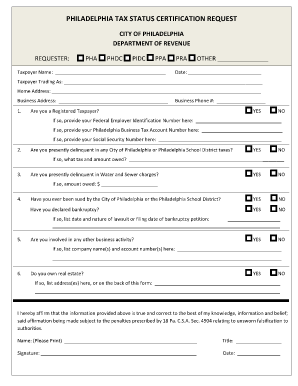

Tax Clearance Philadelphia Form

What is the Tax Clearance Philadelphia

The Tax Clearance Philadelphia is an official document that certifies an individual or business's compliance with local tax obligations. This certificate is often required when applying for permits, licenses, or contracts within the city. It confirms that all taxes owed to the City of Philadelphia have been paid, ensuring that the taxpayer is in good standing with the local revenue department. The document serves as proof of tax compliance and is essential for various business and legal transactions.

How to obtain the Tax Clearance Philadelphia

To obtain the Tax Clearance Philadelphia, individuals or businesses must follow a structured process. The first step involves gathering necessary documentation, including proof of identity and any tax returns or payments made. Next, applicants can submit their request through the Philadelphia Department of Revenue's official channels. This can typically be done online, by mail, or in person. It is important to ensure that all required information is accurate and complete to avoid delays in processing.

Steps to complete the Tax Clearance Philadelphia

Completing the Tax Clearance Philadelphia involves several key steps:

- Gather all relevant tax documents, including returns and payment records.

- Access the Philadelphia Department of Revenue's website to find the application form.

- Fill out the application form with accurate personal or business information.

- Submit the application along with any required documentation, either online or by mail.

- Monitor the status of your application through the department's tracking system.

Legal use of the Tax Clearance Philadelphia

The Tax Clearance Philadelphia holds significant legal weight in various contexts. It is often required for business licenses, permits, and contracts, ensuring that the entity is compliant with local tax laws. Failure to present a valid tax clearance certificate can result in denied applications or legal complications. Understanding the legal implications of this document is crucial for taxpayers, as it impacts their ability to operate within the city legally.

Required Documents

When applying for the Tax Clearance Philadelphia, several documents are typically required to verify the applicant's identity and tax status. These may include:

- Government-issued identification (e.g., driver's license or passport)

- Tax returns for the past few years

- Proof of tax payments made to the City of Philadelphia

- Business registration documents, if applicable

Penalties for Non-Compliance

Non-compliance with tax obligations can lead to severe penalties for individuals and businesses in Philadelphia. These penalties may include fines, interest on unpaid taxes, and potential legal action. Additionally, failing to obtain a Tax Clearance Philadelphia when required can hinder business operations, affecting the ability to secure necessary licenses and permits. It is essential for taxpayers to stay informed about their obligations to avoid these consequences.

Quick guide on how to complete tax clearance philadelphia

Effortlessly Prepare Tax Clearance Philadelphia on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers a great eco-friendly option to conventional printed and signed papers, allowing you to obtain the necessary forms and securely keep them online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents rapidly and without delays. Manage Tax Clearance Philadelphia on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to Edit and Electronically Sign Tax Clearance Philadelphia with Ease

- Obtain Tax Clearance Philadelphia and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Select relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all information and then click the Done button to finalize your changes.

- Select your preferred method for delivering your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, or errors that require new document copies to be printed. airSlate SignNow manages all your document needs in just a few clicks from any device you prefer. Edit and electronically sign Tax Clearance Philadelphia to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is tax clearance in Philadelphia?

Tax clearance in Philadelphia refers to the verification that all due taxes have been paid to the city before completing certain transactions, such as selling property or obtaining business permits. Having a tax clearance ensures compliance with local tax laws and prevents future legal issues.

-

How can airSlate SignNow assist with tax clearance processes in Philadelphia?

airSlate SignNow provides an efficient way to electronically sign and send documents related to your tax clearance in Philadelphia. The platform's user-friendly interface simplifies the collection of necessary signatures and helps streamline communication between parties involved in obtaining the clearance.

-

What are the benefits of using airSlate SignNow for tax clearance in Philadelphia?

Using airSlate SignNow for tax clearance in Philadelphia offers numerous benefits, including reduced turnaround times for document signing, enhanced security through encryption, and the ability to keep all your tax documents organized in one place. This streamlined process helps ensure you meet all requirements without hassle.

-

Is airSlate SignNow cost-effective for managing tax clearance in Philadelphia?

Yes, airSlate SignNow is a cost-effective solution for managing tax clearance in Philadelphia. With flexible pricing plans, businesses can choose an option that fits their budget while still benefiting from advanced features that make the tax clearance process easier and more efficient.

-

Does airSlate SignNow integrate with other software for tax clearance in Philadelphia?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, making it easier to manage your tax clearance in Philadelphia. These integrations can include accounting software and document management systems, enhancing your overall workflow and efficiency.

-

How secure is the signing process for tax clearance documents in Philadelphia using airSlate SignNow?

The signing process for tax clearance documents in Philadelphia using airSlate SignNow is very secure. The platform employs advanced security measures, including encryption, multi-factor authentication, and compliance with various data protection regulations, ensuring that your sensitive information remains safe.

-

Can I track the status of my tax clearance documents with airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their tax clearance documents in Philadelphia easily. You’ll receive real-time notifications when documents are viewed and signed, enabling you to stay updated on the progress of your tax clearance transactions.

Get more for Tax Clearance Philadelphia

- Iifl forms

- Dtc eligibility questionnaire form

- Com grammar worksheet comparatives and superlatives name date write the missing comparatives and superlatives in the chart below form

- Company vehicle request form

- Safety training format

- Legal housing contract for admin related processin in sweden form

- Appendix to workers residence permit application form

- Hcv interim change form the housing authority of the city of

Find out other Tax Clearance Philadelphia

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement