Supporting Documents for Dependency Exemptions Form

What is the Supporting Documents For Dependency Exemptions Form

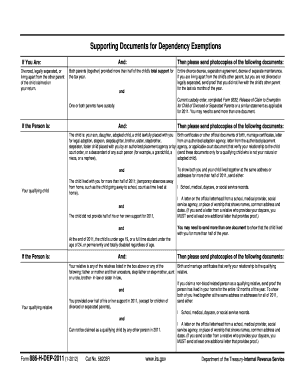

The Supporting Documents for Dependency Exemptions form is a crucial document used by taxpayers to substantiate claims for dependency exemptions on their tax returns. This form provides the Internal Revenue Service (IRS) with necessary information regarding dependents, ensuring that taxpayers can receive appropriate exemptions. It may include details such as the dependent's name, relationship to the taxpayer, and residency status. Understanding this form is essential for compliance with IRS regulations and maximizing potential tax benefits.

How to use the Supporting Documents For Dependency Exemptions Form

Using the Supporting Documents for Dependency Exemptions form involves several steps to ensure accurate completion and submission. First, gather all necessary information about your dependents, including Social Security numbers and any relevant documentation that supports your claims. Next, fill out the form carefully, ensuring that all details are correct and complete. Once the form is filled out, review it for accuracy before submitting it with your tax return. This process helps to avoid delays or issues with the IRS.

Steps to complete the Supporting Documents For Dependency Exemptions Form

Completing the Supporting Documents for Dependency Exemptions form requires attention to detail. Follow these steps:

- Gather required information about each dependent, including their full name, Social Security number, and relationship to you.

- Fill out the form accurately, ensuring that all fields are completed.

- Double-check the information for any errors or omissions.

- Attach any necessary supporting documents that verify your claims, such as birth certificates or custody agreements.

- Submit the completed form along with your tax return, either electronically or via mail.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Supporting Documents for Dependency Exemptions form. Taxpayers must ensure that they meet the eligibility criteria for claiming dependents, which includes residency requirements and relationship tests. The IRS also outlines the necessary documentation that may be required to substantiate claims. Familiarizing yourself with these guidelines can help ensure compliance and avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Supporting Documents for Dependency Exemptions form align with the overall tax filing schedule. Typically, individual tax returns are due on April 15 of each year, unless that date falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. It is essential to keep track of these dates to ensure timely submission and avoid late filing penalties.

Required Documents

When completing the Supporting Documents for Dependency Exemptions form, certain documents may be required to support your claims. These documents can include:

- Birth certificates for each dependent to verify their identity and relationship.

- Proof of residency, such as school records or medical documents.

- Custody agreements if applicable, particularly in cases of divorce or separation.

Having these documents ready can streamline the process and ensure compliance with IRS requirements.

Quick guide on how to complete supporting documents for dependency exemptions form

Complete Supporting Documents For Dependency Exemptions Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Supporting Documents For Dependency Exemptions Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Supporting Documents For Dependency Exemptions Form with ease

- Obtain Supporting Documents For Dependency Exemptions Form and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize critical sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Supporting Documents For Dependency Exemptions Form and ensure effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the significance of the 2012 internal revenue service guidelines for electronic signatures?

The 2012 internal revenue service guidelines established clear standards for the acceptability of electronic signatures in tax-related documents. This means that businesses can now confidently use electronic signatures, like those provided by airSlate SignNow, for IRS forms and submissions while remaining compliant.

-

How can airSlate SignNow help me comply with the 2012 internal revenue service regulations?

airSlate SignNow provides secure and legally-compliant electronic signatures that align with the 2012 internal revenue service regulations. By utilizing our platform, businesses can ensure their electronically signed documents meet all requirements set forth by the IRS, reducing the risk of non-compliance.

-

What features does airSlate SignNow offer to optimize document signing related to the 2012 internal revenue service?

airSlate SignNow offers features such as customizable templates, multiple signing options, and audit trails to help businesses streamline their document signing processes. These features are especially beneficial for handling documents associated with the 2012 internal revenue service, ensuring efficiency and compliance.

-

Is there a cost associated with using airSlate SignNow for 2012 internal revenue service documents?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective option for managing 2012 internal revenue service documents. Depending on your chosen plan, you can benefit from our comprehensive features while staying within your budget.

-

Can I integrate airSlate SignNow with other software used for IRS filings in 2012?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and tax software, making it easier to manage your 2012 internal revenue service filings. This integration allows for a streamlined workflow, ensuring that your documents are ready for electronic signature without additional hassle.

-

What benefits do electronic signatures with airSlate SignNow provide for 2012 internal revenue service forms?

Using airSlate SignNow for electronic signatures provides numerous benefits, including faster turnaround times, enhanced security, and reduced paper usage. These advantages are vital when dealing with 2012 internal revenue service forms, as timely submission can help avoid penalties.

-

Are the electronic signatures from airSlate SignNow legally binding for 2012 internal revenue service submissions?

Yes, electronic signatures from airSlate SignNow are legally binding and comply with the 2012 internal revenue service requirements. This compliance ensures that your signed documents are valid and recognized by the IRS, making our solution reliable for essential business transactions.

Get more for Supporting Documents For Dependency Exemptions Form

Find out other Supporting Documents For Dependency Exemptions Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors