Income Tax and Benefit Return 2024-2026

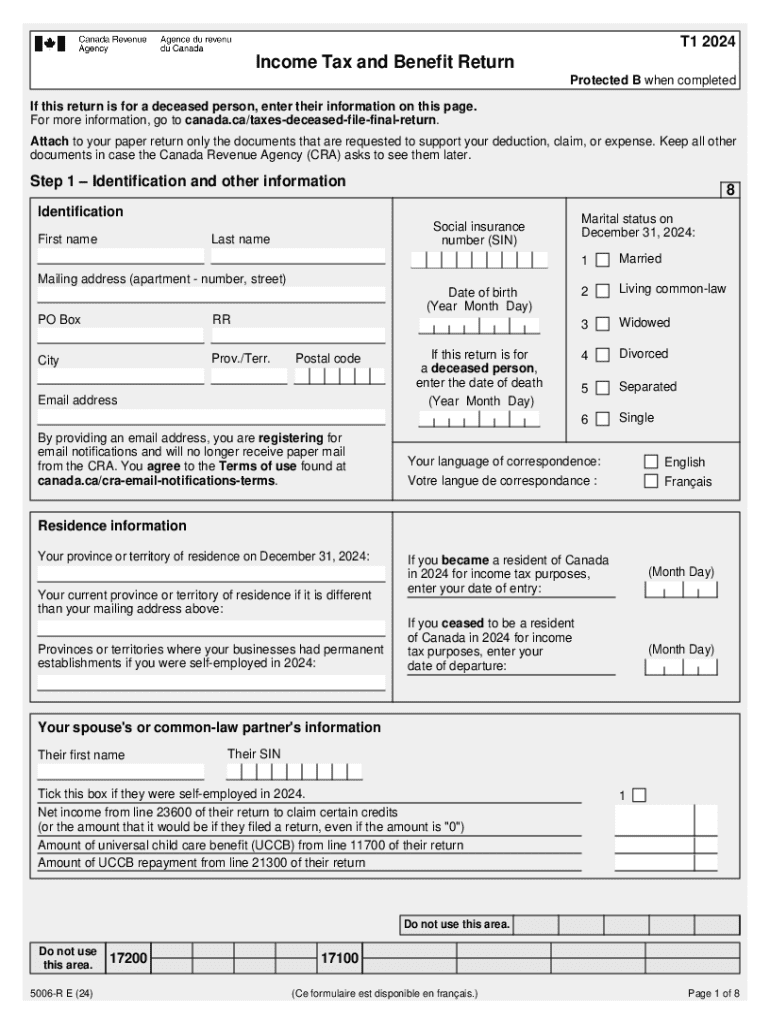

What is the Income Tax And Benefit Return

The Income Tax And Benefit Return is a crucial document that individuals and businesses in the United States use to report their income, calculate their tax liability, and claim various benefits. This form serves as an official record of earnings and taxes owed or refunded. It encompasses various income sources, including wages, dividends, and capital gains, while also allowing taxpayers to detail deductions and credits that may reduce their overall tax burden.

Steps to complete the Income Tax And Benefit Return

Completing the Income Tax And Benefit Return involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and receipts for deductible expenses.

- Choose the correct form based on your filing status and income level.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income accurately in the designated sections.

- Claim deductions and credits to which you are entitled.

- Calculate your total tax liability or refund amount.

- Review the completed form for accuracy before submission.

Required Documents

To successfully complete the Income Tax And Benefit Return, you need to gather specific documents:

- W-2 forms from employers detailing wages and withheld taxes.

- 1099 forms for other income sources, such as freelance work or investments.

- Receipts for deductible expenses, including medical bills and charitable contributions.

- Previous year’s tax return for reference and consistency.

Filing Deadlines / Important Dates

Understanding filing deadlines is essential to avoid penalties. Typically, the deadline for submitting the Income Tax And Benefit Return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can request an extension, allowing them to file up to six months later, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods

The Income Tax And Benefit Return can be submitted through various methods:

- Online filing via tax software or the IRS website, which is often the fastest method.

- Mailing a paper return to the appropriate IRS address based on your state.

- In-person filing at designated IRS offices or authorized tax preparation services.

IRS Guidelines

The Internal Revenue Service (IRS) provides comprehensive guidelines for completing the Income Tax And Benefit Return. These guidelines include instructions on eligibility for various deductions and credits, as well as information on how to report different types of income. Taxpayers are encouraged to review these guidelines to ensure compliance and maximize potential refunds.

Create this form in 5 minutes or less

Find and fill out the correct income tax and benefit return

Create this form in 5 minutes!

How to create an eSignature for the income tax and benefit return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Income Tax And Benefit Return?

An Income Tax And Benefit Return is a form that individuals and businesses file with the government to report their income, calculate taxes owed, and claim benefits. It is essential for ensuring compliance with tax laws and maximizing potential refunds or credits. Understanding this process can help you manage your finances more effectively.

-

How can airSlate SignNow help with my Income Tax And Benefit Return?

airSlate SignNow simplifies the process of preparing and submitting your Income Tax And Benefit Return by allowing you to eSign documents securely and efficiently. Our platform streamlines document management, making it easier to gather necessary signatures and submit forms on time. This can save you valuable time and reduce stress during tax season.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses handling their Income Tax And Benefit Return. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage requirements.

-

Are there any features specifically for managing Income Tax And Benefit Returns?

Yes, airSlate SignNow includes features that are particularly beneficial for managing your Income Tax And Benefit Return. These features include customizable templates, automated reminders for deadlines, and secure storage for your documents. This ensures that you have everything you need at your fingertips when it's time to file.

-

Can I integrate airSlate SignNow with other accounting software for my Income Tax And Benefit Return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your Income Tax And Benefit Return. This integration allows for smooth data transfer and ensures that all your financial information is up-to-date and accurate, simplifying the filing process.

-

What are the benefits of using airSlate SignNow for my Income Tax And Benefit Return?

Using airSlate SignNow for your Income Tax And Benefit Return offers numerous benefits, including enhanced security, time savings, and improved accuracy. Our platform allows you to eSign documents quickly and securely, reducing the risk of errors and ensuring compliance. This can lead to a more efficient tax filing experience overall.

-

Is airSlate SignNow user-friendly for first-time users handling Income Tax And Benefit Returns?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for first-time users managing their Income Tax And Benefit Return. Our intuitive interface guides you through the process, ensuring you can easily navigate document preparation and eSigning. You'll find that getting started is straightforward and hassle-free.

Get more for Income Tax And Benefit Return

- Departamento del trabajo online form

- Ultrasound consent form 331761382

- Calm sponsorship form thecalmzonenet

- Payco expenses form

- Fin594 application for residency change to texas form

- Gifted program prince william county form

- Dr 0100 colorado retail sales tax return form

- Content creator agreement template form

Find out other Income Tax And Benefit Return

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form