Usda Direct Loan Application PDF Form

What is the USDA Direct Loan Application PDF?

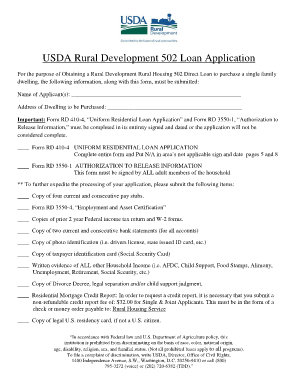

The USDA Direct Loan Application PDF is a standardized form used by individuals seeking financial assistance for purchasing, building, or improving homes in rural areas. This application is specifically designed for the USDA Rural Development program, which aims to promote homeownership in less populated regions. The form collects essential information about the applicant's financial status, property details, and personal background, ensuring that all necessary data is available for processing the loan request. By using this form, applicants can access favorable loan terms, including low-interest rates and reduced mortgage insurance costs.

Steps to Complete the USDA Direct Loan Application PDF

Completing the USDA Direct Loan Application PDF involves several key steps to ensure accuracy and thoroughness. First, gather all necessary documentation, including income statements, tax returns, and identification. Next, fill out the application form, providing detailed information about your financial situation and the property in question. It is crucial to answer all questions honestly and completely, as incomplete applications may lead to delays or denials. After completing the form, review it carefully for any errors before submitting it. Finally, submit the application through the designated method, whether online, by mail, or in person.

Required Documents

When applying for a USDA Direct Loan, several documents are required to support your application. These typically include:

- Proof of income, such as pay stubs or tax returns

- Bank statements for the past few months

- Identification, including a government-issued photo ID

- Details about the property you intend to purchase or improve

- Credit history information

Having these documents ready will help streamline the application process and improve your chances of approval.

Eligibility Criteria

To qualify for a USDA Direct Loan, applicants must meet specific eligibility criteria. These criteria typically include:

- Being a U.S. citizen or legal resident

- Having a steady income that falls within the specified limits for the area

- Demonstrating the ability to repay the loan

- Intending to occupy the property as a primary residence

- Meeting any additional state or local requirements

Understanding these criteria can help applicants determine their eligibility before starting the application process.

Form Submission Methods

The USDA Direct Loan Application PDF can be submitted through various methods, depending on the applicant's preference and the requirements of the local USDA office. Common submission methods include:

- Online submission through the USDA's official website

- Mailing the completed form to the appropriate USDA office

- In-person submission at a local USDA office

Choosing the right submission method can affect the processing time, so applicants should consider their options carefully.

Legal Use of the USDA Direct Loan Application PDF

The USDA Direct Loan Application PDF is a legally recognized document when completed and submitted according to the guidelines set forth by the USDA. To ensure its legal standing, applicants must provide accurate information and comply with all relevant laws and regulations. Additionally, the use of electronic signatures is permitted, provided that they meet the requirements outlined in the ESIGN Act and UETA. This legal framework ensures that eSignatures are valid and enforceable, allowing for a smooth application process.

Quick guide on how to complete usda direct loan application pdf

Effortlessly prepare Usda Direct Loan Application Pdf on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Usda Direct Loan Application Pdf on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

Simple steps to modify and electronically sign Usda Direct Loan Application Pdf

- Locate Usda Direct Loan Application Pdf and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Modify and electronically sign Usda Direct Loan Application Pdf while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a development loan application form?

A development loan application form is a standardized document used to apply for financing to support new projects or developments. This form typically includes details about the project, financial projections, and the applicant's credentials. Completing this form accurately is crucial for a successful application process.

-

How can airSlate SignNow help with the development loan application form?

airSlate SignNow simplifies the process of preparing and submitting your development loan application form by providing easy-to-use eSignature tools. With our platform, you can fill out, sign, and send your documents securely in just a few clicks. This streamlines the approval process and enhances your experience.

-

What are the pricing options for using airSlate SignNow for development loan application forms?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. Each plan includes features for managing your development loan application form, such as unlimited document signing and templates. Visit our pricing page to choose the plan that best fits your needs.

-

Is it possible to integrate airSlate SignNow with other tools for managing development loan application forms?

Yes, airSlate SignNow offers multiple integrations with popular tools and platforms. This allows you to manage your development loan application form alongside your existing business applications. Integrating SignNow streamlines workflows and boosts efficiency.

-

What benefits does using airSlate SignNow for development loan application forms provide?

Using airSlate SignNow for your development loan application form offers numerous benefits, including faster processing times and enhanced security. The platform ensures that your documents are safely stored and can be accessed anytime. Moreover, the intuitive interface reduces the learning curve for new users.

-

Can multiple users collaborate on a development loan application form in airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the same development loan application form. This feature is particularly useful for teams who need to provide input or approvals before submission. Collaboration tools facilitate real-time updates and communication.

-

How secure is the information provided in a development loan application form submitted through airSlate SignNow?

Security is a top priority at airSlate SignNow. All data transmitted through our platform, including the development loan application form, is encrypted and stored securely. Additionally, we comply with industry standards to protect your sensitive information.

Get more for Usda Direct Loan Application Pdf

Find out other Usda Direct Loan Application Pdf

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer