Vat 68 Form Online 2010

What is the Vat 68 Form Online

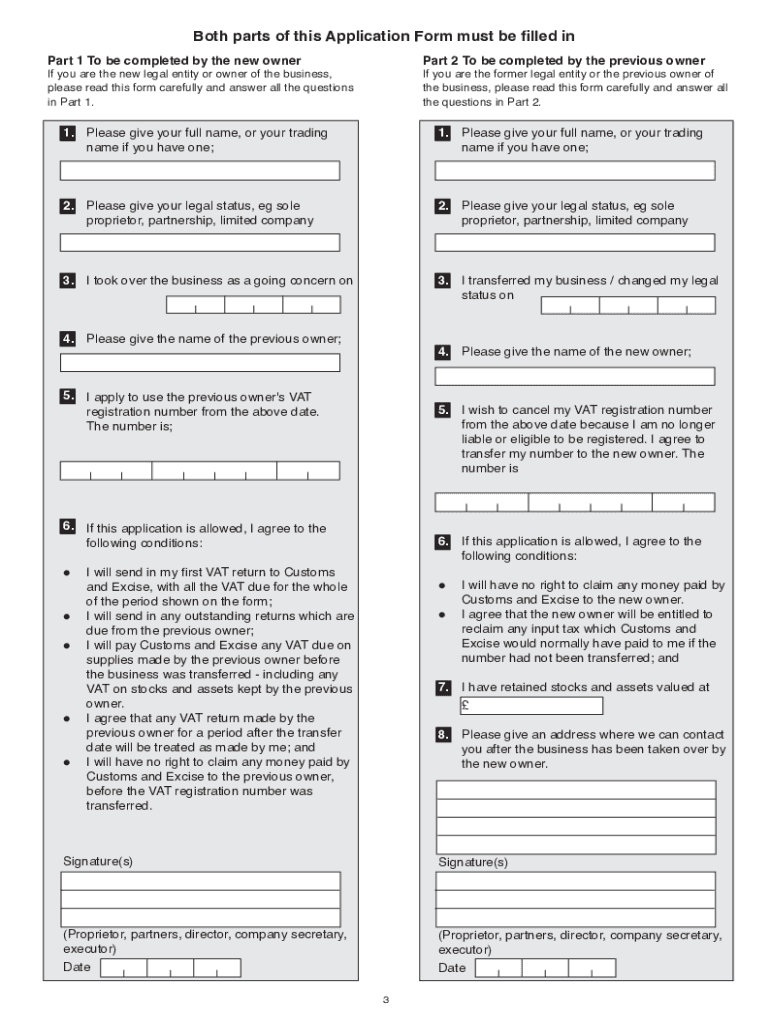

The Vat 68 form, also known as the VAT transfer of going concern form, is a critical document used in the context of transferring a business as a going concern. This form is essential for businesses in the United States that are involved in the sale or transfer of assets and need to comply with specific tax regulations. The Vat 68 form helps ensure that the transaction adheres to the necessary legal and tax obligations, particularly concerning value-added tax (VAT) implications. Understanding the purpose and requirements of the Vat 68 form is crucial for businesses to navigate the complexities of tax compliance effectively.

How to use the Vat 68 Form Online

Using the Vat 68 form online simplifies the process of completing and submitting this important document. To begin, access the form through a reliable digital platform that supports electronic signatures. Fill out the required fields accurately, ensuring that all necessary information is included. After completing the form, you can eSign it using a secure digital signature solution. This method not only streamlines the submission process but also ensures compliance with legal standards for electronic documents. Always double-check the completed form for accuracy before finalizing your submission.

Steps to complete the Vat 68 Form Online

Completing the Vat 68 form online involves a series of straightforward steps:

- Access the Vat 68 form through a trusted digital platform.

- Fill in the required information, including details about the business and the transaction.

- Review the completed form for accuracy, ensuring all fields are filled correctly.

- Utilize a digital signature solution to eSign the document securely.

- Submit the form electronically or follow any specified submission guidelines.

By following these steps, businesses can ensure a smooth and compliant process for using the Vat 68 form online.

Legal use of the Vat 68 Form Online

The legal use of the Vat 68 form online is governed by regulations that recognize electronic signatures as valid. To ensure that the form is legally binding, it is essential to comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures carry the same weight as traditional handwritten signatures, provided that the signer intends to authenticate the document. Using a reputable platform for signing and submitting the Vat 68 form online helps maintain compliance with these legal standards.

Key elements of the Vat 68 Form Online

Several key elements must be included in the Vat 68 form to ensure its validity and effectiveness:

- Business Information: Details about the transferring and receiving parties, including names, addresses, and tax identification numbers.

- Transaction Details: A clear description of the assets being transferred and the terms of the transaction.

- Signature Section: A designated area for electronic signatures, confirming the agreement of all parties involved.

- Date of Transfer: The date on which the transfer of assets is taking place, which is crucial for tax purposes.

Including these elements ensures that the Vat 68 form is complete and legally compliant.

Who Issues the Form

The Vat 68 form is typically issued by the state tax authority or relevant government agency responsible for overseeing tax compliance in the jurisdiction where the business operates. It is essential for businesses to confirm the issuing authority to ensure they are using the correct version of the form and adhering to any specific requirements set forth by that authority. Understanding the issuing body can also provide insights into any additional documentation or processes that may be necessary for a successful transaction.

Quick guide on how to complete vat 68 form online

Complete Vat 68 Form Online effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Vat 68 Form Online on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Vat 68 Form Online effortlessly

- Find Vat 68 Form Online and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight relevant sections of the documents or redact sensitive information with tools specially offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Vat 68 Form Online and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat 68 form online

Create this form in 5 minutes!

How to create an eSignature for the vat 68 form online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is VAT68 and how does it relate to airSlate SignNow?

VAT68 is a specific document format used for Value Added Tax reporting. With airSlate SignNow, you can easily create, sign, and manage VAT68 documents, streamlining your tax compliance process. This integration helps businesses maintain accurate records and simplifies the filing process.

-

How much does airSlate SignNow cost for VAT68 document signing?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for VAT68 document signing. Depending on your plan, you can access features to manage multiple users and templates, ensuring cost-effectiveness for all document workflows. Check our pricing page for detailed information.

-

What are the key features of airSlate SignNow for handling VAT68?

airSlate SignNow provides powerful features for VAT68 management, including customizable templates, automated workflows, and secure storage. These features enhance your document management efficiency, ensuring smooth processing of your VAT68 forms. With electronic signatures, you can finalize documents quickly and securely.

-

How does airSlate SignNow benefit businesses that need to manage VAT68?

By using airSlate SignNow, businesses simplify the management of VAT68 documents, reducing administrative burdens and speeding up the signing process. This efficient approach minimizes errors and ensures compliance with tax regulations. Overall, it helps businesses save time and resources.

-

Can I integrate airSlate SignNow with other applications for VAT68 management?

Yes, airSlate SignNow offers integrations with various applications, making it easy to manage VAT68 documents alongside your other business tools. This flexibility allows for seamless data transfer and enhances overall workflow efficiency. Explore our integrations page for more options.

-

Is airSlate SignNow compliant with tax regulations for VAT68?

Absolutely, airSlate SignNow is designed to comply with relevant tax regulations, ensuring that your VAT68 documents are handled securely and legally. Our platform adheres to strict security standards, providing peace of mind for businesses. You can confidently use our solution for your tax documentation needs.

-

What support does airSlate SignNow provide for users managing VAT68 documents?

airSlate SignNow offers comprehensive customer support to assist users with VAT68 document management. Our dedicated support team is available through various channels to answer your questions and provide guidance. We also offer extensive resources, including FAQs and tutorials, to help you get the most from our platform.

Get more for Vat 68 Form Online

- Classifying chemical reactions worksheet form

- Personal assessment wheel alycia hall form

- Belmont personal supplement form

- Annual report form for guardian filing individually dallas county dallascounty

- Pool party booking form pdf

- John hancock direct deposit form

- Over the counter otc benefit catalog keystone first vip form

- Private pay laboratory requisition panorama nipt form

Find out other Vat 68 Form Online

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word