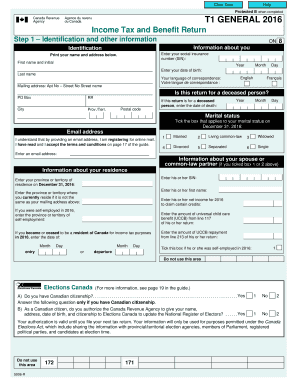

Income Tax and Benefit Return T1 General 2016

What is the Income Tax and Benefit Return T1 General

The Income Tax and Benefit Return T1 General is a crucial form for individuals in the United States to report their annual income and calculate their tax obligations. This form allows taxpayers to declare various sources of income, including wages, dividends, and interest. It also enables individuals to claim deductions and credits, which can reduce their overall tax liability. Understanding this form is essential for ensuring compliance with tax laws and maximizing potential benefits.

Steps to Complete the Income Tax and Benefit Return T1 General

Completing the Income Tax and Benefit Return T1 General involves several key steps:

- Gather necessary documentation, including W-2 forms, 1099 forms, and any relevant receipts for deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring you include all taxable earnings.

- Claim eligible deductions and credits to reduce your taxable income.

- Calculate your total tax owed or refund due based on the information provided.

- Review the completed form for accuracy before submission.

Required Documents

To successfully complete the Income Tax and Benefit Return T1 General, you will need several key documents:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Documentation for deductions, such as mortgage interest statements or medical expense receipts.

- Social Security number or Individual Taxpayer Identification Number (ITIN).

- Any previous year’s tax returns for reference.

Form Submission Methods

The Income Tax and Benefit Return T1 General can be submitted through various methods, providing flexibility for taxpayers:

- Online: Many taxpayers choose to file electronically using tax preparation software that simplifies the process and ensures accuracy.

- Mail: You can print the completed form and send it to the designated IRS address for your state.

- In-Person: Some individuals may prefer to file in person at designated IRS offices or authorized tax assistance centers.

Filing Deadlines / Important Dates

Being aware of the filing deadlines for the Income Tax and Benefit Return T1 General is essential to avoid penalties:

- The standard deadline for filing individual tax returns is typically April 15 of each year.

- If you require additional time, you can request an extension, which usually allows until October 15.

- Be mindful of any changes in deadlines due to special circumstances, such as natural disasters or legislative changes.

Penalties for Non-Compliance

Failing to file the Income Tax and Benefit Return T1 General on time can result in significant penalties:

- Late filing penalties can accumulate based on the amount of tax owed, increasing over time.

- Interest may accrue on any unpaid taxes, adding to the total amount due.

- In severe cases, non-compliance can lead to legal action or garnishment of wages.

Quick guide on how to complete income tax and benefit return t1 general 2016

Complete Income Tax And Benefit Return T1 General effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Income Tax And Benefit Return T1 General on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign Income Tax And Benefit Return T1 General seamlessly

- Locate Income Tax And Benefit Return T1 General and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure confidential details using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your method of delivering your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Income Tax And Benefit Return T1 General to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax and benefit return t1 general 2016

Create this form in 5 minutes!

People also ask

-

What is an income tax benefit return and how can it help my business?

An income tax benefit return is a crucial document that outlines your taxable income and possible deductions, which can help in maximizing your refunds and minimizing liabilities. By utilizing airSlate SignNow, businesses can efficiently manage these documents to ensure they achieve the best tax outcomes.

-

How does airSlate SignNow ensure the security of my income tax benefit return documents?

airSlate SignNow prioritizes document security by employing end-to-end encryption and secure cloud storage. This ensures that your income tax benefit return and other sensitive documents remain protected from unauthorized access.

-

Can I integrate airSlate SignNow with accounting software for handling income tax benefit returns?

Yes, airSlate SignNow easily integrates with popular accounting software to streamline the process of managing income tax benefit returns. This integration helps in organizing your documents efficiently while ensuring compliance with tax regulations.

-

What features does airSlate SignNow offer for managing income tax benefit returns?

airSlate SignNow offers features like electronic signatures, document templates, and real-time tracking that facilitate the management of income tax benefit returns. These tools simplify the entire process, making it easier for businesses to stay organized and compliant.

-

Is airSlate SignNow cost-effective for submitting income tax benefit returns?

Absolutely! airSlate SignNow provides a cost-effective solution tailored for businesses looking to submit income tax benefit returns without overspending. With various pricing plans, you can select an option that fits your budget while receiving robust features.

-

How quickly can I send my income tax benefit return documents using airSlate SignNow?

Using airSlate SignNow, you can send your income tax benefit return documents quickly thanks to its user-friendly interface and efficient e-signature process. Most documents can be sent and signed within minutes, signNowly speeding up your tax filing process.

-

Are there any mobile features available for managing income tax benefit returns?

Yes, airSlate SignNow offers mobile features that allow you to manage your income tax benefit returns on the go. With the mobile app, you can send documents, collect signatures, and track the status of your forms anytime, anywhere.

Get more for Income Tax And Benefit Return T1 General

Find out other Income Tax And Benefit Return T1 General

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online