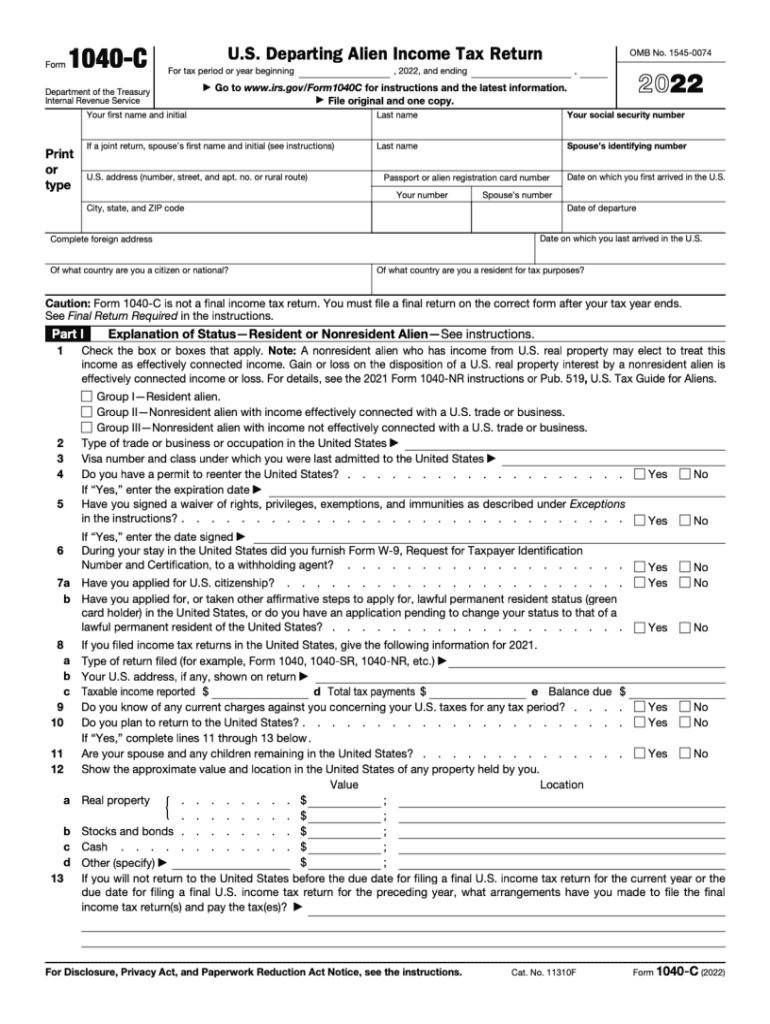

Irs Income Tax Return Form 2022

What is the IRS Income Tax Return Form?

The IRS income tax return form, specifically the 1040c form, is designed for U.S. taxpayers who need to report their income and calculate their tax obligations. This form is particularly relevant for individuals who are self-employed or have specific income types that require detailed reporting. The 1040c form allows taxpayers to declare income, claim deductions, and determine their overall tax liability. Understanding this form is essential for ensuring compliance with federal tax laws and for accurately reporting financial information to the IRS.

Steps to Complete the IRS Income Tax Return Form

Completing the 1040c form involves several key steps that ensure accurate reporting of income and deductions. Here’s a straightforward process to follow:

- Gather necessary documents: Collect all income statements, such as W-2s and 1099s, as well as receipts for deductible expenses.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: List all sources of income, including wages, self-employment income, and any other taxable earnings.

- Claim deductions: Identify and enter eligible deductions, such as business expenses, to lower your taxable income.

- Calculate tax liability: Use the IRS tax tables to determine the tax owed based on your taxable income.

- Review and sign: Carefully review all entries for accuracy before signing the form to validate your submission.

Legal Use of the IRS Income Tax Return Form

The 1040c form must be filled out and submitted in compliance with federal tax regulations to be considered legally binding. This includes ensuring that all information is accurate and complete. The form serves as an official document that the IRS uses to assess your tax obligations. To maintain its legal standing, it is crucial to use a reliable method for signing and submitting the form, such as electronic signatures that comply with the ESIGN and UETA acts. This ensures that the form is recognized as valid and enforceable by the IRS.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is essential to avoid penalties and ensure timely submission of the 1040c form. The typical deadline for filing your income tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers may also apply for an extension, which typically allows an additional six months to file, although any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To accurately complete the 1040c form, certain documents are necessary. These typically include:

- W-2 forms from employers detailing wages and withheld taxes.

- 1099 forms for any freelance or self-employment income.

- Receipts for deductible expenses related to business operations.

- Records of any additional income sources, such as rental income or dividends.

Having these documents organized and readily available will streamline the process of filling out the form and help ensure accuracy.

Form Submission Methods

The 1040c form can be submitted in several ways to the IRS, providing flexibility for taxpayers. The most common methods include:

- Online submission: Filing electronically through approved software or services can expedite processing and reduce errors.

- Mail: Taxpayers can print and send the completed form via postal service to the designated IRS address.

- In-person: Some taxpayers may choose to deliver their forms directly to local IRS offices, though this may require an appointment.

Choosing the right submission method can enhance the efficiency of the filing process and ensure timely receipt by the IRS.

Quick guide on how to complete irs income tax return form 606827749

Complete Irs Income Tax Return Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a stellar eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely keep them online. airSlate SignNow provides you with all the resources needed to create, edit, and electronically sign your documents swiftly without interruptions. Manage Irs Income Tax Return Form on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The simplest way to edit and electronically sign Irs Income Tax Return Form with ease

- Locate Irs Income Tax Return Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools offered by airSlate SignNow designed for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Choose your preferred way to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Irs Income Tax Return Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs income tax return form 606827749

Create this form in 5 minutes!

People also ask

-

What is the 1040c form used for?

The 1040c form is primarily used for making corrections to a previously filed Form 1040. This form allows taxpayers to amend their tax returns and ensures accurate reporting to the IRS. By using the 1040c form, individuals can correct errors or add missed income and deductions.

-

How can airSlate SignNow help with the 1040c form?

airSlate SignNow simplifies the process of filling out the 1040c form by allowing users to eSign and send documents securely. Our platform provides templates and editing tools, ensuring that your amendments are completed correctly and efficiently. With airSlate SignNow, you can stay organized and keep a digital record of your submissions.

-

Is there a cost associated with using the 1040c form on airSlate SignNow?

While the 1040c form itself is free from the IRS, airSlate SignNow offers a cost-effective solution for electronic signing and form management. Depending on your usage and features needed, there are different pricing plans available. You can choose a plan that fits your business needs, making it a budget-friendly option.

-

What features does airSlate SignNow offer for the 1040c form?

airSlate SignNow offers a range of features ideal for managing the 1040c form including eSignature capabilities, document sharing, and templates. Our user-friendly interface allows for easy navigation, and you can track changes and signatures in real time. Additionally, airSlate SignNow ensures that your documents are secure and legally binding.

-

Can I integrate airSlate SignNow with other software when working with the 1040c form?

Yes, airSlate SignNow provides seamless integrations with various software tools, enhancing your experience when working with the 1040c form. Whether you're using CRM systems, cloud storage platforms, or accounting software, our integrations help streamline your workflow. This interoperability allows for a more efficient document management process.

-

What benefits does airSlate SignNow provide for businesses handling the 1040c form?

For businesses dealing with the 1040c form, airSlate SignNow offers efficiency and cost savings. Our platform reduces paperwork by enabling electronic signatures, saving time and resources. Additionally, the secure storage of documents ensures that sensitive information is protected, giving peace of mind to businesses.

-

How does airSlate SignNow ensure the security of the 1040c form?

airSlate SignNow prioritizes your security, especially when dealing with sensitive documents like the 1040c form. We use advanced encryption methods to protect your data both in transit and at rest. Compliance with industry-standard regulations further reinforces our commitment to safeguarding your information.

Get more for Irs Income Tax Return Form

- Audit charter example form

- Krisflyer enrolment form

- Medstudy pediatrics 9th edition pdf download 40934183 form

- Chick fil a w2 form

- Maryland first time home buyer affidavit form

- Paper seal account form

- Instructions for form 6220 alaska underpayment of 769845536

- Cot st918 maryland unclaimed property report form

Find out other Irs Income Tax Return Form

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now