Tl11a Form

What is the Tl11a?

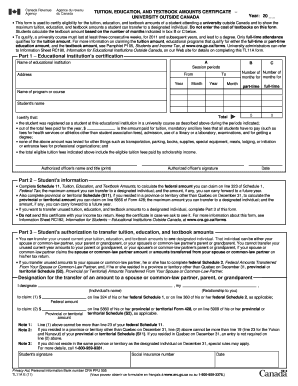

The Tl11a is a form used in the United States primarily for reporting tuition fees and related expenses for educational purposes. This form is essential for individuals seeking to claim educational tax credits or deductions. It captures vital information about the taxpayer, the educational institution, and the amounts paid for tuition and related fees. Understanding the Tl11a is crucial for ensuring compliance with tax regulations and maximizing potential benefits.

How to use the Tl11a

Using the Tl11a involves accurately filling out the required fields to report tuition payments. Taxpayers should gather all relevant documentation, such as receipts and statements from educational institutions. Once the necessary information is compiled, it can be entered into the form, ensuring that all amounts reflect actual payments made during the tax year. After completion, the Tl11a can be submitted along with the taxpayer's annual tax return, either electronically or by mail.

Steps to complete the Tl11a

Completing the Tl11a requires careful attention to detail. Follow these steps for accurate submission:

- Gather all relevant documents, including tuition statements and payment receipts.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details about the educational institution, including its name and address.

- Enter the total amount of tuition and fees paid during the tax year.

- Review the form for accuracy and completeness.

- Submit the completed Tl11a with your tax return.

Legal use of the Tl11a

The Tl11a must be used in accordance with IRS guidelines to ensure its legal validity. This includes accurately reporting tuition payments and adhering to deadlines for submission. Failure to comply with these regulations may result in penalties or the denial of tax benefits. Understanding the legal implications of the Tl11a helps taxpayers navigate their responsibilities effectively.

Required Documents

To complete the Tl11a, specific documents are necessary. These include:

- Tuition payment receipts from the educational institution.

- Statements detailing the amounts paid for tuition and related fees.

- Personal identification information, such as a Social Security number.

Having these documents ready will streamline the process of completing and submitting the Tl11a.

Form Submission Methods

The Tl11a can be submitted through various methods, offering flexibility for taxpayers. Options include:

- Online submission via tax preparation software, which often includes e-filing options.

- Mailing a physical copy of the form to the appropriate tax authority.

- In-person submission at designated tax offices, if available.

Choosing the right submission method can enhance the efficiency of the filing process.

Quick guide on how to complete tl11a

Complete Tl11a effortlessly on any device

Web-based document management has become favored among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Manage Tl11a on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Tl11a with ease

- Find Tl11a and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or errors that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Tl11a and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is tl11a and how does it work with airSlate SignNow?

The tl11a form is a tax document used in Canada. With airSlate SignNow, you can seamlessly fill out, send, and eSign the tl11a, ensuring compliance and accuracy in your submissions. Our platform simplifies the process, making tax documentation more efficient.

-

How much does airSlate SignNow cost for managing tl11a forms?

AirSlate SignNow offers competitive pricing plans that fit various budgets for managing tl11a forms. We provide a cost-effective solution designed for businesses of all sizes, ensuring you can manage your tax documents without breaking the bank. Check our pricing page for more detailed options.

-

What features does airSlate SignNow offer for processing tl11a documents?

AirSlate SignNow provides a range of features ideal for processing tl11a documents, including customizable templates, secure eSigning, and document tracking. These tools help streamline your workflow, reduce errors, and improve collaboration on tax files. Our user-friendly interface makes it easy to handle all your documentation needs.

-

How does airSlate SignNow ensure the security of my tl11a documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents like tl11a forms. We employ advanced encryption protocols, secure cloud storage, and compliance with legal regulations to protect your data. You can trust us to keep your tax documents safe throughout the entire signing process.

-

Can I integrate airSlate SignNow with other applications to manage tl11a forms?

Yes, airSlate SignNow offers integrations with numerous applications, allowing you to manage your tl11a forms efficiently. Compatible with tools like CRM software and cloud storage services, our integrations enhance productivity and streamline your workflow. Customize your experience to fit your specific business needs.

-

What benefits do businesses gain by using airSlate SignNow for tl11a documents?

Using airSlate SignNow for tl11a documents offers numerous benefits, including time savings, reduced paperwork, and improved accuracy in tax submissions. Our solution allows for hassle-free eSigning and document management, which leads to increased efficiency. Take advantage of our features to simplify your tax processes.

-

Is airSlate SignNow user-friendly for handling tl11a forms?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to handle tl11a forms without technical expertise. Our intuitive interface guides you through every step, from document creation to eSigning, ensuring a smooth and efficient experience.

Get more for Tl11a

Find out other Tl11a

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney

- How Do I Electronic signature South Carolina Unlimited Power of Attorney

- How Can I Electronic signature Alaska Limited Power of Attorney

- How To Electronic signature Massachusetts Retainer Agreement Template