Address Change Form Pa

What is the Address Change Form Pa

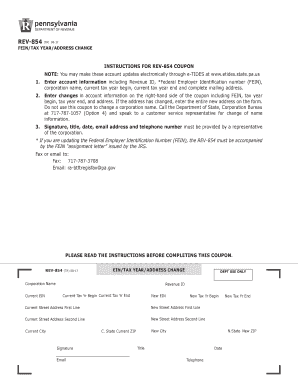

The Address Change Form PA is a crucial document for individuals and businesses in Pennsylvania who need to update their address with the appropriate state agencies. This form is essential for ensuring that all correspondence, including tax documents and notifications, is sent to the correct location. By submitting this form, you can maintain accurate records with the Pennsylvania Department of Revenue and other relevant entities.

How to use the Address Change Form Pa

Using the Address Change Form PA is straightforward. First, download the form from the official state website or obtain it through a local office. Fill in the required fields, which typically include your old address, new address, and personal identification details. Once completed, submit the form according to the instructions provided, ensuring that you keep a copy for your records. This process helps prevent any disruptions in receiving important documents.

Steps to complete the Address Change Form Pa

Completing the Address Change Form PA involves several key steps:

- Download the form from the Pennsylvania Department of Revenue website.

- Provide your full name, Social Security number, and the old address you are changing from.

- Enter your new address, ensuring that all details are accurate.

- Sign and date the form to verify the information provided.

- Submit the form via mail or electronically, as specified in the instructions.

Legal use of the Address Change Form Pa

The Address Change Form PA is legally binding once submitted to the relevant authorities. It ensures that your address is officially updated in state records, which is crucial for compliance with tax obligations and other legal requirements. Failing to use this form may lead to missed communications regarding tax filings or other important notifications, potentially resulting in penalties.

Required Documents

When submitting the Address Change Form PA, you may need to provide additional documentation to verify your identity and address change. Commonly required documents include:

- A government-issued photo ID, such as a driver's license or passport.

- Proof of your new address, which can be a utility bill, lease agreement, or bank statement.

- Any previous correspondence from the Pennsylvania Department of Revenue that includes your old address.

Form Submission Methods (Online / Mail / In-Person)

The Address Change Form PA can typically be submitted through various methods, depending on your preference and the guidelines set by the Pennsylvania Department of Revenue. You may choose to:

- Submit the form online through the department's official website, if available.

- Mail the completed form to the designated address provided in the instructions.

- Visit a local office in person to submit the form directly and receive immediate confirmation.

Quick guide on how to complete address change form pa

Complete Address Change Form Pa effortlessly on any device

Digital document organization has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without interruptions. Manage Address Change Form Pa on any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest method to modify and eSign Address Change Form Pa with ease

- Obtain Address Change Form Pa and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with features that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device you prefer. Edit and eSign Address Change Form Pa and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the address change form pa and why do I need it?

The address change form pa is a document used to officially update your address with various state agencies and institutions. It is essential for ensuring that your records are accurate and that you receive important correspondence, such as tax documents or legal notices, at your new address.

-

How can airSlate SignNow help me with the address change form pa?

airSlate SignNow provides an easy-to-use platform for filling out and eSigning the address change form pa. With our solution, you can complete the form quickly, ensuring that all necessary information is included, which can streamline the submission process to the relevant authorities.

-

Is there a cost associated with using airSlate SignNow for the address change form pa?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Whether you're a small business or a large organization, you can find a plan that includes access to features for managing your address change form pa and other document needs affordably.

-

What features does airSlate SignNow offer that are beneficial for submitting the address change form pa?

With airSlate SignNow, you can enjoy features such as customizable templates, secure eSigning, and real-time status tracking. These features enhance the submission process for your address change form pa, ensuring it is filed efficiently and securely.

-

Can I integrate airSlate SignNow with other software to manage my address change form pa?

Yes, airSlate SignNow seamlessly integrates with various CRM and document management systems. This allows you to efficiently manage the address change form pa alongside your other business documentation, streamlining your operations.

-

How does airSlate SignNow ensure the security of my address change form pa?

airSlate SignNow follows industry-leading security protocols, including encryption and secure storage practices. This ensures that your sensitive information in the address change form pa is protected throughout the signing and submission process.

-

Is it easy to use airSlate SignNow for first-time users submitting an address change form pa?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, allowing even first-time users to navigate and complete the address change form pa effortlessly. Our intuitive interface and step-by-step guidance make the process simple and accessible.

Get more for Address Change Form Pa

Find out other Address Change Form Pa

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple