T1236e 2018-2026

What is the T1236e

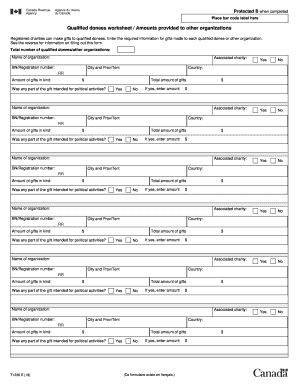

The T1236e form is a critical document used in Canada for reporting qualified donees amounts. It allows organizations to disclose their contributions to registered charities and other qualified donees. Understanding the purpose of the T1236e is essential for ensuring compliance with Canadian tax regulations. This form is particularly relevant for non-profit organizations and charities that need to maintain transparency about their financial activities and contributions.

Steps to complete the T1236e

Completing the T1236e form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including donation receipts and records of contributions made to qualified donees. Next, fill out the form by providing detailed information about each donee, including their name, registration number, and the amounts contributed. Ensure that all entries are accurate and reflect the actual donations made during the reporting period. Finally, review the completed form for any errors before submission.

Legal use of the T1236e

The legal use of the T1236e form is governed by Canadian tax laws, which mandate that organizations must accurately report their contributions to qualified donees. This form serves as an official record that can be reviewed by tax authorities to verify compliance. To ensure the form's legal validity, organizations must adhere to the guidelines set forth by the Canada Revenue Agency (CRA) and maintain proper documentation of all contributions made.

How to obtain the T1236e

Organizations can obtain the T1236e form through the Canada Revenue Agency's website or by contacting their local CRA office. The form is available in both digital and printable formats, allowing for easy access. Once downloaded, organizations can fill out the form electronically or by hand, depending on their preference. It is important to ensure that the most current version of the form is used to comply with any updates in regulations.

Form Submission Methods

The T1236e form can be submitted through various methods, including online, by mail, or in-person at designated CRA offices. For online submissions, organizations can use the CRA's secure portal to upload their completed forms. Mailing the form requires careful attention to address details to ensure it reaches the correct department. In-person submissions may be beneficial for organizations seeking immediate confirmation of receipt.

Examples of using the T1236e

Organizations typically use the T1236e form to report their donations to registered charities, such as local food banks, educational institutions, or health organizations. For instance, a non-profit that contributes to multiple charities throughout the year would compile their donation records and use the T1236e to report these amounts accurately. This form not only helps maintain transparency but also allows organizations to claim any applicable tax credits for their contributions.

Quick guide on how to complete t1236e

Complete T1236e effortlessly on any gadget

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, enabling you to find the right form and safely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage T1236e on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and electronically sign T1236e without hassle

- Locate T1236e and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign T1236e and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1236e

Create this form in 5 minutes!

People also ask

-

What is the t1236 form and why is it important?

The t1236 form is a critical document used for various tax purposes, particularly for tax credits and deductions. Understanding its requirements and correct filling methods can help you avoid common mistakes and ensure compliance with tax laws.

-

How can airSlate SignNow help me in signing the t1236 form?

airSlate SignNow simplifies the process of preparing and eSigning the t1236 form. With our user-friendly interface, you can easily upload, fill out, and quickly send the form for signatures, ensuring a hassle-free experience.

-

Is there a specific pricing plan for managing the t1236 form with airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide tailored features for handling documents like the t1236 form efficiently, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other applications for the t1236 form?

Absolutely! airSlate SignNow supports numerous integrations with popular applications, allowing you to streamline your workflow when dealing with the t1236 form. This connectivity enhances productivity by combining your essential tasks into one platform.

-

What are the key benefits of using airSlate SignNow for the t1236 form?

Using airSlate SignNow for the t1236 form comes with several benefits, including time-saving eSignature features, improved document security, and easy collaboration. These advantages help you manage your submissions more effectively and maintain compliance.

-

How secure is airSlate SignNow for handling the t1236 form?

Security is a top priority at airSlate SignNow. We implement industry-standard encryption and authentication protocols to protect sensitive information related to the t1236 form, ensuring your data remains safe throughout the signing process.

-

Can I track the status of my t1236 form through airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your t1236 form in real-time. You'll receive notifications when documents are viewed and signed, giving you complete visibility over your workflows.

Get more for T1236e

Find out other T1236e

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online