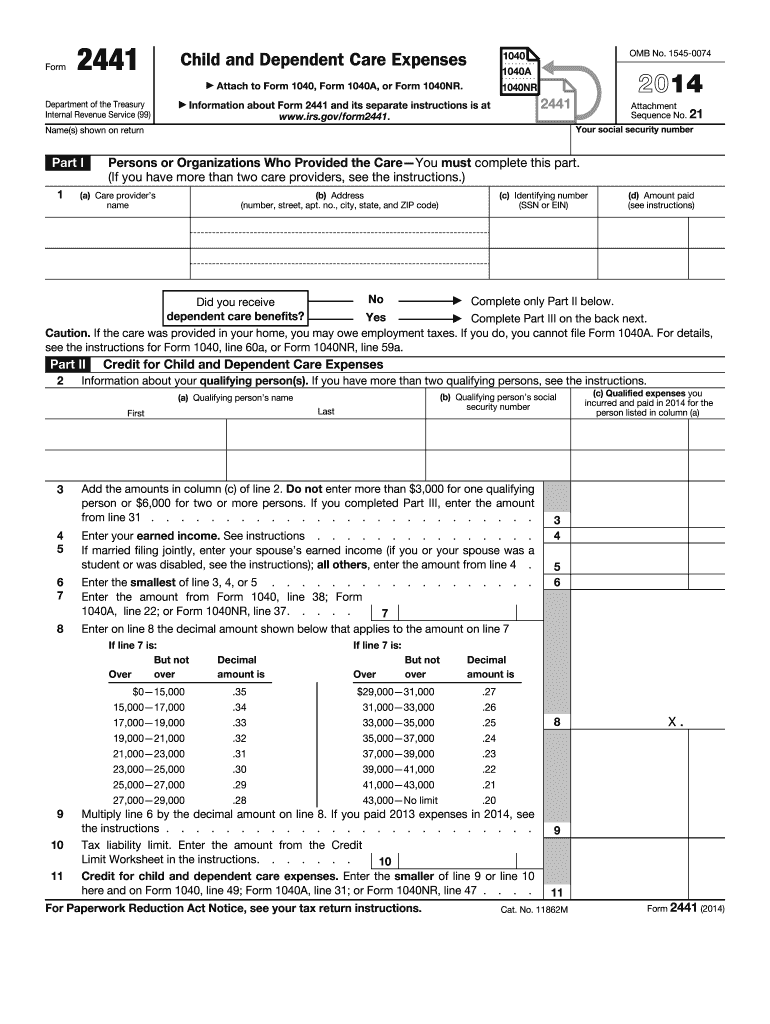

The 2441 Form, officially known as the Child and Dependent Care Expenses form, is used by taxpayers in the United States to claim a credit for expenses incurred for the care of qualifying individuals. This form is essential for those who pay for childcare or care for a dependent while they work or look for work. The credit can significantly reduce the amount of tax owed, making it a valuable tool for families managing care expenses.

How to use the 2441 Form

To effectively use the 2441 Form, taxpayers must first determine their eligibility based on the care expenses incurred for qualifying individuals. After gathering necessary information, such as the names and Social Security numbers of the dependents, as well as the details of the care providers, individuals can fill out the form. The completed form is then submitted along with the taxpayer's annual income tax return, allowing them to claim the credit for eligible expenses.

Steps to complete the 2441 Form

Completing the 2441 Form involves several key steps:

- Gather necessary information, including details about the care provider and the qualifying individuals.

- Complete the identification section, including your name, Social Security number, and filing status.

- Report the total amount of care expenses incurred during the tax year.

- Calculate the credit based on the percentage applicable to your income level.

- Review the form for accuracy and completeness before submission.

Legal use of the 2441 Form

The 2441 Form is legally binding when completed accurately and submitted according to IRS guidelines. To ensure compliance, taxpayers must retain documentation of all care expenses and provider information. This documentation may be requested by the IRS in case of an audit. Adhering to the legal requirements not only protects taxpayers but also maximizes their potential credit for care expenses.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the 2441 Form. Generally, the deadline for submitting the form coincides with the annual tax return deadline, which is typically April 15. However, if taxpayers file for an extension, they may have additional time to complete and submit the 2441 Form. It is essential to stay informed about any changes to deadlines to avoid penalties.

Required Documents

When completing the 2441 Form, taxpayers should prepare several key documents, including:

- Receipts or invoices for childcare expenses.

- The care provider's name, address, and taxpayer identification number.

- Social Security numbers of qualifying individuals.

Having these documents ready can streamline the process and ensure accurate reporting of expenses.

Examples of using the 2441 Form

There are various scenarios in which taxpayers might use the 2441 Form. For instance, a working parent who pays for daycare services for their child while they are at work can claim these expenses. Similarly, a caregiver who incurs costs for caring for an elderly parent while also maintaining employment may also be eligible. Each situation highlights the form's utility in providing financial relief for care expenses.

Quick guide on how to complete 2441 2014 form

Complete 2441 Form effortlessly on any gadget

Digital document management has become increasingly favored by enterprises and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without interruptions. Handle 2441 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign 2441 Form with ease

- Find 2441 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then hit the Done button to save your updates.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign 2441 Form and ensure exceptional communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2441 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 2441 2014 form

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the 2441 Form used for?

The 2441 Form is used to claim the Child and Dependent Care Expenses Credit, allowing taxpayers to receive a tax credit for qualifying care expenses. This form is crucial for families who incur such costs while working or looking for work. Accurately completing the 2441 Form can help maximize your tax savings.

-

How can airSlate SignNow help me with the 2441 Form?

airSlate SignNow offers an efficient way to eSign and send the 2441 Form securely. Our platform provides templates and guidance to ensure your form is completed correctly and promptly. With airSlate SignNow, you can streamline the submission process and ensure your documents are handled with care.

-

Is there a charge to use the 2441 Form with airSlate SignNow?

Yes, airSlate SignNow offers affordable pricing plans that include access to the 2441 Form and other features. Our pricing is designed to be cost-effective for businesses of all sizes, ensuring you get the best value for your eSignature needs. You can choose a plan that suits your specific requirements without breaking the bank.

-

What features does airSlate SignNow provide for the 2441 Form?

airSlate SignNow includes features like document templates, secure eSigning, and real-time tracking for your 2441 Form. You can easily edit and customize your forms, and our user-friendly interface makes it simple to navigate. Additionally, our platform ensures that your documents are securely stored and accessible at any time.

-

Can I integrate airSlate SignNow with other software for my 2441 Form?

Absolutely! airSlate SignNow supports integration with various software platforms, enhancing your experience with the 2441 Form. You can connect with popular applications like Google Drive, Dropbox, and CRM systems, making it easier to manage your documents in one centralized location. This streamlines your workflow and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for the 2441 Form?

Using airSlate SignNow for your 2441 Form offers numerous benefits, including increased efficiency, cost-effectiveness, and enhanced security. You'll save time by digitally signing and sending documents without the hassle of printing or mailing. Furthermore, our platform ensures that all data is encrypted and compliant with industry standards.

-

How secure is my information when using the 2441 Form with airSlate SignNow?

Security is a top priority at airSlate SignNow. When using the 2441 Form, your information is protected through advanced encryption and secure servers. We adhere to strict compliance protocols to ensure that your personal and financial data remains confidential and safeguarded against unauthorized access.

Get more for 2441 Form

Find out other 2441 Form

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple