International Fuel Tax Agreement Tax Return IF Washington Dol Wa Form

What is the DOL 441241 Fuel Return?

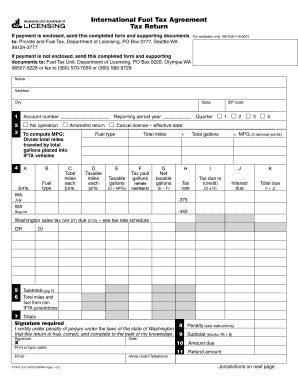

The DOL 441241 form, also known as the Washington International Fuel Tax Agreement (IFTA) Tax Return, is a critical document for businesses involved in interstate transportation. This form is used to report fuel use and calculate the taxes owed to the state of Washington based on the fuel consumed by vehicles operating in multiple jurisdictions. It ensures compliance with the International Fuel Tax Agreement, which simplifies the reporting process for fuel taxes across participating states and provinces.

Steps to Complete the DOL 441241 Fuel Return

Completing the DOL 441241 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding fuel purchases and mileage driven in each jurisdiction. Next, fill out the form with details such as the total gallons of fuel purchased, the miles driven in each jurisdiction, and the applicable tax rates. After completing the calculations, review the form for any errors before submission. It is essential to keep copies of all documentation for your records.

Legal Use of the DOL 441241 Fuel Return

The DOL 441241 form is legally binding when completed correctly and submitted on time. Compliance with the International Fuel Tax Agreement ensures that businesses adhere to state and federal regulations regarding fuel taxation. Accurate reporting is crucial, as errors or omissions can lead to penalties or audits. Utilizing a reliable eSignature solution, such as airSlate SignNow, can help ensure that your submissions are secure and legally recognized.

Filing Deadlines for the DOL 441241 Fuel Return

Filing deadlines for the DOL 441241 form are typically quarterly, with specific due dates for each quarter. It is important to keep track of these dates to avoid late fees or penalties. For example, the first quarter return is usually due by April 30, the second quarter by July 31, the third quarter by October 31, and the fourth quarter by January 31 of the following year. Staying informed about these deadlines helps ensure timely compliance.

Required Documents for the DOL 441241 Fuel Return

To complete the DOL 441241 form, several documents are required. These typically include receipts for fuel purchases, mileage logs, and any prior tax returns related to fuel use. Maintaining accurate records of fuel consumption and travel can simplify the filing process. It is advisable to keep these documents organized and readily accessible for reference when preparing the return.

Penalties for Non-Compliance with the DOL 441241

Failure to comply with the requirements of the DOL 441241 form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by state authorities. It is crucial for businesses to ensure accurate reporting and timely submission to avoid these consequences. Understanding the implications of non-compliance can help motivate timely and precise filing.

Quick guide on how to complete international fuel tax agreement tax return if washington dol wa

Facilitate International Fuel Tax Agreement Tax Return IF Washington Dol Wa effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage International Fuel Tax Agreement Tax Return IF Washington Dol Wa on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered task today.

How to modify and electronically sign International Fuel Tax Agreement Tax Return IF Washington Dol Wa with ease

- Find International Fuel Tax Agreement Tax Return IF Washington Dol Wa and click on Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your files or obscure sensitive content with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searching, or errors that necessitate printing new versions. airSlate SignNow fulfills your needs in document management in just a few clicks from any device of your choosing. Modify and electronically sign International Fuel Tax Agreement Tax Return IF Washington Dol Wa and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is dol 441241 and how does it relate to airSlate SignNow?

Dol 441241 refers to specific document standards and requirements set by the Department of Labor. airSlate SignNow helps businesses comply with these standards by providing an easy-to-use platform for eSigning and sending documents relevant to dol 441241.

-

How can airSlate SignNow assist my business with dol 441241 compliance?

airSlate SignNow offers features that streamline the signing and management of documents related to dol 441241. This includes templates, secure storage, and audit trails to ensure that all compliance requirements are met efficiently.

-

What pricing plans does airSlate SignNow offer for businesses looking to manage dol 441241 documents?

airSlate SignNow provides various pricing plans tailored to different business needs. These plans include features specifically designed to handle dol 441241 documentation, ensuring that you can find an option that aligns with your budget and compliance requirements.

-

Is airSlate SignNow user-friendly for individuals unfamiliar with dol 441241 documents?

Yes, airSlate SignNow is designed with a user-friendly interface that simplifies the process of managing dol 441241 documents. Even users with limited experience can easily navigate the platform to send, sign, and track documents seamlessly.

-

Are there any integrations available with airSlate SignNow for dol 441241 document management?

Absolutely! airSlate SignNow integrates with various third-party applications, enhancing the functionality for dol 441241 document management. These integrations facilitate effortless workflows, allowing you to connect with tools that complement your business processes.

-

What are the key benefits of using airSlate SignNow for dol 441241 documentation?

The key benefits include enhanced compliance with dol 441241, faster processing times for documents, and improved collaboration among team members. By utilizing airSlate SignNow, businesses can also reduce paper use and streamline their overall document management processes.

-

Can airSlate SignNow help my team stay organized while handling dol 441241 documents?

Yes, airSlate SignNow includes robust organizational tools to help teams manage dol 441241 documents effectively. Features like document folders, tagging, and search capabilities ensure that you can easily find and track important files.

Get more for International Fuel Tax Agreement Tax Return IF Washington Dol Wa

Find out other International Fuel Tax Agreement Tax Return IF Washington Dol Wa

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement