Income Driven Repayment Plan Request Income Based Repayment I B R, Pay as You Earn, and Income Contingent ?Repayment I C R Plans Form

Understanding the Income Driven Repayment Plan Request

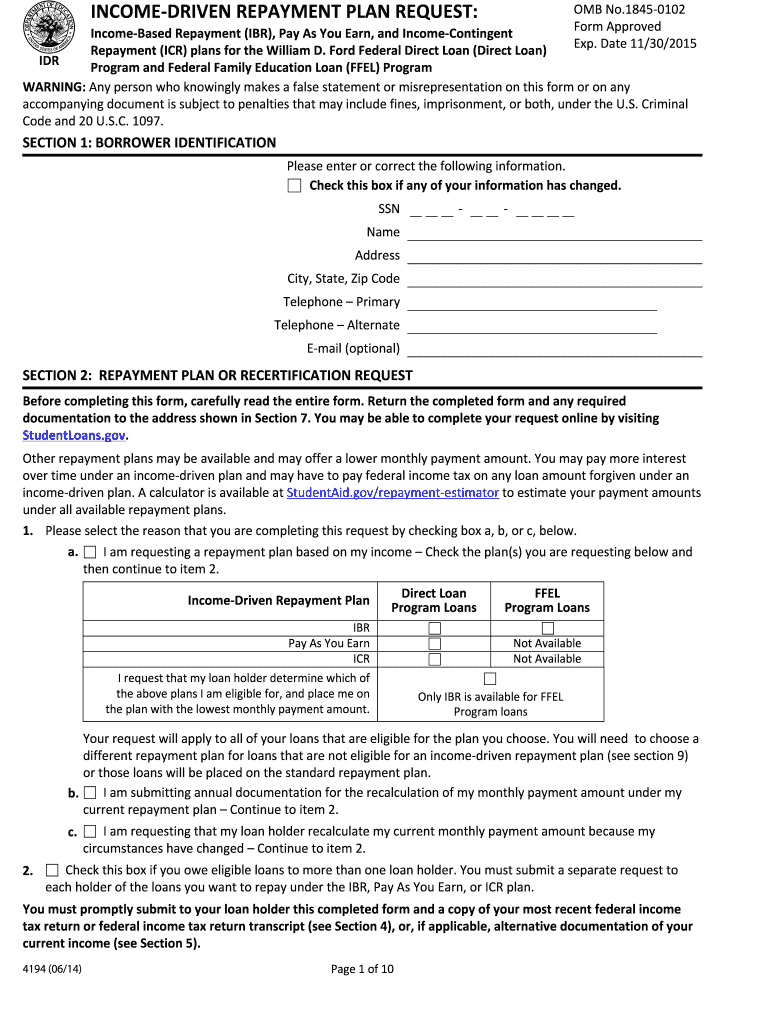

The Income Driven Repayment Plan Request is a crucial form for borrowers seeking financial relief through income-based repayment options. This form encompasses various plans, including Income Based Repayment (IBR), Pay As You Earn (PAYE), and Income Contingent Repayment (ICR) plans. These repayment options are designed to adjust monthly payments based on a borrower's income and family size, making student loan repayment more manageable for those facing financial hardships.

How to Use the Income Driven Repayment Plan Request

Using the Income Driven Repayment Plan Request involves several steps to ensure that borrowers can effectively apply for the repayment plans. First, gather all necessary financial documents, including income statements and family size information. Next, complete the form accurately, ensuring that all details are correct to avoid delays. Once filled out, the form can be submitted electronically or via mail, depending on the borrower's preference. Utilizing electronic signatures can simplify this process, ensuring a quicker response from loan servicers.

Steps to Complete the Income Driven Repayment Plan Request

Completing the Income Driven Repayment Plan Request involves a systematic approach. Start by downloading the form from the official website or obtaining a physical copy. Fill in personal information, including your name, Social Security number, and loan details. Provide accurate income information, which may require documentation such as pay stubs or tax returns. After reviewing the form for accuracy, submit it to your loan servicer. It is advisable to keep a copy for your records and to track the submission date for follow-up purposes.

Eligibility Criteria for Income Driven Repayment Plans

Eligibility for the Income Driven Repayment Plans varies based on several factors. Generally, borrowers must have federal student loans to qualify. Each plan has specific requirements regarding income and family size that must be met. For instance, IBR and PAYE plans typically require borrowers to demonstrate a partial financial hardship, while ICR plans are available to all borrowers regardless of income level. Understanding these criteria is essential for borrowers to select the most suitable repayment option.

Required Documents for the Income Driven Repayment Plan Request

To successfully complete the Income Driven Repayment Plan Request, borrowers need to prepare several key documents. These typically include proof of income, such as recent pay stubs, tax returns, or a letter from an employer. Additionally, information regarding family size is necessary, which may require documentation if dependents are involved. Having these documents ready can streamline the application process and facilitate quicker approval by loan servicers.

Form Submission Methods

Borrowers can submit the Income Driven Repayment Plan Request through various methods. The most convenient option is electronic submission, which allows for immediate processing and confirmation of receipt. Alternatively, borrowers may choose to mail the completed form to their loan servicer. In-person submissions may also be possible at certain locations. It is essential to verify the preferred submission method with the loan servicer to ensure compliance with their requirements.

Quick guide on how to complete income driven repayment plan request income based repayment i b r pay as you earn and income contingent repayment i c r plans

Effortlessly Prepare Income Driven Repayment Plan Request Income Based Repayment I B R, Pay As You Earn, And Income Contingent ?Repayment I C R Plans on Any Device

Managing documents online has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily find the appropriate form and securely store it in the cloud. airSlate SignNow provides all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Income Driven Repayment Plan Request Income Based Repayment I B R, Pay As You Earn, And Income Contingent ?Repayment I C R Plans on any device using airSlate SignNow’s Android or iOS applications and streamline your document-centric operations today.

The Easiest Way to Edit and eSign Income Driven Repayment Plan Request Income Based Repayment I B R, Pay As You Earn, And Income Contingent ?Repayment I C R Plans Seamlessly

- Obtain Income Driven Repayment Plan Request Income Based Repayment I B R, Pay As You Earn, And Income Contingent ?Repayment I C R Plans and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, either via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Income Driven Repayment Plan Request Income Based Repayment I B R, Pay As You Earn, And Income Contingent ?Repayment I C R Plans to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Income Driven Repayment Plan?

An Income Driven Repayment Plan, such as Income Based Repayment (IBR), Pay As You Earn (PAYE), and Income Contingent Repayment (ICR), allows borrowers to lower their monthly federal student loan payments based on income and family size. These plans are available for the William D Ford Federal Direct Loan Program and Federal Family Education Loan (FFEL) program. By choosing an Income Driven Repayment Plan, you can manage your student loan debt more effectively.

-

How can I request an Income Driven Repayment Plan?

To request an Income Driven Repayment Plan, borrowers must complete a request form, typically available through their loan servicer's website. This process allows you to apply for plans like Income Based Repayment (IBR), Pay As You Earn (PAYE), and Income Contingent Repayment (ICR). Be sure to provide accurate information about your income and family size to determine your eligibility.

-

What are the benefits of these repayment plans?

The primary benefits of Income Driven Repayment Plans include lower monthly payments that adjust based on income, potential loan forgiveness after a specific repayment term, and flexibility during financial hardships. Programs such as IBR, PAYE, and ICR are designed to help borrowers maintain financial stability while managing their student loan debt. By utilizing these plans, borrowers can focus on other financial obligations.

-

What types of loans qualify for these repayment plans?

The Income Driven Repayment Plans, including Income Based Repayment (IBR), Pay As You Earn (PAYE), and Income Contingent Repayment (ICR), are applicable for loans under the William D Ford Federal Direct Loan Program and Federal Family Education Loan (FFEL) program. It's important to review the eligibility criteria for your specific loans, as only certain types qualify. Contact your loan servicer to confirm if your loans are eligible.

-

Are there any fees associated with using these repayment plans?

There are no additional fees for using Income Driven Repayment Plans like Income Based Repayment (IBR), Pay As You Earn (PAYE), and Income Contingent Repayment (ICR). However, borrowers must continue to pay their student loans according to the new monthly payment amount determined by the plan. It's worth noting that while there are no direct fees, borrowers may still accrue interest on their loans during the repayment period.

-

Can I switch to another repayment plan after enrolling?

Yes, borrowers have the flexibility to switch between different repayment plans after enrolling in an Income Driven Repayment Plan like IBR, PAYE, or ICR. If your financial situation changes or if you wish to pursue a different repayment strategy, you can request a change through your loan servicer. Always ensure to review potential impacts on your monthly payments and loan terms before making a switch.

-

How do my payments change with Income Driven Repayment Plans?

Payments under Income Driven Repayment Plans, such as Income Based Repayment (IBR), Pay As You Earn (PAYE), and Income Contingent Repayment (ICR), are calculated based on your income and family size. As your income fluctuates or if your family situation changes, your monthly payment may adjust accordingly. This adaptability helps ensure that payments remain manageable and aligns with your financial circumstances.

Get more for Income Driven Repayment Plan Request Income Based Repayment I B R, Pay As You Earn, And Income Contingent ?Repayment I C R Plans

- Temporary stay information form

- Homeowners association membership form sample

- Reach declaration template form

- Certificate of ownership tn form

- Bohr model worksheet form

- Sunscreen permission form for daycare

- Bankers life continued monthly residence form

- This letter represents a conditional offer of employment for the stated position form

Find out other Income Driven Repayment Plan Request Income Based Repayment I B R, Pay As You Earn, And Income Contingent ?Repayment I C R Plans

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form