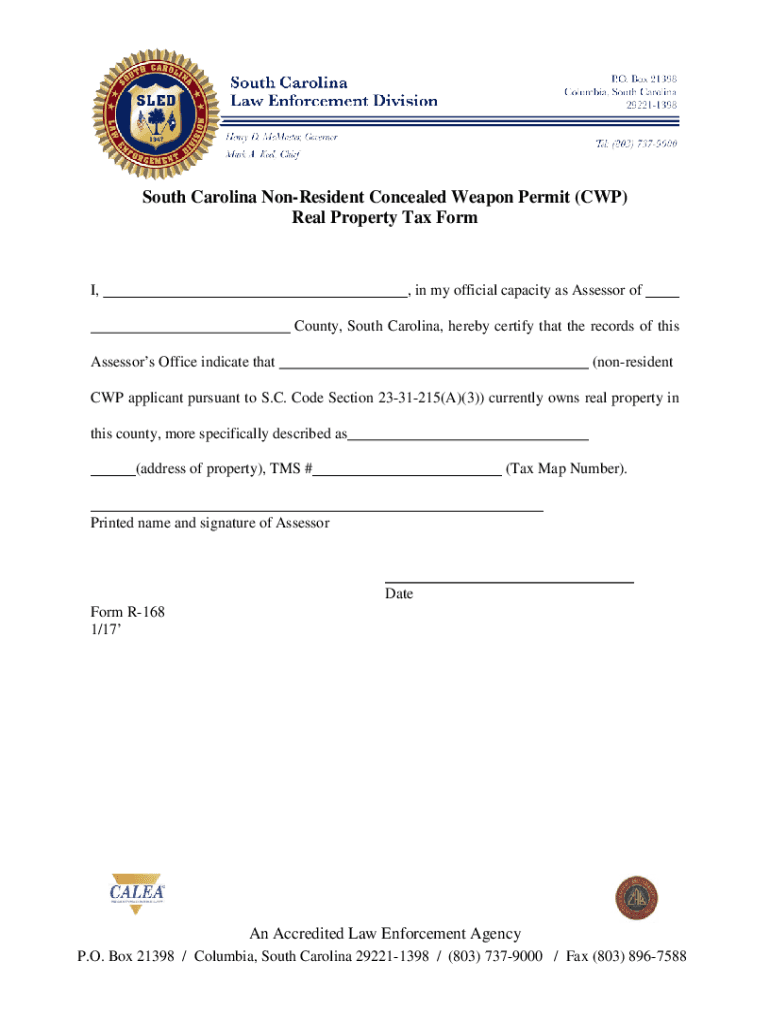

Sled Form R 168

What is the Sled Form R 168

The Sled Form R 168 is a specific document used primarily for non-resident tax purposes in the United States. This form is essential for individuals who do not reside in the state where they are filing taxes but have income sourced from that state. It helps to determine the appropriate tax obligations for non-residents and ensures compliance with state tax regulations. Understanding the purpose of this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Sled Form R 168

Using the Sled Form R 168 involves several key steps. First, gather all necessary information regarding your income sources and residency status. Then, accurately fill out the form, ensuring that all details are correct and complete. It is important to follow the instructions provided with the form closely, as any inaccuracies can lead to delays or issues with your tax filing. After completing the form, review it for errors before submission to ensure compliance with state tax laws.

Steps to complete the Sled Form R 168

Completing the Sled Form R 168 requires careful attention to detail. Here are the essential steps:

- Obtain the latest version of the Sled Form R 168 from the appropriate state tax authority.

- Provide your personal information, including your name, address, and Social Security number.

- Detail your income sources, specifying amounts earned in the state.

- Indicate any deductions or credits you may be eligible for as a non-resident.

- Review the form for accuracy and completeness.

- Submit the form according to the guidelines provided, either online or via mail.

Legal use of the Sled Form R 168

The legal use of the Sled Form R 168 is governed by state tax laws that outline the requirements for non-resident tax filings. To be considered legally binding, the form must be completed accurately and submitted on time. Additionally, it is important to ensure that any signatures or electronic submissions comply with the relevant eSignature laws, such as the ESIGN Act and UETA. This legal framework helps to safeguard the integrity of the document and ensures that it is recognized by tax authorities.

Key elements of the Sled Form R 168

Several key elements are crucial for the Sled Form R 168. These include:

- Personal Information: Accurate details about the taxpayer, including name and address.

- Income Reporting: Clear documentation of income earned within the state.

- Deductions: Any applicable deductions that can reduce taxable income.

- Signature: A required signature or electronic acknowledgment to validate the form.

Who Issues the Form

The Sled Form R 168 is typically issued by the state tax authority where the income is sourced. Each state may have its own specific requirements and regulations governing the use of this form. It is important for taxpayers to verify that they are using the correct version of the form as issued by their respective state to ensure compliance with local tax laws.

Quick guide on how to complete sled form r 168

Prepare Sled Form R 168 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-conscious substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Sled Form R 168 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest method to modify and electronically sign Sled Form R 168 without hassle

- Locate Sled Form R 168 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Sled Form R 168 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the sled form r 168 in airSlate SignNow?

The sled form r 168 is a customizable digital document that can be easily integrated into the airSlate SignNow platform. It allows users to collect signatures electronically, streamlining business processes and improving workflow efficiency. With airSlate SignNow, managing the sled form r 168 has never been easier.

-

How much does it cost to use the sled form r 168 with airSlate SignNow?

Pricing for using the sled form r 168 depends on the airSlate SignNow subscription plan you select. airSlate SignNow offers various plans that cater to different business needs, making it a cost-effective solution for eSigning documents. You can explore our pricing page for more details on how the sled form r 168 fits into your budget.

-

What are the key features of the sled form r 168?

The sled form r 168 includes several key features such as electronic signature capability, customizable templates, and automated workflows. Users can easily tailor the form to suit their specific requirements, ensuring a smooth signing experience. Additionally, airSlate SignNow's robust security measures protect all data associated with the sled form r 168.

-

How can the sled form r 168 benefit my business?

Utilizing the sled form r 168 can signNowly enhance your business's efficiency by reducing paperwork and speeding up the signing process. With airSlate SignNow, you can manage document workflows seamlessly, allowing you to focus on core business activities. This not only saves time but also improves customer satisfaction when documents are processed faster.

-

Can I integrate the sled form r 168 with other applications?

Yes, the sled form r 168 can be easily integrated with a variety of applications through airSlate SignNow’s API. This enables you to automate workflows and push data between different systems, making your processes more efficient. Integration options provide flexibility and help teams work cohesively, maximizing productivity.

-

Is it easy to create a sled form r 168?

Absolutely! Creating a sled form r 168 in airSlate SignNow is user-friendly and requires no technical expertise. The platform provides intuitive tools and templates that guide you through the setup process, ensuring that you can generate your form quickly and effectively without any hassle.

-

What security measures are in place for the sled form r 168?

airSlate SignNow prioritizes security for the sled form r 168, implementing robust encryption protocols and compliance with industry standards. Our platform protects sensitive data at every step of the signing process, ensuring that all information remains confidential and secure. You can confidently manage documents knowing they are safeguarded.

Get more for Sled Form R 168

- Doh 2557 form

- Gambling license cost in kenya form

- Des moines area community college transcripts form

- Notification of serious incident form si01

- Megaphone printable template form

- Slam poetry worksheet pdf form

- Theory test pass certificate template form

- Certification of inspection by a duly constituted form

Find out other Sled Form R 168

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document