Authority to Deduct Form Pag Ibig

What is the Authority to Deduct Form Pag Ibig

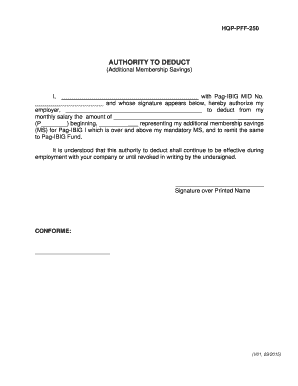

The Authority to Deduct Form Pag Ibig is a crucial document used by members of the Pag-IBIG Fund in the Philippines. This form allows members to authorize their employers to deduct contributions directly from their salaries. The deductions are intended for various purposes, including savings and housing loans. Understanding this form is essential for ensuring that contributions are made consistently and that members can access benefits associated with the Pag-IBIG Fund.

How to Use the Authority to Deduct Form Pag Ibig

Using the Authority to Deduct Form Pag Ibig involves a straightforward process. Members need to fill out the form with accurate personal details, including their Pag-IBIG membership number, employer information, and the amount to be deducted. Once completed, the form should be submitted to the employer's human resources or payroll department. This ensures that the deductions are processed correctly and timely, allowing members to enjoy the benefits of their contributions.

Steps to Complete the Authority to Deduct Form Pag Ibig

Completing the Authority to Deduct Form Pag Ibig requires several key steps:

- Obtain the form from your employer or the Pag-IBIG Fund website.

- Fill in your personal information, including your full name, address, and Pag-IBIG membership number.

- Provide your employer's details, including the company name and address.

- Indicate the amount to be deducted from your salary.

- Sign and date the form to confirm your authorization.

- Submit the completed form to your employer's HR or payroll department.

Legal Use of the Authority to Deduct Form Pag Ibig

The Authority to Deduct Form Pag Ibig is legally binding once signed by the member. It complies with the regulations set forth by the Pag-IBIG Fund, ensuring that contributions are deducted as authorized. Employers are required to adhere to the terms outlined in the form and must ensure that the deductions are made in accordance with the member's instructions. This legal framework protects both the member's rights and the employer's obligations.

Key Elements of the Authority to Deduct Form Pag Ibig

Several key elements must be included in the Authority to Deduct Form Pag Ibig to ensure its validity:

- Member Information: Full name, address, and Pag-IBIG membership number.

- Employer Details: Company name, address, and contact information.

- Deduction Amount: The specific amount to be deducted from the salary.

- Signature: The member's signature, which serves as authorization.

- Date: The date when the form is signed.

Form Submission Methods

The Authority to Deduct Form Pag Ibig can be submitted through various methods, depending on the employer's policies. Common submission methods include:

- In-Person: Hand-delivering the form to the HR or payroll department.

- Via Email: Sending a scanned copy of the signed form to the designated HR email address.

- Online Portal: Some employers may offer an online platform for submitting forms electronically.

Quick guide on how to complete authority to deduct form pag ibig

Effortlessly Prepare Authority To Deduct Form Pag Ibig on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow offers all the resources you require to create, modify, and eSign your documents swiftly without any delays. Manage Authority To Deduct Form Pag Ibig on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign Authority To Deduct Form Pag Ibig with Ease

- Locate Authority To Deduct Form Pag Ibig and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Authority To Deduct Form Pag Ibig to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a membership form in the Philippines?

A membership form in the Philippines is a document that organizations use to register new members. This form typically collects essential information, including the member's name, contact details, and membership type. Using airSlate SignNow, you can create and manage these forms efficiently, ensuring a smooth onboarding process.

-

How can airSlate SignNow help with electronic membership forms in the Philippines?

airSlate SignNow simplifies the process of creating and sending electronic membership forms in the Philippines. With our platform, you can customize templates, add fields for signatures, and ensure secure data collection. It streamlines registrations and reduces the paperwork burden for organizations.

-

What features does airSlate SignNow offer for membership forms in the Philippines?

airSlate SignNow offers features like e-signatures, document templates, and customizable workflows specifically for membership forms in the Philippines. You can track the status of forms, set reminders, and integrate with other tools to enhance operational efficiency. These features help organizations manage their memberships more effectively.

-

Is airSlate SignNow cost-effective for managing membership forms in the Philippines?

Yes, airSlate SignNow is a cost-effective solution for managing membership forms in the Philippines. Our pricing plans are designed to suit various budgets, allowing organizations to choose a package that meets their needs. The savings from reduced paper usage and streamlined processes make it a valuable investment.

-

Can I integrate airSlate SignNow with other applications for my membership forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications that organizations in the Philippines use. You can connect with CRMs, payment systems, and other tools to enhance your membership form processes, ensuring better data management and customer relationship handling.

-

What are the benefits of using airSlate SignNow for membership forms in the Philippines?

Utilizing airSlate SignNow for membership forms in the Philippines brings numerous benefits. It enhances efficiency through streamlined workflows, reduces errors with e-signatures, and enhances user experience for new members. These advantages lead to higher satisfaction and better retention rates.

-

How secure is airSlate SignNow for handling membership forms in the Philippines?

airSlate SignNow prioritizes security, ensuring that all membership forms in the Philippines are handled with the highest level of data protection. We use encryption, secure cloud storage, and compliance with industry standards to keep sensitive information safe. This instills confidence in users and protects organizational reputation.

Get more for Authority To Deduct Form Pag Ibig

- Background screeners of america disclosure and release form

- Dd form 1351 2 may

- Pag ibig calamity loan form

- Yazoo valley electric application form

- Kuwait visa medical form pdf

- Interim federal health program ifhp form

- Student registration form on line to success queen39s

- Completion of community involvement activities form

Find out other Authority To Deduct Form Pag Ibig

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History