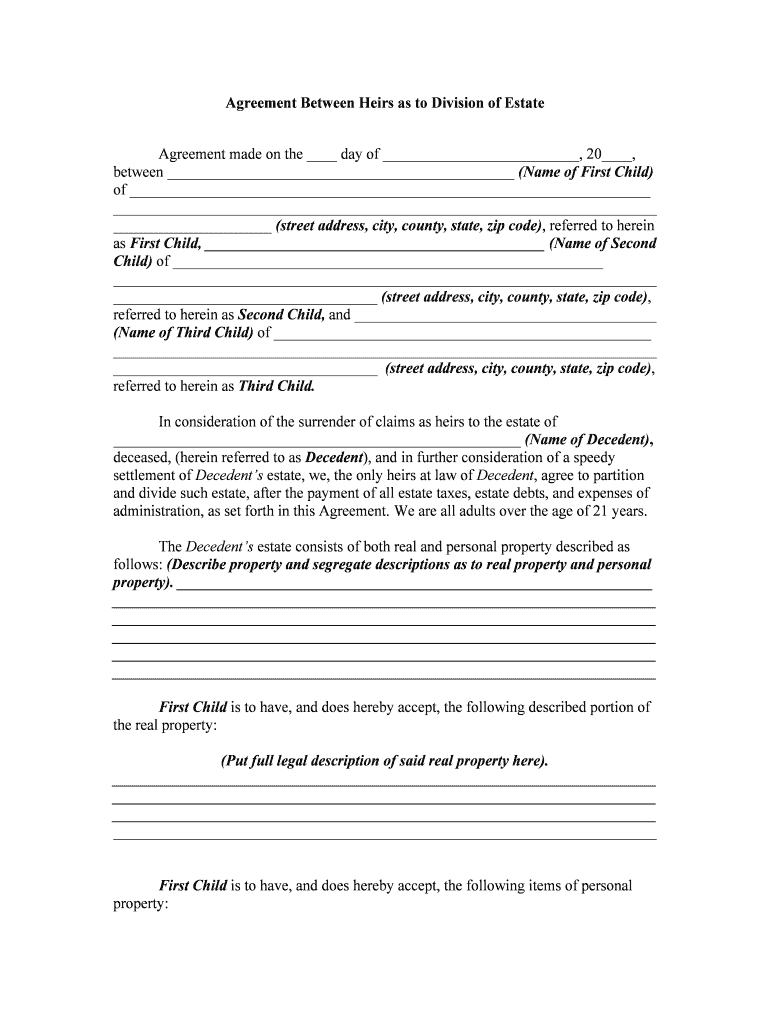

Agreement between Heirs as to Division of Estate Form

Understanding the Agreement Between Heirs for Estate Division

The Agreement Between Heirs for the division of an estate is a legal document that outlines how the assets of a deceased individual will be distributed among their heirs. This agreement is crucial in preventing disputes and ensuring that all parties are aware of their rights and responsibilities. It typically includes details about the specific assets involved, the percentage each heir will receive, and any conditions that may apply to the distribution. By formalizing these agreements, heirs can avoid potential conflicts and ensure a smoother transition of assets.

Steps to Complete the Agreement Between Heirs for Estate Division

Completing the Agreement Between Heirs involves several important steps to ensure that it is legally binding and accurately reflects the intentions of all parties involved. Here are the key steps:

- Gather Information: Collect all relevant information regarding the estate, including asset valuations and any debts.

- Discuss with Heirs: Hold discussions with all heirs to agree on the distribution of assets and any specific terms.

- Draft the Agreement: Create a written document that outlines the agreed-upon terms, ensuring clarity and detail.

- Review and Revise: Allow all heirs to review the document and suggest any necessary changes.

- Sign the Agreement: Ensure that all parties sign the document, preferably in the presence of a notary public to enhance its legal standing.

Legal Use of the Agreement Between Heirs for Estate Division

The legal use of the Agreement Between Heirs is essential for ensuring that the distribution of an estate is recognized by courts and other legal entities. This document serves as proof of the heirs' agreement and can be used in probate proceedings to validate the distribution plan. It is important that the agreement complies with state laws to avoid any legal challenges. Consulting with an attorney specializing in estate law can provide guidance on the legal requirements and help ensure that the agreement is enforceable.

Key Elements of the Agreement Between Heirs for Estate Division

To create a comprehensive Agreement Between Heirs, several key elements must be included:

- Identification of Heirs: Clearly list all heirs involved in the agreement.

- Description of Assets: Provide a detailed description of the assets being divided.

- Distribution Plan: Outline how each asset will be distributed among the heirs.

- Signatures: Include signatures of all heirs to signify their agreement.

- Date of Agreement: Document the date when the agreement is finalized.

State-Specific Rules for the Agreement Between Heirs for Estate Division

Each state in the U.S. has its own laws governing the distribution of estates and the validity of agreements among heirs. It is crucial to be aware of these state-specific rules, as they can affect the enforceability of the agreement. For example, some states may require the agreement to be notarized, while others may have specific forms or procedures that must be followed. Researching local laws or consulting with a legal professional can help ensure compliance and avoid complications during the probate process.

Examples of Using the Agreement Between Heirs for Estate Division

Real-life examples of the Agreement Between Heirs can illustrate its importance and application. For instance, in a scenario where siblings inherit a family home, they may use the agreement to decide who will live in the home, who will receive financial compensation, and how to handle maintenance costs. Another example could involve dividing personal property, such as jewelry or collectibles, where the heirs agree on specific items each person will receive. These examples highlight how the agreement can facilitate clear communication and prevent misunderstandings among heirs.

Quick guide on how to complete agreement between heirs as to division of estate

Complete Agreement Between Heirs As To Division Of Estate seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Agreement Between Heirs As To Division Of Estate on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

How to modify and eSign Agreement Between Heirs As To Division Of Estate effortlessly

- Locate Agreement Between Heirs As To Division Of Estate and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Agreement Between Heirs As To Division Of Estate and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an agreement probate purchase?

An agreement probate purchase is a legal document used during the probate process, facilitating the purchase of assets from an estate. This agreement ensures that the buyer has the legal right to acquire the specified assets, simplifying transactions related to estates.

-

How does airSlate SignNow facilitate the agreement probate purchase process?

airSlate SignNow streamlines the agreement probate purchase process by allowing users to easily send and eSign documents online. Its intuitive interface helps ensure that all parties can quickly review and approve necessary documents, accelerating the overall transaction time.

-

What are the benefits of using airSlate SignNow for my agreement probate purchase?

Using airSlate SignNow for your agreement probate purchase provides several benefits, including enhanced security, improved efficiency, and cost savings. The platform reduces the need for physical paperwork and in-person meetings, allowing for a more convenient and reliable transaction process.

-

Is airSlate SignNow compliant with legal standards for agreement probate purchase?

Yes, airSlate SignNow complies with legal standards for eSignature and document management, ensuring that your agreement probate purchase holds up in court. The platform adheres to regulations like the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA).

-

What pricing plans does airSlate SignNow offer for agreement probate purchase solutions?

airSlate SignNow offers various pricing plans tailored to different needs, including options for individual users and teams. Each plan includes essential features for managing your agreement probate purchase efficiently, ensuring you find a solution that fits your budget.

-

Can I integrate airSlate SignNow with other tools for agreement probate purchase management?

Absolutely! airSlate SignNow integrates seamlessly with many popular tools and platforms, enhancing the management of your agreement probate purchase. This includes CRM systems, cloud storage solutions, and productivity apps, allowing you to create a cohesive workflow.

-

What features of airSlate SignNow are most useful for managing agreement probate purchases?

Key features of airSlate SignNow for managing agreement probate purchases include customizable templates, real-time collaboration, and secure document storage. These tools enable users to efficiently create, sign, and manage documents required for smooth transactions.

Get more for Agreement Between Heirs As To Division Of Estate

- Social security payee form filled example

- Office file number or imm 1343 case label form

- 132a form

- Econet premium form

- Plant review worksheet part 1 form

- Correct the details of a marriage or civil partnership registration form

- Application form to correct the details of a marriage registration correct the details of a marriage registration

- Efta cl appendix 5 to annex viii switzerland schedule of specific commitments form

Find out other Agreement Between Heirs As To Division Of Estate

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement