Contractor Statement Contractor Statement Non Construction Catalogue No 45062893 Form No 921

Understanding the Contractor Statement

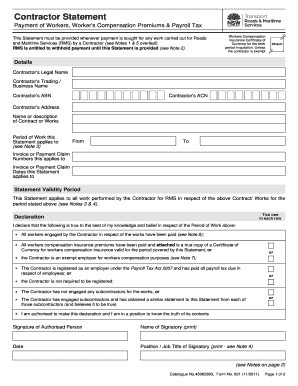

The Contractor Statement, specifically the Contractor Statement Non-Construction (Catalogue No 45062893, Form No 921), serves as a vital document for contractors in various sectors. This form provides essential information regarding the contractor's details, including their business structure, tax identification, and compliance status. Understanding the purpose of this form is crucial for both contractors and employers to ensure accurate reporting and adherence to legal requirements.

Steps to Complete the Contractor Statement

Completing the Contractor Statement involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including the contractor's name, address, and tax identification number. Next, fill out the form carefully, ensuring that all sections are completed as required. It is important to double-check for any errors or omissions before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements of the issuing authority.

Legal Use of the Contractor Statement

The legal use of the Contractor Statement is paramount for ensuring that contractor payments and employer obligations are documented properly. This form is recognized as a legal document that can be used in various contexts, including tax reporting and compliance audits. By accurately completing and submitting the Contractor Statement, both contractors and employers can protect themselves from potential legal issues related to misreporting or non-compliance.

Key Elements of the Contractor Statement

Key elements of the Contractor Statement include the contractor's identification details, the nature of the work performed, and the payment terms agreed upon. Additionally, the form may require information on subcontractors, if applicable, and any relevant licenses or permits held by the contractor. These elements are essential for establishing the legitimacy of the contractor's business and ensuring compliance with federal and state regulations.

IRS Guidelines for Contractor Payments

According to IRS guidelines, contractors must be properly classified for tax purposes, which is where the Contractor Statement plays a significant role. The IRS requires that payments made to contractors be documented accurately to avoid misclassification as employees. This can have significant tax implications for both the contractor and the employer. Understanding these guidelines helps ensure that all parties are compliant with tax regulations.

Required Documents for Submission

When submitting the Contractor Statement, certain documents may be required to support the information provided. These can include proof of identity, tax identification numbers, and any relevant business licenses. Having these documents ready can facilitate a smoother submission process and help avoid delays or issues with compliance.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Contractor Statement can lead to significant penalties. This may include fines, additional taxes owed, or legal action in severe cases. Understanding the potential consequences of non-compliance emphasizes the importance of accurately completing and submitting the form on time.

Quick guide on how to complete contractor statement contractor statement non construction catalogue no 45062893 form no 921

Prepare Contractor Statement Contractor Statement Non Construction Catalogue No 45062893 Form No 921 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle Contractor Statement Contractor Statement Non Construction Catalogue No 45062893 Form No 921 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Contractor Statement Contractor Statement Non Construction Catalogue No 45062893 Form No 921 effortlessly

- Locate Contractor Statement Contractor Statement Non Construction Catalogue No 45062893 Form No 921 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Contractor Statement Contractor Statement Non Construction Catalogue No 45062893 Form No 921 and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's approach to contractor employer purposes?

airSlate SignNow provides a streamlined solution specifically designed for contractor employer purposes, allowing businesses to efficiently manage contracts with independent contractors. With its intuitive interface, companies can send documents for eSignature, ensuring compliance and swift onboarding. This feature not only saves time but also enhances productivity for employers.

-

How does airSlate SignNow ensure the security of documents for contractor employer purposes?

Security is paramount when handling contractor employer purposes, and airSlate SignNow uses advanced encryption protocols to protect all documents. This ensures that sensitive information remains confidential while being shared between employers and contractors. Additionally, it offers audit trails and authentication features to enhance security further.

-

What pricing plans are available for airSlate SignNow for contractor employer purposes?

airSlate SignNow offers flexible pricing plans tailored for contractor employer purposes, with options ideal for businesses of all sizes. These plans range from basic to more comprehensive features, ensuring that companies can choose an option that fits their budget and requirements. A free trial is also available, so you can explore the features risk-free before committing.

-

Can airSlate SignNow be integrated with other tools for contractor employer purposes?

Yes, airSlate SignNow offers seamless integrations with various tools that cater to contractor employer purposes. These integrations include popular platforms such as CRMs, accounting software, and project management tools, allowing for a holistic approach to managing contracts. This interoperability helps streamline workflows for businesses.

-

What are the key features of airSlate SignNow for contractor employer purposes?

Key features of airSlate SignNow for contractor employer purposes include customizable templates, bulk sending of documents, and automated reminders for outstanding signatures. These functionalities help ensure that contracts are processed quickly and efficiently, enhancing the overall experience for both employers and contractors. This makes managing contractor agreements both simple and effective.

-

How does airSlate SignNow improve the hiring process for contractors?

By using airSlate SignNow, employers can signNowly improve the hiring process for contractors by streamlining document management. With quick eSignature options and secure document storage, contracts can be executed faster, allowing stakeholders to focus on more engaging aspects of the hire. This efficiency is vital for contractor employer purposes, where speed and accuracy are critical.

-

Is airSlate SignNow compliant with legal standards for contractor employer purposes?

Yes, airSlate SignNow is compliant with legal standards required for contractor employer purposes, adhering to regulations such as eIDAS and UETA. This compliance ensures that electronically signed documents are legally binding and enforceable, providing peace of mind to businesses and their contractors. You can confidently use airSlate SignNow, knowing that your contracts meet legal requirements.

Get more for Contractor Statement Contractor Statement Non Construction Catalogue No 45062893 Form No 921

Find out other Contractor Statement Contractor Statement Non Construction Catalogue No 45062893 Form No 921

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online