Railroad Track Maintenance Tax Credit Form

What is the Railroad Track Maintenance Tax Credit

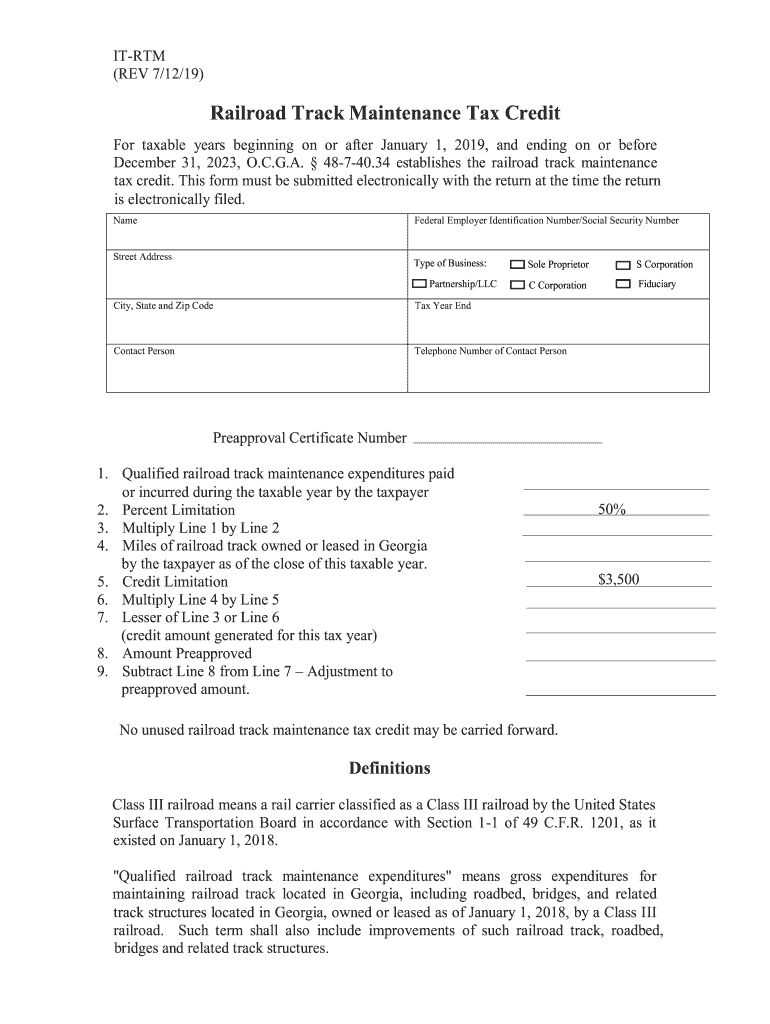

The Railroad Track Maintenance Tax Credit is a federal tax incentive designed to encourage the maintenance and improvement of railroad tracks. This credit allows eligible taxpayers to receive a credit against their federal income tax for a portion of the expenses incurred in maintaining and repairing railroad tracks. The aim is to enhance the safety and efficiency of rail transport, which is crucial for economic growth and infrastructure development in the United States.

Eligibility Criteria

To qualify for the Railroad Track Maintenance Tax Credit, taxpayers must meet specific criteria. Generally, the credit is available to railroads that own or lease track and are involved in the transportation of goods or passengers. Eligible expenses typically include costs related to track maintenance, such as repairs, upgrades, and replacements. Taxpayers should ensure they are compliant with the IRS regulations regarding the credit to maximize their benefits.

Steps to Complete the Railroad Track Maintenance Tax Credit

Completing the Railroad Track Maintenance Tax Credit involves several key steps:

- Determine eligibility based on ownership or leasing of railroad tracks.

- Identify qualifying expenses related to track maintenance and repairs.

- Gather necessary documentation, including receipts and invoices for the maintenance work.

- Complete the appropriate IRS forms, ensuring all required information is accurately reported.

- Submit the completed forms with your federal tax return, either electronically or by mail.

Required Documents

When applying for the Railroad Track Maintenance Tax Credit, taxpayers must prepare specific documentation to support their claim. Required documents typically include:

- Invoices and receipts for maintenance work performed on the railroad tracks.

- Records of any contracts with maintenance providers.

- Documentation proving ownership or leasing of the railroad tracks.

- Completed IRS forms related to the tax credit.

IRS Guidelines

The IRS provides detailed guidelines regarding the Railroad Track Maintenance Tax Credit. These guidelines outline the eligibility requirements, qualifying expenses, and the documentation needed for claiming the credit. Taxpayers should refer to the IRS website or consult a tax professional to ensure compliance with all regulations and to avoid potential issues during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for claiming the Railroad Track Maintenance Tax Credit align with the standard federal tax return deadlines. Typically, taxpayers must file their returns by April 15 of the following year. However, it is essential to stay updated on any changes to tax laws or deadlines that may affect the filing process. Taxpayers should also consider any extensions that may apply to their specific situation.

Quick guide on how to complete railroad track maintenance tax credit

Accomplish Railroad Track Maintenance Tax Credit effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the appropriate form and securely maintain it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly, without delays. Handle Railroad Track Maintenance Tax Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Railroad Track Maintenance Tax Credit easily

- Obtain Railroad Track Maintenance Tax Credit and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or conceal sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your preference. Alter and eSign Railroad Track Maintenance Tax Credit to ensure outstanding communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What steps should be taken regarding tax employee death documentation?

In the event of a tax employee death, it is crucial to manage their documentation efficiently. Utilizing airSlate SignNow can simplify this process by enabling you to collect necessary signatures and approvals electronically. This ensures that all tax-related documents are processed swiftly and securely, alleviating any potential administrative burden during a difficult time.

-

How can airSlate SignNow help with tax employee death forms?

airSlate SignNow can streamline the completion and submission of tax employee death forms by allowing users to fill out, sign, and send documents from anywhere. The platform's intuitive interface makes it easy to gather signatures from multiple parties, reducing delays and ensuring compliance with tax regulations related to employee death.

-

Is airSlate SignNow affordable for small businesses facing tax employee death issues?

Yes, airSlate SignNow is a cost-effective solution for small businesses dealing with tax employee death. Our pricing plans are designed for scalability, allowing you to choose a package that fits your budget while still providing powerful features for document management and eSigning. This ensures you can efficiently handle sensitive situations without incurring high costs.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers a variety of features tailored for managing tax documents, including secure eSigning, document storage, and template creation. These capabilities allow users to streamline their workflow effectively in cases of tax employee death, ensuring that all necessary actions are taken promptly and accurately.

-

Can airSlate SignNow be integrated with other software for tax purposes?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting and HR software solutions, allowing you to manage tax documentation related to employee death more efficiently. This integration means you can maintain consistency across your systems, keeping all vital tax information synchronized and accessible.

-

How does airSlate SignNow ensure the security of documents related to tax employee death?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents such as those related to tax employee death. Our platform employs advanced encryption methods, secure cloud storage, and identity verification processes to ensure that your documents are safe and only accessible to authorized users.

-

What benefits does airSlate SignNow provide for managing tax employee death documentation?

By using airSlate SignNow to manage tax employee death documentation, you can signNowly reduce processing time and improve accuracy. The platform's user-friendly features allow for quick access to templates, eSigning, and streamlined collaboration, which can help ease the burden on teams facing challenging circumstances.

Get more for Railroad Track Maintenance Tax Credit

Find out other Railroad Track Maintenance Tax Credit

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now