St 810 Form

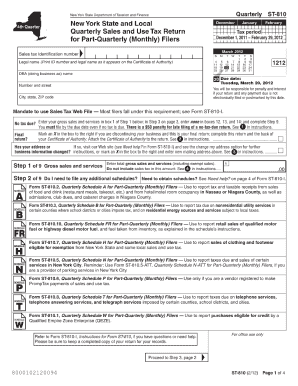

What is the ST-810?

The ST-810 form, also known as the New York State Sales Tax Exempt Certificate, is a crucial document for businesses and individuals in the state of New York. It allows purchasers to buy certain goods and services without paying sales tax, provided they meet specific criteria. This form is primarily used by organizations that are exempt from sales tax, such as non-profit entities, government agencies, and certain educational institutions. By completing the ST-810, buyers can ensure compliance with New York tax regulations while benefiting from tax exemptions on eligible purchases.

How to Obtain the ST-810

To obtain the ST-810 form, individuals or organizations can visit the New York State Department of Taxation and Finance website. The form is available for download in PDF format, making it easy to access and print. Additionally, some businesses may have the form provided by their vendors or suppliers, who may require it for tax-exempt transactions. It is essential to ensure that the form is filled out correctly to avoid any issues with tax compliance.

Steps to Complete the ST-810

Completing the ST-810 form involves several straightforward steps:

- Download the ST-810 form from the New York State Department of Taxation and Finance website.

- Fill in the required information, including the purchaser's name, address, and the reason for the exemption.

- Provide details about the seller, including their name and address.

- Sign and date the form to certify that the information provided is accurate and that the purchase qualifies for tax exemption.

- Submit the completed form to the seller at the time of purchase.

Legal Use of the ST-810

The ST-810 form is legally binding when completed accurately and used for qualifying purchases. It is important for users to understand the specific criteria that allow for tax exemption to avoid penalties. Misuse of the form, such as using it for ineligible purchases, can lead to legal repercussions, including fines and back taxes owed. Therefore, ensuring compliance with New York State tax laws is essential when utilizing the ST-810.

Key Elements of the ST-810

Several key elements must be included in the ST-810 form to ensure its validity:

- Purchaser Information: Name and address of the buyer.

- Seller Information: Name and address of the seller.

- Reason for Exemption: A clear explanation of why the purchase is exempt from sales tax.

- Signature: The purchaser must sign and date the form to certify its accuracy.

Form Submission Methods

The ST-810 form can be submitted in various ways, depending on the seller's requirements. Typically, the form is presented in person at the time of purchase. However, some sellers may accept the form via email or fax. It is advisable to check with the seller regarding their preferred submission method to ensure a smooth transaction.

Quick guide on how to complete st 810

Effortlessly Prepare St 810 on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to the conventional printed and signed documents, as it allows you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents promptly without delays. Manage St 810 across any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Alter and eSign St 810 with Ease

- Locate St 810 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all details carefully and click on the Done button to save your modifications.

- Select your preferred method of submitting your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that necessitate the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign St 810 to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 810

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 810 form, and why is it important?

The ST 810 form is a sales tax exemption certificate used in specific states to allow purchases without sales tax. Understanding and correctly using the ST 810 form is crucial for businesses to ensure compliance with state tax regulations and to prevent unnecessary taxation on exempt purchases.

-

How can airSlate SignNow help with the ST 810 form?

airSlate SignNow simplifies the process of completing and digitally signing the ST 810 form. With its intuitive platform, users can create, send, and eSign this essential document quickly, ensuring that all tax exemption claims are processed efficiently and securely.

-

Is there a cost associated with using the ST 810 form through airSlate SignNow?

Yes, while there are costs involved in using airSlate SignNow for document management, it offers a cost-effective solution tailored to meet various business needs. The pricing plans vary based on the features and volume of documents managed, including the usage of the ST 810 form.

-

What features are included when using airSlate SignNow for the ST 810 form?

When using airSlate SignNow for the ST 810 form, features include customizable templates, automated workflows, and secure storage. These tools enhance productivity and ensure that all transactions requiring the ST 810 form are handled smoothly.

-

Can I integrate airSlate SignNow with other software for the ST 810 form?

Absolutely! airSlate SignNow offers various integrations with popular software platforms, enabling seamless workflow management for the ST 810 form and other documents. This ensures that users can easily connect the ST 810 form into their existing systems.

-

How does airSlate SignNow ensure the security of the ST 810 form?

Security is a priority for airSlate SignNow, which implements robust encryption and secure storage measures to protect the ST 810 form and other sensitive documents. Users can trust that their data remains confidential during transmission and while stored online.

-

Can I track the status of the ST 810 form once sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for the ST 810 form once it has been sent for eSignature. You will receive notifications when the document is viewed, eSigned, or requires any further action, streamlining the entire process.

Get more for St 810

- Grant deed 497298323 form

- Conservatorship murphy ca form

- Quitclaim deed three individuals to two individuals california form

- Grant deed from two individuals as grantors to two individuals as grantees california form

- California husband wife 497298327 form

- Grant deed trust 497298328 form

- Quitclaim deed individual to six individuals california form

- Mineral rights form

Find out other St 810

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA