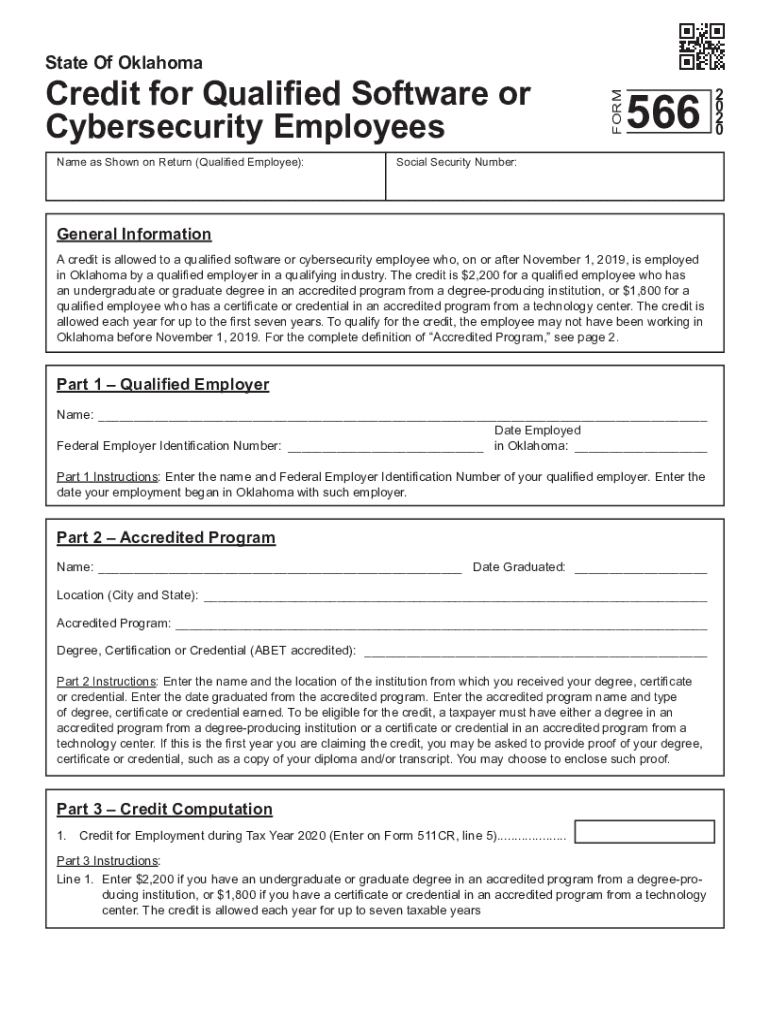

Credit for Qualified Software or Cybersecurity Employees Form

What is the credit for qualified software or cybersecurity employees?

The credit for qualified software or cybersecurity employees is a tax incentive designed to encourage businesses to invest in their workforce by hiring and retaining skilled professionals in these critical fields. This credit can help offset the costs associated with salaries and benefits for employees who meet specific qualifications. It is particularly relevant for companies looking to enhance their cybersecurity measures or develop innovative software solutions. Understanding the criteria and benefits of this credit can significantly impact a business's financial health and operational capabilities.

Eligibility criteria for the credit for qualified software or cybersecurity employees

To qualify for the credit for qualified software or cybersecurity employees, businesses must meet certain eligibility criteria. These typically include:

- The employee must be a full-time worker engaged in qualified activities related to software development or cybersecurity.

- The business must demonstrate that the employee's work directly contributes to the development or enhancement of software or cybersecurity solutions.

- Employers must maintain records that substantiate the employee's qualifications and the nature of their work.

It is essential for businesses to review these criteria carefully to ensure compliance and maximize their potential benefits from the credit.

Steps to complete the credit for qualified software or cybersecurity employees

Completing the credit for qualified software or cybersecurity employees involves several key steps:

- Determine eligibility by reviewing the criteria for both the business and the employees.

- Gather necessary documentation, including employee records and proof of their work in qualified activities.

- Complete the appropriate forms as required by the IRS or state tax authorities.

- Submit the forms by the specified deadlines, ensuring all information is accurate and complete.

Following these steps can help ensure that businesses successfully claim the credit and benefit from the associated tax savings.

Legal use of the credit for qualified software or cybersecurity employees

The legal use of the credit for qualified software or cybersecurity employees requires adherence to specific regulations set forth by the IRS and state tax authorities. Businesses must ensure that:

- All employees claimed for the credit meet the defined qualifications and are engaged in eligible activities.

- Documentation is maintained to support claims, including payroll records and job descriptions.

- Forms are filed accurately and submitted by the required deadlines to avoid penalties.

Understanding these legal requirements is crucial for businesses to protect themselves from compliance issues and maximize their tax benefits.

How to obtain the credit for qualified software or cybersecurity employees

To obtain the credit for qualified software or cybersecurity employees, businesses should follow a systematic approach:

- Identify qualified employees and verify their eligibility based on the criteria established by the IRS.

- Collect all necessary documentation that supports the claim, such as employment contracts and project descriptions.

- Complete the required tax forms accurately, ensuring that all information is current and precise.

- File the forms with the appropriate tax authority, either electronically or via mail, according to the guidelines provided.

By following these steps, businesses can effectively secure the credit and enhance their financial position.

Required documents for the credit for qualified software or cybersecurity employees

When applying for the credit for qualified software or cybersecurity employees, businesses must prepare and submit several key documents:

- Employee records that demonstrate full-time employment status and engagement in qualified activities.

- Documentation of the specific projects or tasks performed by the employees that qualify for the credit.

- Completed tax forms required by the IRS or state authorities for claiming the credit.

Having these documents ready can streamline the application process and help ensure compliance with all requirements.

Quick guide on how to complete credit for qualified software or cybersecurity employees

Prepare Credit For Qualified Software Or Cybersecurity Employees effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional paper documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Credit For Qualified Software Or Cybersecurity Employees on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Credit For Qualified Software Or Cybersecurity Employees with ease

- Find Credit For Qualified Software Or Cybersecurity Employees and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important areas of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form navigation, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Credit For Qualified Software Or Cybersecurity Employees and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the credit for qualified software or cybersecurity employees?

The credit for qualified software or cybersecurity employees is a financial incentive that businesses can utilize to support their hiring and training needs in the tech industry. This credit can help offset costs associated with employing skilled professionals, enabling companies to invest more in technology solutions like airSlate SignNow.

-

How can airSlate SignNow help businesses qualify for this credit?

airSlate SignNow streamlines the eSigning process, allowing businesses to manage documents efficiently. By demonstrating the integration of advanced software solutions to enhance operations, companies can showcase their investment in qualified software employees, making them more likely to qualify for the credit.

-

What features does airSlate SignNow offer that appeal to qualified software and cybersecurity employees?

AirSlate SignNow provides robust features such as secure document storage, customizable workflows, and advanced encryption protocols. These features not only enhance the business processes but also fulfill the criteria for the credit for qualified software or cybersecurity employees, making your team more competitive.

-

Are there any specific industries that benefit most from the credit for qualified software or cybersecurity employees?

While many industries can leverage the credit for qualified software or cybersecurity employees, tech, finance, and healthcare sectors often see the most signNow advantages. These industries demand highly skilled professionals who can benefit from solutions like airSlate SignNow, which enhances their efficiency and compliance.

-

Does airSlate SignNow integrate with other software tools that qualified employees use?

Yes, airSlate SignNow integrates seamlessly with various tools including CRM systems, project management software, and cloud storage solutions. This capability not only assists qualified software or cybersecurity employees in their daily tasks but also reflects the company's commitment to maintaining an innovative and collaborative tech environment.

-

What are the pricing options for airSlate SignNow, especially for teams focusing on qualified software or cybersecurity roles?

AirSlate SignNow offers flexible pricing plans tailored to suit businesses of all sizes. By investing in this eSigning solution, companies focusing on hiring qualified software or cybersecurity employees can maximize their budget utilization, especially when factoring in the potential benefits from the credit.

-

How can I leverage the credit for qualified software or cybersecurity employees in my business strategy?

To effectively leverage the credit for qualified software or cybersecurity employees, align your hiring strategies with technology investments like airSlate SignNow. By clearly showcasing how your software solutions enhance operational efficiency, you can argue for a stronger case in utilizing these credits during audits and financial reviews.

Get more for Credit For Qualified Software Or Cybersecurity Employees

Find out other Credit For Qualified Software Or Cybersecurity Employees

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors