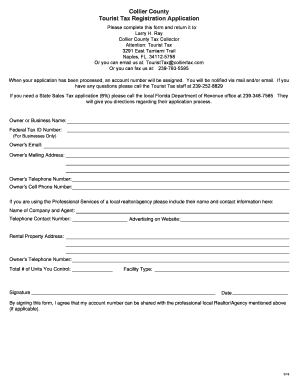

Collier County Tourist Tax Form

What is the Collier County Tourist Tax

The Collier County Tourist Tax, also known as the bed tax, is a tax levied on short-term rentals and accommodations within Collier County, Florida. This tax applies to hotels, motels, vacation rentals, and other lodging facilities that cater to tourists. The revenue generated from this tax is primarily used to promote tourism and support local infrastructure, enhancing the overall visitor experience in the area.

How to use the Collier County Tourist Tax

Using the Collier County Tourist Tax involves understanding the applicable rates and ensuring compliance with local regulations. Property owners and managers must collect the tax from guests at the time of booking and remit it to the county. The current tax rate is typically a percentage of the rental fee and varies based on local legislation. It is essential to stay updated on any changes to the tax rate or regulations to ensure proper collection and remittance.

Steps to complete the Collier County Tourist Tax

Completing the Collier County Tourist Tax involves several key steps:

- Determine the applicable tax rate based on current legislation.

- Collect the tax from guests during their stay.

- Maintain accurate records of all transactions and tax collected.

- File the required tax return with the Collier County Tax Collector's office.

- Remit the collected tax by the specified deadlines to avoid penalties.

Legal use of the Collier County Tourist Tax

The legal use of the Collier County Tourist Tax is governed by state and local laws. Property owners must ensure they are properly registered with the county and comply with all tax collection and remittance regulations. Failure to comply can result in penalties, including fines and interest on unpaid taxes. It is advisable to consult with a tax professional or legal advisor to ensure compliance with all relevant laws.

Required Documents

To properly manage the Collier County Tourist Tax, certain documents are necessary:

- Tax registration certificate from the Collier County Tax Collector.

- Records of all rental transactions, including guest information and tax collected.

- Completed tax return forms, which detail the amount of tax collected and remitted.

- Any correspondence with the county regarding tax matters.

Penalties for Non-Compliance

Non-compliance with the Collier County Tourist Tax regulations can lead to significant penalties. These may include:

- Fines for failure to collect or remit the tax.

- Interest on unpaid taxes, which can accumulate over time.

- Potential legal action by the county to recover owed taxes.

- Loss of the ability to operate as a rental property if compliance issues persist.

Quick guide on how to complete collier county tourist tax

Effortlessly Prepare Collier County Tourist Tax on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without delay. Manage Collier County Tourist Tax seamlessly on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Collier County Tourist Tax with Ease

- Find Collier County Tourist Tax and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, be it via email, SMS, an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, laborious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Collier County Tourist Tax and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Collier County Tourist Tax?

The Collier County Tourist Tax, also known as a bed tax, is a tax imposed on short-term rental accommodations in Collier County. This tax is typically levied on guests staying in hotels, motels, vacation rentals, and similar lodging facilities. Understanding this tax is crucial for compliance and financial planning for property owners.

-

How can airSlate SignNow help with managing the Collier County Tourist Tax?

airSlate SignNow simplifies the process of managing the Collier County Tourist Tax by providing a platform for eSigning and sending necessary documentation related to tax compliance. With our user-friendly features, businesses can easily keep track of tax filings and ensure timely submissions, reducing the risk of penalties.

-

What are the key features of airSlate SignNow that support compliance with Collier County Tourist Tax?

Key features of airSlate SignNow that support compliance with the Collier County Tourist Tax include secure document storage, customizable templates, and automated reminders for tax submissions. These tools help businesses streamline their operations while ensuring they meet all regulatory requirements effectively.

-

Is airSlate SignNow cost-effective for businesses dealing with the Collier County Tourist Tax?

Yes, airSlate SignNow is a cost-effective solution for businesses managing the Collier County Tourist Tax. Our pricing model is designed to accommodate various business sizes, making it accessible for small to large enterprises while providing a comprehensive suite of features to enhance productivity.

-

Can airSlate SignNow integrate with other software to help with the Collier County Tourist Tax?

Absolutely! airSlate SignNow offers numerous integrations with popular financial and property management software that can aid in managing the Collier County Tourist Tax. These integrations allow for seamless data transfer, improving accuracy and reducing the workload related to tax compliance.

-

What benefits does airSlate SignNow offer to property owners regarding the Collier County Tourist Tax?

Property owners can benefit from airSlate SignNow by gaining an efficient and streamlined approach to handling the Collier County Tourist Tax paperwork. The platform’s eSigning capabilities ensure quick approvals and documentation sharing, allowing owners to focus more on their properties and less on tax-related tasks.

-

How secure is airSlate SignNow when dealing with Collier County Tourist Tax documents?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents related to the Collier County Tourist Tax. Our platform is equipped with advanced encryption and compliance features to protect your data, ensuring that all document interactions are secure and confidential.

Get more for Collier County Tourist Tax

- College visit worksheet pdf 219263062 form

- 5 2 rewriting percent expressions form

- Oasis d form

- Deficiency slip form

- Child adolescent diagnostic assessment form

- Prokureursorde pretoria form

- Verification of death form

- Inventario clnico de millon para adolescentes resultados de la prueba maci mediante el sistema wwwe perfilcom form

Find out other Collier County Tourist Tax

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself