Rs4531 Form

What is the Rs4531

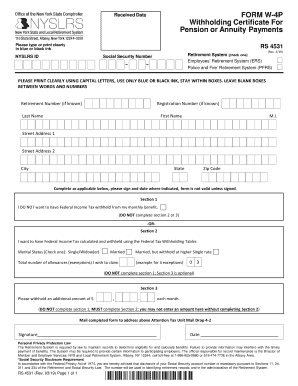

The Rs4531 form is a crucial document used in the context of New York State pension and annuity payments. This form is specifically designed for individuals who are receiving pension benefits and need to manage their withholding tax obligations. It allows recipients to specify the amount of state tax to be withheld from their payments, ensuring compliance with state tax regulations. Understanding the purpose and implications of the Rs4531 is essential for anyone receiving pension or annuity payments in New York.

How to use the Rs4531

Using the Rs4531 form involves a few straightforward steps. First, individuals must download the form from the appropriate state resources. Once downloaded, the form requires personal information, including the recipient's name, address, and Social Security number. Next, recipients must indicate their desired withholding amount, which can vary based on individual tax situations. After completing the form, it should be submitted to the pension provider to ensure that the correct amount is withheld from future payments.

Steps to complete the Rs4531

Completing the Rs4531 form accurately is vital for proper tax withholding. Here are the steps to follow:

- Download the form: Access the Rs4531 form from the New York State official website.

- Fill in personal details: Provide your full name, address, and Social Security number in the designated fields.

- Select withholding amount: Choose the appropriate withholding amount based on your tax situation. This can be a specific dollar amount or a percentage of your payment.

- Review your information: Double-check all entries for accuracy to avoid issues with tax withholding.

- Submit the form: Send the completed Rs4531 form to your pension provider, ensuring they have the latest information for your payments.

Legal use of the Rs4531

The Rs4531 form is legally recognized for managing tax withholding on pension and annuity payments in New York. To ensure its legal validity, it must be filled out completely and accurately. The form complies with state tax laws, which require pension providers to withhold the appropriate amount of tax from payments. By using the Rs4531, recipients can avoid potential tax penalties and ensure their withholding aligns with their financial needs.

Key elements of the Rs4531

Several key elements define the Rs4531 form and its use:

- Personal Information: Essential details such as name, address, and Social Security number must be included.

- Withholding Amount: Recipients can specify a fixed amount or a percentage for tax withholding.

- Signature: The form must be signed to validate the information provided.

- Submission Instructions: Clear guidance on where to send the completed form is provided to ensure proper processing.

Form Submission Methods

The Rs4531 form can be submitted through various methods, depending on the preferences of the pension provider. Common submission methods include:

- Online Submission: Some pension providers may allow for electronic submission of the form through their secure portals.

- Mail: The completed form can be printed and mailed directly to the pension provider's designated address.

- In-Person: Recipients may also choose to deliver the form in person at the provider's office, ensuring immediate processing.

Quick guide on how to complete rs4531

Effortlessly Prepare Rs4531 on Any Device

The management of digital documents has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Rs4531 on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to alter and electronically sign Rs4531 with ease

- Find Rs4531 and click Get Form to begin.

- Use the tools provided to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive details with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Rs4531 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the purpose of withholding w 4p?

Withholding w 4p is used to specify additional withholding on your income beyond the standard deductions. This can help ensure that you are covered for your tax liabilities over the year. Understanding this form is essential for effective tax planning.

-

How can airSlate SignNow help with signing withholding w 4p forms?

airSlate SignNow allows you to easily send and eSign withholding w 4p forms securely online. It provides a user-friendly interface that facilitates quick signature processes, ensuring that you can manage your tax documentation efficiently without hassle.

-

Is there a cost associated with using airSlate SignNow for withholding w 4p forms?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing your withholding w 4p forms. Our plans include features like unlimited document signing and integrations with popular apps to enhance your user experience at a competitive price.

-

What features does airSlate SignNow offer for handling withholding w 4p?

With airSlate SignNow, you can benefit from features like template creation for repetitive tasks, document tracking, and reminders for outstanding signatures. These features streamline the signing and submission of withholding w 4p forms, ensuring efficiency and compliance.

-

Can I integrate airSlate SignNow with my existing software for withholding w 4p processing?

Absolutely! airSlate SignNow seamlessly integrates with various platforms such as CRM systems, cloud storage, and accounting software. This integration allows for effortless management of your withholding w 4p forms and related documents, enhancing your overall workflow.

-

What are the benefits of using airSlate SignNow for withholding w 4p?

Using airSlate SignNow for withholding w 4p forms offers numerous benefits, such as improved accuracy, reduced processing time, and enhanced security for your documents. Additionally, our electronic signatures are legally binding, ensuring compliance and peace of mind.

-

How does airSlate SignNow ensure the security of my withholding w 4p documents?

airSlate SignNow prioritizes the security of your withholding w 4p documents through advanced encryption and stringent access controls. We comply with leading security standards to protect your sensitive information throughout the signing process.

Get more for Rs4531

Find out other Rs4531

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure