Withholding Declaration Form

What is the Withholding Declaration Form

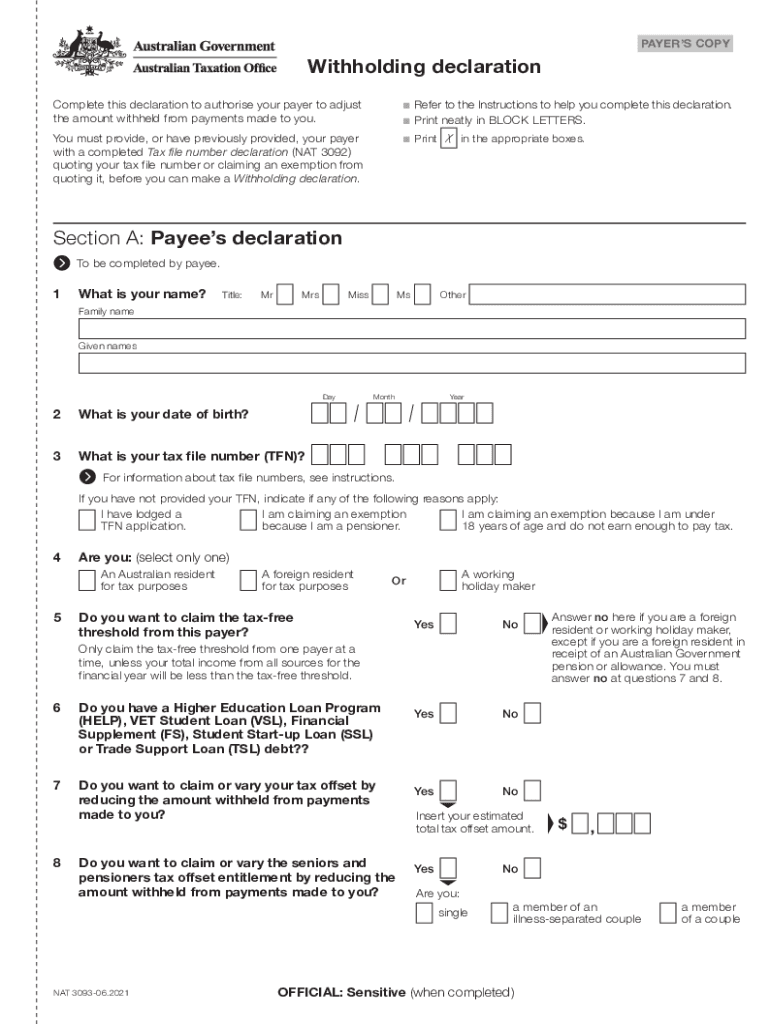

The withholding declaration form, often referred to as the TFN withholding declaration form, is a crucial document used in the United States for tax purposes. This form allows employees to inform their employers about their tax file number (TFN) and any relevant details that affect the amount of tax withheld from their paychecks. By completing this form accurately, employees can ensure that the correct amount of tax is deducted, which helps in avoiding underpayment or overpayment of taxes throughout the year.

How to use the Withholding Declaration Form

Using the withholding declaration form involves several straightforward steps. First, obtain the form from a reliable source, such as the IRS website or your employer. Next, fill out the required fields, including your personal information and TFN. It is essential to provide accurate information to avoid any issues with tax withholding. After completing the form, submit it to your employer, who will use it to calculate the appropriate tax deductions from your paycheck.

Steps to complete the Withholding Declaration Form

To complete the withholding declaration form effectively, follow these steps:

- Gather necessary information, including your TFN and personal details.

- Carefully read the instructions provided with the form.

- Fill in the required sections, ensuring accuracy in your entries.

- Review the completed form for any errors or omissions.

- Submit the form to your employer in a timely manner.

Legal use of the Withholding Declaration Form

The withholding declaration form is legally recognized as a valid document for tax purposes in the United States. It is essential for ensuring compliance with federal tax laws. Employers are required to keep this form on file and use the information provided to calculate the correct amount of tax to withhold from employee wages. Failure to use the form correctly may result in penalties for both the employer and employee.

Key elements of the Withholding Declaration Form

Several key elements are essential to the withholding declaration form. These include:

- Tax File Number (TFN): This unique identifier is crucial for tax purposes.

- Personal Information: This includes your name, address, and Social Security number.

- Withholding Preferences: Indicate any specific preferences regarding tax withholding.

- Signature: Your signature confirms that the information provided is accurate.

Form Submission Methods

The withholding declaration form can be submitted through various methods, depending on your employer's policies. Common submission methods include:

- Online: Some employers may allow electronic submission via their payroll systems.

- Mail: You can send a printed copy of the form to your employer's HR or payroll department.

- In-Person: Delivering the form directly to your employer may also be an option.

Quick guide on how to complete withholding declaration form

Effortlessly prepare Withholding Declaration Form on any device

Online document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle Withholding Declaration Form on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest way to alter and eSign Withholding Declaration Form without any hassle

- Obtain Withholding Declaration Form and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether it be by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Withholding Declaration Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a TFN withholding declaration form?

The TFN withholding declaration form is a document used by employees in Australia to disclose their Tax File Number (TFN) to their employer. This form helps ensure that the correct amount of tax is withheld from your earnings. Using airSlate SignNow, you can easily prepare and send this form electronically, making the process seamless and efficient.

-

How do I fill out a TFN withholding declaration form?

To fill out a TFN withholding declaration form, you’ll need to provide personal details including your name, address, and TFN. Ensure that all the information is accurate to avoid any discrepancies in tax withholding. With airSlate SignNow, you can complete this form online and even save your progress for future reference.

-

What are the benefits of using airSlate SignNow for the TFN withholding declaration form?

airSlate SignNow offers a user-friendly interface that simplifies the completion and sending of the TFN withholding declaration form. Its features include electronic signatures, secure document storage, and instant notifications, which enhance efficiency and compliance. Additionally, our platform ensures that your documents are legally binding and protected.

-

Is airSlate SignNow cost-effective for handling TFN withholding declaration forms?

Yes, airSlate SignNow provides a cost-effective solution for managing TFN withholding declaration forms compared to traditional paper-based processes. Our pricing plans are flexible and designed to accommodate businesses of all sizes, ensuring you get great value while streamlining your workflow. Adopting our service can lead to signNow savings in time and resources.

-

Can I integrate airSlate SignNow with other software for handling TFN withholding declaration forms?

Absolutely! airSlate SignNow offers various integrations with popular applications such as Google Drive, Salesforce, and Microsoft Office. This flexibility allows you to manage your TFN withholding declaration forms directly from your preferred software, enhancing productivity and making collaboration simpler.

-

How secure is the information on my TFN withholding declaration form with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods to protect your personal information, including data related to the TFN withholding declaration form. Additionally, our platform complies with industry standards to ensure that your documents remain confidential and secure.

-

How can I track the status of my TFN withholding declaration form using airSlate SignNow?

With airSlate SignNow, tracking the status of your TFN withholding declaration form is straightforward. You will receive instant notifications when your document is viewed, signed, or requires any action. This real-time update feature helps you stay informed throughout the entire process.

Get more for Withholding Declaration Form

Find out other Withholding Declaration Form

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word