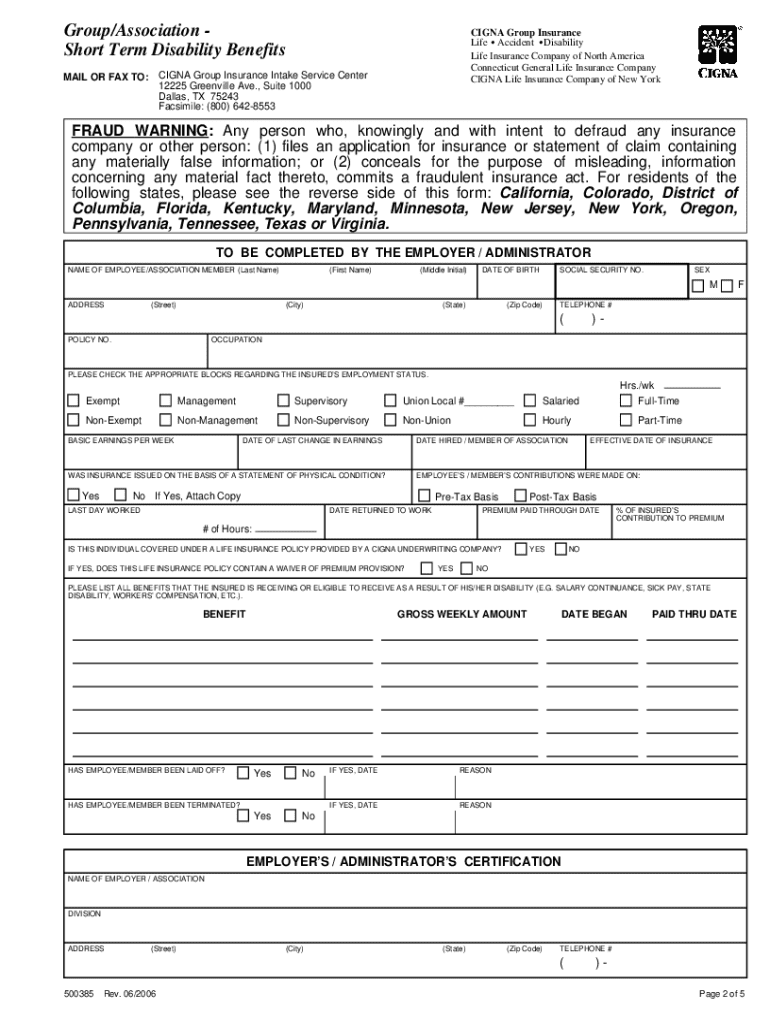

GroupAssociation Short Term Disability Benefits Cigna Form

Understanding the Form Approval Process

The form approval process is essential for ensuring that documents are completed accurately and legally. This process typically involves reviewing the information provided in the form, verifying the identity of the signer, and ensuring compliance with relevant regulations. When using electronic signatures, it is crucial to utilize a platform that adheres to the ESIGN and UETA acts, which establish the legality of eSignatures in the United States. By following these guidelines, organizations can streamline their form approval process while maintaining legal integrity.

Key Elements of a Form Approval Application

A form approval application generally includes several key elements that must be addressed to ensure successful processing. These elements often encompass:

- Accurate Information: All fields must be filled out correctly to avoid delays.

- Signature Requirements: Depending on the type of form, specific signatures may be required to validate the application.

- Supporting Documents: Additional documentation may be necessary to support the information provided in the form.

- Compliance with Regulations: Ensuring that the application meets all legal requirements is vital for approval.

Steps to Complete the Form Approval Application

Completing a form approval application involves several straightforward steps. Following these steps can help ensure a smooth submission process:

- Gather all necessary information and documents.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or missing information.

- Sign the form electronically, using a compliant eSignature tool.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Legal Use of Electronic Signatures in Form Approval

Electronic signatures are legally recognized in the United States, provided they comply with specific regulations. The ESIGN Act and UETA establish the framework for the legal use of eSignatures, ensuring they hold the same weight as traditional handwritten signatures. To ensure legal compliance, organizations should use trusted platforms that provide features like audit trails and secure storage, which help maintain the integrity of the signed documents.

Eligibility Criteria for Form Approval

Eligibility criteria for form approval can vary depending on the type of application being submitted. Common criteria may include:

- Age requirements, such as being at least eighteen years old.

- Residency status, which may require applicants to be U.S. citizens or legal residents.

- Specific qualifications related to the type of form, such as employment or financial status.

Form Submission Methods

Submitting a form approval application can be done through various methods, each with its own advantages. Common submission methods include:

- Online Submission: Fast and efficient, allowing for immediate processing.

- Mail: Traditional method that may be required for certain forms.

- In-Person Submission: Useful for forms that require personal verification or additional documentation.

Quick guide on how to complete groupassociation short term disability benefits cigna

Accomplish GroupAssociation Short Term Disability Benefits Cigna effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly and without delays. Manage GroupAssociation Short Term Disability Benefits Cigna on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign GroupAssociation Short Term Disability Benefits Cigna with ease

- Find GroupAssociation Short Term Disability Benefits Cigna and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a traditional wet signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign GroupAssociation Short Term Disability Benefits Cigna while ensuring clear communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form approval in the context of airSlate SignNow?

Form approval with airSlate SignNow refers to the process of obtaining digital signatures on forms and documents seamlessly. This solution allows businesses to ensure that all necessary approvals are not only gathered promptly but also securely, increasing the efficiency of document workflows.

-

How does airSlate SignNow streamline the form approval process?

AirSlate SignNow streamlines the form approval process by providing a user-friendly platform for sending, signing, and tracking documents. Features such as templates, automated reminders, and real-time status updates help ensure that approvals are obtained quickly and efficiently, reducing delays in essential business operations.

-

What are the pricing options for airSlate SignNow's form approval feature?

AirSlate SignNow offers flexible pricing plans tailored to meet different business needs for form approval. Plans typically vary based on features and the number of users, allowing businesses of all sizes to find an economical solution that suits their form approval requirements.

-

Can airSlate SignNow integrate with other applications for improved form approval?

Yes, airSlate SignNow integrates seamlessly with a variety of applications such as CRM systems, document management platforms, and cloud storage solutions. These integrations enhance your form approval process by enabling better data flow and collaboration across different tools.

-

What security measures are in place for form approval in airSlate SignNow?

AirSlate SignNow prioritizes security for your form approval processes through various measures including SSL encryption, secure cloud storage, and compliance with regulations such as GDPR and HIPAA. This ensures that all documents and signatures are protected throughout the approval lifecycle.

-

What are the benefits of using airSlate SignNow for form approval?

Using airSlate SignNow for form approval provides several benefits, including faster turnaround times, enhanced accuracy, and the elimination of paper-based processes. Businesses can enjoy increased productivity and a more streamlined approach to obtaining approvals with minimal effort.

-

Is it easy to track the status of form approvals in airSlate SignNow?

Absolutely! AirSlate SignNow offers a user-friendly dashboard that allows you to track the status of all form approvals in real time. You can see who has signed, who is pending, and set reminders for those who haven’t yet completed their approvals, ensuring nothing falls through the cracks.

Get more for GroupAssociation Short Term Disability Benefits Cigna

Find out other GroupAssociation Short Term Disability Benefits Cigna

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android