Self Employment Income Verification Form

What is the Self Employment Income Verification Form

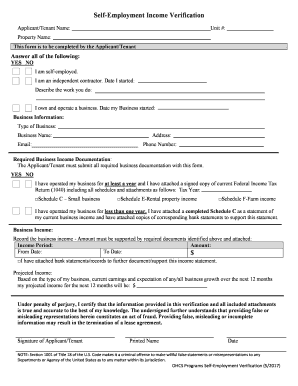

The Self Employment Income Verification Form is a crucial document used to confirm the income of individuals who are self-employed. This form is often required by financial institutions, government agencies, or other organizations to assess an applicant's financial status. It provides a detailed account of earnings, ensuring that the income reported aligns with tax filings and other financial documentation. This verification is essential for processes such as loan applications, rental agreements, and government assistance programs.

How to use the Self Employment Income Verification Form

Using the Self Employment Income Verification Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including tax returns, profit and loss statements, and any other relevant income records. Next, fill out the form with precise information regarding your earnings, business expenses, and any other financial details required. Once completed, the form can be submitted to the requesting institution, either electronically or in paper format, depending on their requirements.

Steps to complete the Self Employment Income Verification Form

Completing the Self Employment Income Verification Form requires careful attention to detail. Follow these steps for a successful submission:

- Collect your financial documents, such as your most recent tax returns and income statements.

- Fill in your personal information, including your name, address, and contact details.

- Provide a detailed account of your self-employment income, including gross earnings and net income.

- Include any relevant business expenses that may affect your net income.

- Review the form for accuracy and completeness before signing it.

- Submit the form as instructed by the requesting organization.

Key elements of the Self Employment Income Verification Form

Key elements of the Self Employment Income Verification Form include personal identification details, a comprehensive breakdown of income sources, and documentation of business expenses. It is essential to include:

- Your full name and contact information.

- A summary of your business activities and the nature of your self-employment.

- Annual income figures, including gross and net income.

- Supporting documentation, such as tax returns and profit and loss statements.

Legal use of the Self Employment Income Verification Form

The legal use of the Self Employment Income Verification Form is governed by various regulations, ensuring that the information provided is accurate and truthful. Misrepresentation of income on this form can lead to serious legal consequences, including fraud charges. It is essential to understand the legal implications of submitting this form, as it may be used in financial assessments, loan approvals, or eligibility determinations for government programs.

Required Documents

When completing the Self Employment Income Verification Form, several documents are typically required to support the information provided. These may include:

- Recent tax returns, including all schedules.

- Profit and loss statements for the current year.

- Bank statements that reflect business transactions.

- Any contracts or invoices that verify income sources.

Quick guide on how to complete self employment income verification form

Complete Self Employment Income Verification Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Self Employment Income Verification Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to adjust and electronically sign Self Employment Income Verification Form with ease

- Find Self Employment Income Verification Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or obscure confidential details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Adjust and electronically sign Self Employment Income Verification Form to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is self employment income verification?

Self employment income verification is the process of confirming an individual's income from self-employment to secure loans, mortgages, or other financial services. This verification typically involves providing documentation such as tax returns, profit and loss statements, and bank statements to demonstrate consistent income levels.

-

How can airSlate SignNow assist with self employment income verification?

airSlate SignNow offers an efficient platform for managing and signing financial documents necessary for self employment income verification. With our easy-to-use digital signature solutions, you can securely send and receive vital verification documents, ensuring a smooth and organized process.

-

Are there any costs associated with using airSlate SignNow for self employment income verification?

airSlate SignNow offers competitive pricing plans that cater to different business needs, allowing you to choose a plan that fits your budget. Our services, while cost-effective, provide the essential tools needed for efficient self employment income verification without compromising on quality.

-

What types of documents are needed for self employment income verification?

To complete self employment income verification, you typically need to provide tax returns, bank statements, profit and loss statements, and potentially client contracts. Using airSlate SignNow, you can easily prepare and manage these documents online, ensuring they're properly signed and stored.

-

Can I integrate airSlate SignNow with other financial software for self employment income verification?

Yes, airSlate SignNow offers integrations with a variety of financial software applications, making it streamlined to combine document signing with your existing financial processes. This makes handling self employment income verification more seamless and efficient for your business.

-

What measures does airSlate SignNow take to secure documents during self employment income verification?

At airSlate SignNow, we prioritize your data security with advanced encryption, secure servers, and compliance with industry standards to protect sensitive information during self employment income verification. You can trust us to keep your data safe while managing important documents.

-

Is it easy to use airSlate SignNow for self employment income verification?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing even those with minimal technical skills to easily navigate the platform. Whether you're preparing documents for self employment income verification or managing eSignatures, our intuitive interface simplifies the entire process.

Get more for Self Employment Income Verification Form

Find out other Self Employment Income Verification Form

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now