TC 922, IFTA and Special Fuel User Tax Return, Additional Pages Forms & Publications Tax Utah

Understanding the TC-922: IFTA and Special Fuel User Tax Return

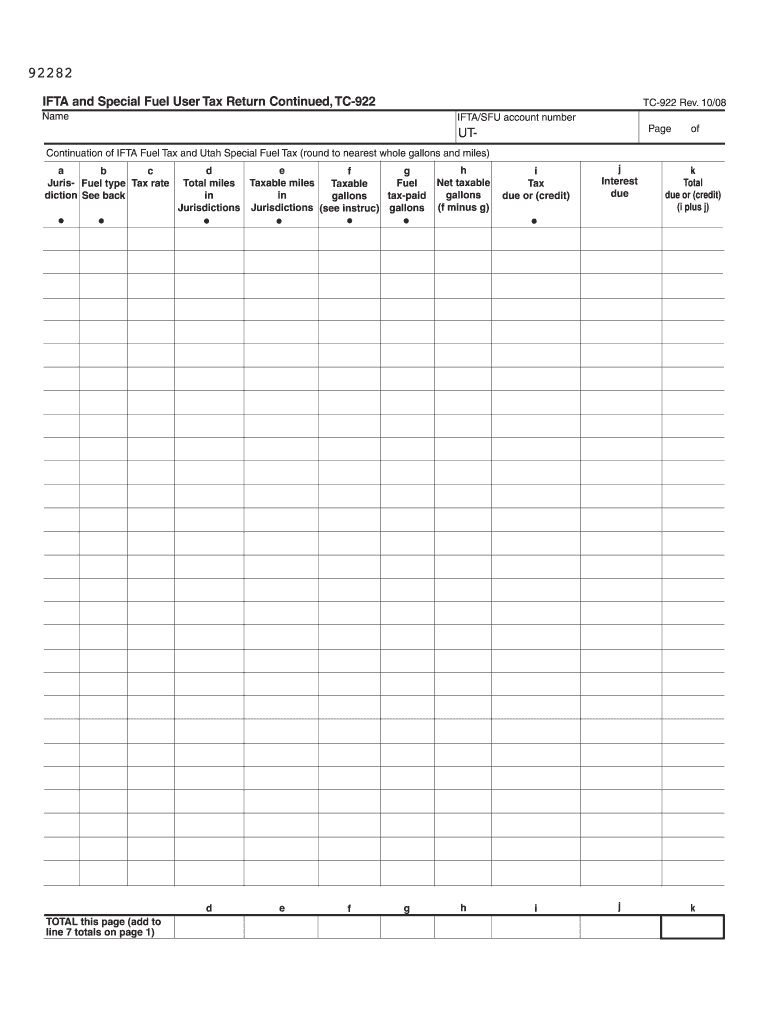

The TC-922 form is essential for individuals and businesses involved in the transportation industry in Utah. This tax return is specifically designed for reporting International Fuel Tax Agreement (IFTA) and special fuel user taxes. It helps ensure compliance with state tax regulations and is crucial for those who operate vehicles that consume fuel subject to these taxes. Understanding the purpose and requirements of the TC-922 is vital for accurate reporting and avoiding penalties.

Steps to Complete the TC-922 Form

Completing the TC-922 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including mileage records and fuel purchase receipts. Next, fill out the form by entering the total miles driven in each jurisdiction and the gallons of fuel purchased. Be sure to calculate the tax owed based on the fuel consumption and rates applicable to each jurisdiction. After reviewing the information for accuracy, sign and date the form before submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the TC-922 form to avoid late fees and penalties. Typically, the tax return is due on the last day of the month following the end of the quarter. For example, the first quarter's return is due by April 30. Staying informed about these dates and planning ahead can help ensure timely submission and compliance with state tax laws.

Required Documents for TC-922 Submission

To successfully complete and submit the TC-922 form, certain documents are required. These include:

- Mileage records detailing the distances traveled in each jurisdiction.

- Receipts for fuel purchases, which must reflect the gallons purchased and the type of fuel used.

- Any additional documentation that may be requested by the Utah State Tax Commission.

Having these documents prepared in advance can streamline the completion process and reduce the risk of errors.

Legal Use of the TC-922 Form

The TC-922 form serves a legal purpose in the context of tax compliance. When filled out correctly, it provides a record of fuel consumption and tax obligations, which can be used to demonstrate compliance with state regulations. It is important to ensure that all information is accurate and complete, as discrepancies may lead to audits or penalties from tax authorities.

Form Submission Methods for TC-922

The TC-922 form can be submitted through various methods, offering flexibility for taxpayers. Options typically include:

- Online submission through the Utah State Tax Commission's website, which allows for quick processing.

- Mailing a hard copy of the form to the appropriate tax office.

- In-person submission at designated tax offices, providing an opportunity for immediate assistance.

Choosing the right submission method can help ensure that the form is processed efficiently and on time.

Quick guide on how to complete tc 922 ifta and special fuel user tax return additional pages forms amp publications tax utah

Complete TC 922, IFTA And Special Fuel User Tax Return, Additional Pages Forms & Publications Tax Utah effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage TC 922, IFTA And Special Fuel User Tax Return, Additional Pages Forms & Publications Tax Utah on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and digitally sign TC 922, IFTA And Special Fuel User Tax Return, Additional Pages Forms & Publications Tax Utah with ease

- Locate TC 922, IFTA And Special Fuel User Tax Return, Additional Pages Forms & Publications Tax Utah and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, time-consuming form searches, or errors that require reprinting. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign TC 922, IFTA And Special Fuel User Tax Return, Additional Pages Forms & Publications Tax Utah and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for managing tax return Utah documents?

airSlate SignNow provides a range of features designed to streamline the management of tax return Utah documents. Users can easily upload, sign, and send tax-related forms securely. The platform also supports multiple file formats and provides templates that simplify the process of preparing and sending tax returns.

-

How can airSlate SignNow help me with my tax return Utah e-signing needs?

Using airSlate SignNow for your tax return Utah e-signing needs allows for a secure, efficient, and legally binding way to sign essential documents. The platform ensures that all signatures are encrypted and complies with e-signature laws. With its user-friendly interface, you can complete the signing process in just a few clicks.

-

What is the cost of using airSlate SignNow for tax return Utah services?

The pricing for using airSlate SignNow for tax return Utah services is designed to be budget-friendly, offering various plans to suit different business needs. You can choose from monthly or annual subscriptions, providing flexibility based on your usage requirements. Additionally, there may be discounts available for longer-term commitments.

-

Can I integrate airSlate SignNow with other tools for my tax return Utah workflow?

Yes, airSlate SignNow seamlessly integrates with various tools that can enhance your tax return Utah workflow. Whether it's accounting software, CRM platforms, or cloud storage services, these integrations ensure that all your documents are easily accessible and manageable. This connectivity helps streamline the entire process, saving you time and effort.

-

Is airSlate SignNow secure for handling sensitive tax return Utah information?

Absolutely! airSlate SignNow employs robust security measures to protect sensitive tax return Utah information. With end-to-end encryption and compliance with industry standards such as GDPR and HIPAA, users can trust that their data remains confidential and secure throughout the signing process.

-

What benefits can I expect from using airSlate SignNow for tax return Utah?

By using airSlate SignNow for your tax return Utah processes, you can expect increased efficiency and reduced turnaround times for document signing. The platform allows for real-time tracking of document status, ensuring that you are always in the loop. Furthermore, it eliminates the need for paper documents, thus supporting eco-friendly practices.

-

How do I get started with airSlate SignNow for my tax return Utah?

Getting started with airSlate SignNow for your tax return Utah is simple and quick. You just need to sign up for an account, select the plan that fits your needs, and start uploading your documents. The intuitive interface will guide you through the process of setting up, ensuring you can manage your tax return tasks efficiently.

Get more for TC 922, IFTA And Special Fuel User Tax Return, Additional Pages Forms & Publications Tax Utah

Find out other TC 922, IFTA And Special Fuel User Tax Return, Additional Pages Forms & Publications Tax Utah

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy