Combined Life Insurance Form

What is the Combined Life Insurance Form

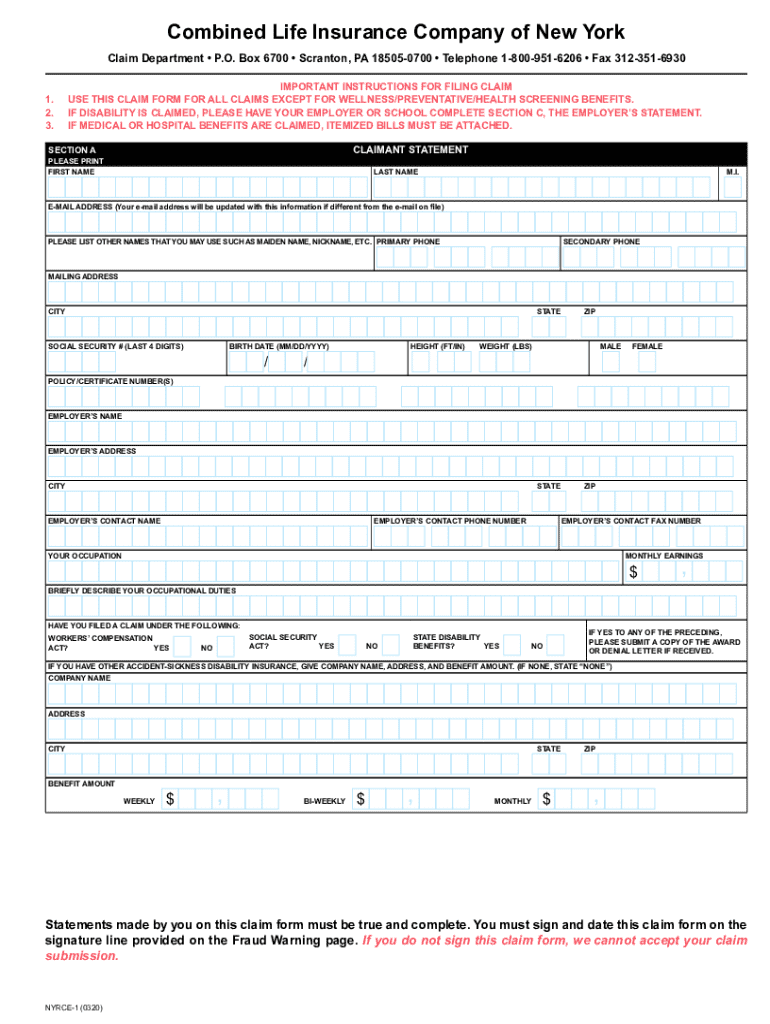

The Combined Life Insurance Form is a crucial document used to apply for life insurance coverage through a combined life insurance policy. This form typically includes personal information, details about the desired coverage, and health-related questions that help insurers assess risk. Understanding the purpose and components of this form is essential for applicants to ensure they provide accurate information, which can influence the approval process and policy terms.

How to use the Combined Life Insurance Form

Using the Combined Life Insurance Form involves several steps to ensure that the application is completed correctly. First, gather all necessary personal information, including identification details and financial data. Next, carefully fill out the form, paying close attention to health questions and coverage options. It is important to review the completed form for accuracy before submission, as any discrepancies can delay the processing time or affect the policy outcome.

Steps to complete the Combined Life Insurance Form

Completing the Combined Life Insurance Form requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as identification and financial records.

- Fill in personal information, including your name, address, and date of birth.

- Provide details regarding the type and amount of coverage you desire.

- Answer health-related questions honestly and thoroughly.

- Review the form for any errors or missing information.

- Submit the completed form through the preferred method, whether online or by mail.

Legal use of the Combined Life Insurance Form

The Combined Life Insurance Form is legally binding once it is signed and submitted. It is important to ensure that all information provided is accurate and truthful, as any misrepresentation can lead to denial of coverage or cancellation of the policy. Compliance with state regulations and insurance laws is essential for the form to be considered valid, and applicants should familiarize themselves with these legal requirements.

Who Issues the Form

The Combined Life Insurance Form is typically issued by insurance companies that offer combined life insurance policies. These companies are regulated by state insurance departments, which oversee the issuance and management of insurance forms. Applicants should obtain the form directly from the issuing insurance company to ensure they are using the most current version and that it meets all necessary legal requirements.

Required Documents

When completing the Combined Life Insurance Form, several documents may be required to support the application. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport.

- Proof of income or financial statements to assess affordability.

- Medical records or reports, if applicable, to provide information on health status.

- Any previous insurance policies that may affect the new application.

Form Submission Methods (Online / Mail / In-Person)

The Combined Life Insurance Form can typically be submitted through various methods, depending on the insurance provider's options. Common submission methods include:

- Online submission via the insurance company's secure website.

- Mailing the completed form to the insurance company's designated address.

- In-person submission at a local insurance office or agent's office.

Choosing the appropriate submission method can affect the processing time, so applicants should consider their preferences and the company's guidelines.

Quick guide on how to complete combined life insurance form

Effortlessly prepare Combined Life Insurance Form on any device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly alternative to conventional printed and signed papers, allowing you to easily locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Combined Life Insurance Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Combined Life Insurance Form with ease

- Find Combined Life Insurance Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure confidential information with tools designed by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you would like to send your form—via email, SMS, direct link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Combined Life Insurance Form while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is combined life insurance and how does it work?

Combined life insurance is a policy that integrates different life insurance coverages into one versatile solution. With this approach, businesses can ensure adequate coverage for their employees while managing costs effectively. This streamlined process simplifies administration and helps businesses focus on their core operations.

-

How does airSlate SignNow enhance the process of managing combined life policies?

airSlate SignNow provides a seamless platform for managing combined life policies by allowing businesses to send, sign, and store important documents electronically. The easy-to-use interface ensures that all parties can review and eSign documents quickly, reducing turnaround time signNowly. This efficiency translates into better management of combined life policies for businesses.

-

What features does airSlate SignNow offer for businesses dealing with combined life insurance?

airSlate SignNow includes features such as customizable templates, automatic reminders, and secure storage, which are essential for managing combined life insurance documents. These tools facilitate the eSigning process and ensure that all necessary documentation is completed accurately and on time. Utilizing these features can signNowly improve operational efficiency.

-

What are the benefits of using airSlate SignNow for combined life policies?

The main benefits of airSlate SignNow for managing combined life policies include cost-effectiveness, enhanced security, and improved workflow. Businesses can streamline their document processes while ensuring compliance and security through encrypted communications. This results in higher employee satisfaction and optimized management of insurance policies.

-

Is there a cost associated with using airSlate SignNow for combined life insurance management?

Yes, there are various pricing plans available for airSlate SignNow, allowing businesses to choose an option that suits their needs when managing combined life insurance. The plans are designed to be cost-effective, particularly for those handling multiple documents and signatures regularly. Investing in airSlate SignNow leads to signNow savings in time and resources.

-

Can airSlate SignNow integrate with other tools for combined life insurance management?

Absolutely! airSlate SignNow offers integrations with various software and platforms to enhance the management of combined life insurance. This includes popular CRM systems and document management tools, making it simpler for businesses to incorporate airSlate SignNow into their existing workflows. This integration capability helps maintain a cohesive operational strategy.

-

How secure is airSlate SignNow when handling combined life insurance documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive combined life insurance documents. The platform employs advanced encryption protocols and strict data protection measures to safeguard all transactional data. This commitment to security helps businesses manage their combined life policies with confidence.

Get more for Combined Life Insurance Form

Find out other Combined Life Insurance Form

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document