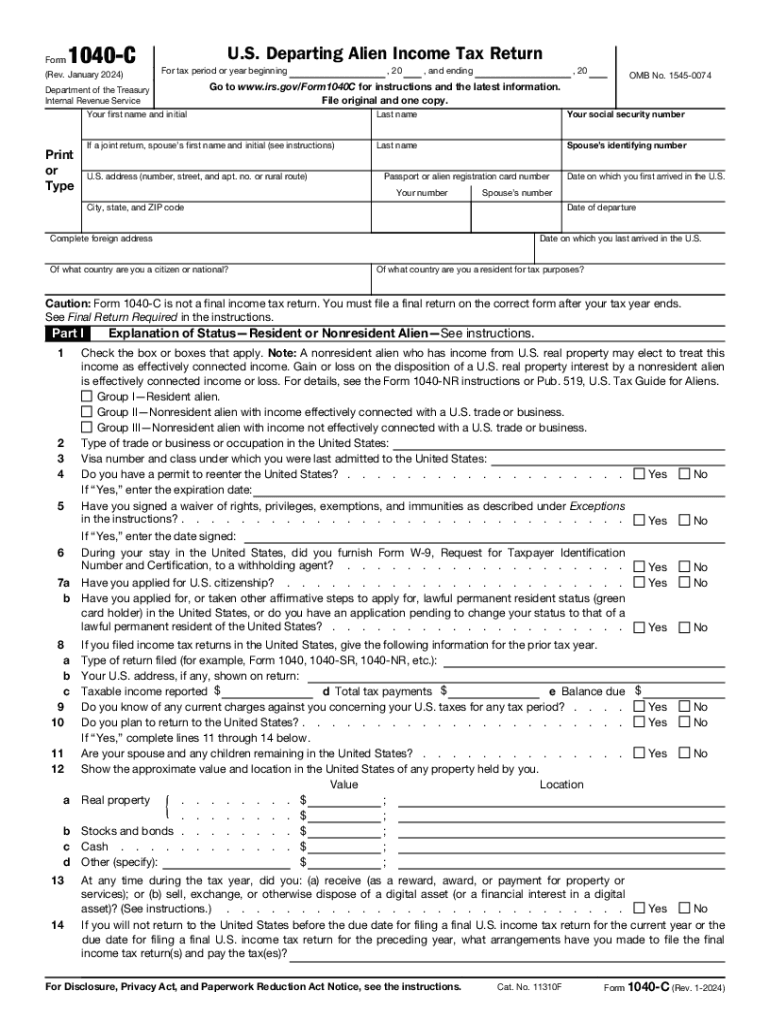

Form 1040 C U S Departing Alien Income Tax Return 2024-2026

Understanding the 1040 Schedule C

The 1040 Schedule C is a crucial tax form used by self-employed individuals to report their income and expenses. This form is part of the IRS Form 1040 series, specifically designed for sole proprietors. It allows taxpayers to detail their business earnings and claim deductions for various business-related expenses, thus determining their net profit or loss. Understanding how to accurately fill out this form is essential for compliance with tax regulations and for optimizing tax liabilities.

Steps to Complete the 1040 Schedule C

Completing the 1040 Schedule C involves several key steps:

- Gather Financial Records: Collect all income statements, receipts, and documentation related to business expenses.

- Fill Out Business Information: Provide details about your business, including its name, address, and the principal business activity.

- Report Income: List all income earned from the business, including sales and services.

- Deduct Expenses: Itemize all allowable business expenses, such as rent, utilities, and supplies, to reduce taxable income.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine net profit or loss.

- Sign and Date the Form: Ensure the form is signed and dated before submission.

Required Documents for 1040 Schedule C

To complete the 1040 Schedule C accurately, specific documents are necessary:

- Income Records: Invoices, bank statements, and sales records to verify income.

- Expense Receipts: Receipts for all business-related purchases and expenses.

- Business Licenses: Documentation proving the legitimacy of the business.

- Previous Tax Returns: Prior year tax returns can provide a reference for income and expenses.

Filing Deadlines for the 1040 Schedule C

The deadline for filing the 1040 Schedule C typically aligns with the individual income tax return deadline. For most taxpayers, this is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers may also file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

IRS Guidelines for the 1040 Schedule C

The IRS provides specific guidelines for completing the 1040 Schedule C. Taxpayers must ensure that all reported income is accurate and that all claimed deductions are legitimate and well-documented. The IRS may require additional documentation to support claims made on the form, so maintaining thorough records is essential. Additionally, taxpayers should be aware of the potential for audits and ensure compliance with all IRS regulations.

Common Mistakes to Avoid on the 1040 Schedule C

When filling out the 1040 Schedule C, several common mistakes can occur:

- Omitting Income: Failing to report all sources of income can lead to penalties.

- Incorrect Expense Deductions: Claiming non-eligible expenses can trigger audits.

- Inaccurate Calculations: Double-checking calculations can prevent errors in net profit or loss.

- Missing Signatures: Ensure the form is signed to validate the submission.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 c u s departing alien income tax return

Create this form in 5 minutes!

How to create an eSignature for the form 1040 c u s departing alien income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040 Schedule C and why is it important?

The 1040 Schedule C is a tax form used by sole proprietors to report income and expenses from their business. It is crucial for accurately calculating taxable income and ensuring compliance with IRS regulations. Understanding how to fill out the 1040 Schedule C can help you maximize deductions and minimize tax liabilities.

-

How can airSlate SignNow help with the 1040 Schedule C process?

airSlate SignNow streamlines the process of preparing and signing your 1040 Schedule C by allowing you to easily send and eSign documents. This ensures that all necessary forms are completed accurately and submitted on time. With our user-friendly interface, managing your tax documents becomes hassle-free.

-

What features does airSlate SignNow offer for managing 1040 Schedule C documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for 1040 Schedule C forms. These tools help you organize your tax documents efficiently and ensure that all signatures are collected promptly. Additionally, our platform allows for easy collaboration with accountants or tax professionals.

-

Is airSlate SignNow cost-effective for small business owners filing a 1040 Schedule C?

Yes, airSlate SignNow is a cost-effective solution for small business owners who need to manage their 1040 Schedule C filings. Our pricing plans are designed to fit various budgets, ensuring that you can access essential features without breaking the bank. This affordability makes it easier for you to focus on growing your business while staying compliant with tax regulations.

-

Can I integrate airSlate SignNow with other accounting software for my 1040 Schedule C?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your 1040 Schedule C alongside your financial records. This integration allows for automatic data transfer, reducing the risk of errors and saving you time during tax season. You can streamline your workflow and ensure that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for eSigning my 1040 Schedule C?

Using airSlate SignNow for eSigning your 1040 Schedule C offers numerous benefits, including enhanced security and convenience. You can sign documents from anywhere, at any time, using any device. This flexibility not only speeds up the signing process but also ensures that your documents are securely stored and easily accessible.

-

How does airSlate SignNow ensure the security of my 1040 Schedule C documents?

airSlate SignNow prioritizes the security of your 1040 Schedule C documents by employing advanced encryption and secure cloud storage. Our platform complies with industry standards to protect sensitive information, ensuring that your tax documents remain confidential. You can trust that your data is safe while using our eSigning services.

Get more for Form 1040 C U S Departing Alien Income Tax Return

- Cni 037 smokeco alarm self verification form sonoma county sonoma county

- Worksheet federalism answer key form

- Compensation agreement template form

- Medicine expiry return format pdf

- Pringle real estate form

- Oab q short form pdf

- Indiana property tax benefits form 51781

- Vegetated road verge nature strip maintenance approval yoursay blacktown nsw gov form

Find out other Form 1040 C U S Departing Alien Income Tax Return

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online