Tlctifdriver Form

What is the Tlctifdriver?

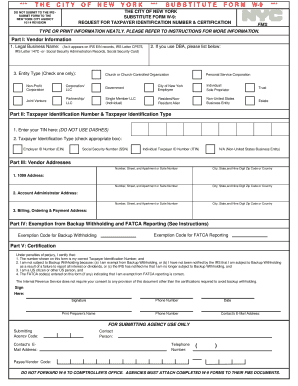

The Tlctifdriver is a specific form used in the United States for taxpayer identification purposes. It serves as a means for individuals and businesses to provide their taxpayer identification number (TIN) to various entities, such as financial institutions or government agencies. This identification number is essential for tax reporting and compliance, ensuring that all parties involved can accurately track income and tax obligations.

How to use the Tlctifdriver

Using the Tlctifdriver involves completing the form with accurate information. Users must enter their taxpayer identification number, along with other required details such as name and address. It is crucial to ensure that all information matches the records held by the IRS to avoid any discrepancies. Once completed, the form can be submitted electronically or in paper format, depending on the requirements of the receiving entity.

Steps to complete the Tlctifdriver

Completing the Tlctifdriver can be broken down into several straightforward steps:

- Gather necessary information, including your taxpayer identification number and personal details.

- Access the Tlctifdriver form through the appropriate platform or agency.

- Fill in all required fields, ensuring accuracy and consistency with IRS records.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, as per the instructions provided.

Legal use of the Tlctifdriver

The Tlctifdriver is legally binding when filled out correctly and submitted to the appropriate parties. It is important to comply with all relevant regulations, including those set forth by the IRS. Proper use of this form ensures that taxpayer identification numbers are handled securely and in accordance with federal and state laws.

Required Documents

When completing the Tlctifdriver, individuals may need to provide additional documentation to verify their identity. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport.

- Social Security card or other documentation that confirms the taxpayer identification number.

- Proof of address, such as a utility bill or bank statement.

IRS Guidelines

The IRS provides specific guidelines for using taxpayer identification numbers, including how to apply for one and the circumstances under which it is required. It is essential to adhere to these guidelines to ensure compliance and avoid potential penalties. The IRS website offers comprehensive resources for understanding the requirements associated with taxpayer identification numbers.

Quick guide on how to complete tlctifdriver

Prepare Tlctifdriver effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without issues. Manage Tlctifdriver on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

How to edit and electronically sign Tlctifdriver with ease

- Locate Tlctifdriver and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and bears the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your edits.

- Select how you'd like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Tlctifdriver and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a taxpayer identification number (TIN) and why is it important?

A taxpayer identification number (TIN) is a unique identifier assigned to individuals and businesses for the purpose of tax reporting. It is critical for ensuring accurate tax filing and compliance with IRS regulations. Using a TIN helps reduce the risk of identity theft and streamlines transactions with your financial institutions.

-

How does airSlate SignNow help in managing documents with taxpayer identification numbers?

airSlate SignNow provides an intuitive platform to eSign documents securely, including those that require a taxpayer identification number. Our solution simplifies the process of obtaining signatures and ensures sensitive information, such as TINs, is managed securely and efficiently within documents. This streamlined approach enhances both compliance and user experience.

-

What pricing options does airSlate SignNow offer for businesses using taxpayer identification numbers?

airSlate SignNow provides a range of pricing plans suitable for businesses of all sizes needing to manage documents containing taxpayer identification numbers. Our plans are designed to be cost-effective while providing comprehensive features that ensure ease of use and security. You can choose between various tiers depending on your company's needs and anticipated volume.

-

Are there any specific features related to taxpayer identification numbers in airSlate SignNow?

Yes, airSlate SignNow includes advanced features tailored to businesses that frequently deal with taxpayer identification numbers. These features include customizable templates, secure storage for sensitive data, and real-time tracking of document statuses. This allows users to maintain compliance and access necessary information quickly and efficiently.

-

Can airSlate SignNow integrate with other tools that require the use of a taxpayer identification number?

Absolutely! airSlate SignNow seamlessly integrates with various business tools, allowing the easy sharing and management of documents that include taxpayer identification numbers. This integration enhances workflow efficiency and ensures that your financial and tax-related processes are cohesive and streamlined across different platforms.

-

How secure is the handling of taxpayer identification numbers with airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when handling sensitive information like taxpayer identification numbers. We utilize industry-standard encryption to protect documents during transmission and storage. Additionally, our platform complies with regulatory standards to ensure that your data remains confidential and secure.

-

What benefits does eSigning documents with taxpayer identification numbers offer?

eSigning documents that include taxpayer identification numbers offers numerous benefits, including faster turnaround times and reduced paper usage. With airSlate SignNow, you can quickly and securely sign documents without the hassle of printing and scanning, which can delay tax processes. This not only saves time but also enhances operational efficiency.

Get more for Tlctifdriver

Find out other Tlctifdriver

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation