Habitat for Humanity Donation Receipt Template EForms 2019-2026

IRS Guidelines

The IRS provides specific guidelines for taxpayers regarding deductions and contributions, including those related to charitable donations. For instance, when utilizing the Habitat for Humanity donation receipt template, it is essential to follow the IRS rules on what constitutes a valid deduction. According to IRS Publication 526, taxpayers can deduct contributions made to qualified organizations, provided they have the necessary documentation. This includes receipts that detail the donation amount and the organization’s name. Understanding these guidelines ensures that taxpayers can accurately report their deductions and avoid potential issues with the IRS.

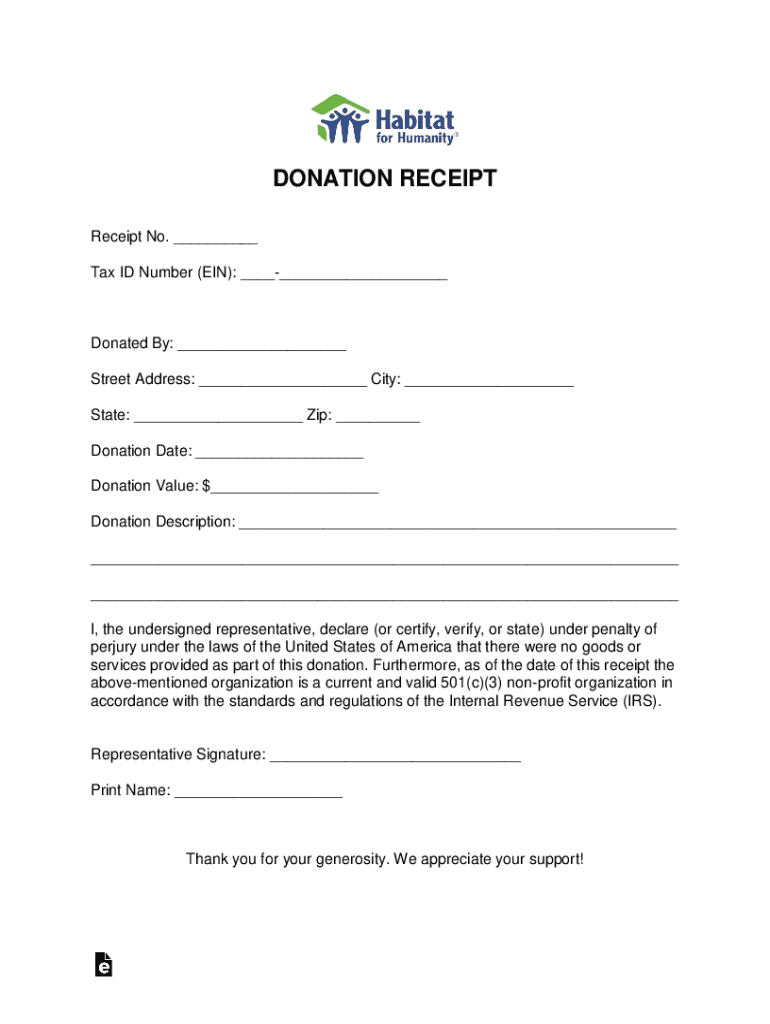

Key elements of the Habitat For Humanity Donation Receipt Template

The Habitat for Humanity donation receipt template includes several key elements that are crucial for proper documentation. First, it should clearly state the name and address of the donor, along with the date of the donation. Next, the receipt must specify the type of contribution, whether it is cash or non-cash items. For non-cash donations, a description of the items donated is necessary. Additionally, the receipt should include the name and address of Habitat for Humanity, confirming its status as a qualified charitable organization. These elements help ensure that the receipt meets IRS requirements for tax deductions.

Steps to complete the Habitat For Humanity Donation Receipt Template

Completing the Habitat for Humanity donation receipt template involves a few straightforward steps. Begin by entering the donor's name and address at the top of the form. Next, input the date of the donation and the specific amount contributed or a detailed description of non-cash items. If the contribution is non-cash, it is advisable to include an estimated fair market value for each item donated. Finally, ensure that the organization’s details are filled in correctly, including its name and address. Once completed, both the donor and a representative from Habitat for Humanity should sign the receipt for validation.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for taxpayers looking to claim deductions for their contributions. For the tax year, the IRS typically sets a deadline for submitting tax returns, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may shift to the next business day. Taxpayers should ensure that any contributions made to Habitat for Humanity are documented and submitted by this deadline to qualify for deductions on their tax returns. Keeping track of these important dates can help avoid penalties and ensure compliance with tax laws.

Form Submission Methods (Online / Mail / In-Person)

When submitting tax forms, including those related to charitable contributions, taxpayers have several options. Forms can typically be submitted online through the IRS e-file system, which is efficient and secure. Alternatively, taxpayers may choose to mail their forms to the appropriate IRS address, ensuring they are sent well before the deadline. For those who prefer a personal touch, submitting forms in person at local IRS offices is also an option. Each method has its advantages, and choosing the right one can depend on individual preferences and circumstances.

Legal use of the Habitat For Humanity Donation Receipt Template

Using the Habitat for Humanity donation receipt template legally requires adherence to IRS regulations. The receipt must be issued by the organization and should accurately reflect the donation details. Taxpayers must retain this receipt as part of their records when filing their taxes, especially if they plan to itemize deductions. It is essential to ensure that the receipt is filled out correctly and signed by both the donor and a representative from Habitat for Humanity. This legal documentation serves as proof of the contribution and is vital in case of an audit or review by the IRS.

Quick guide on how to complete habitat for humanity donation receipt template eforms

Prepare Habitat For Humanity Donation Receipt Template EForms effortlessly on any gadget

Web-based document handling has gained traction among companies and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed papers, as you can locate the appropriate format and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents promptly without holdups. Manage Habitat For Humanity Donation Receipt Template EForms on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Habitat For Humanity Donation Receipt Template EForms without effort

- Locate Habitat For Humanity Donation Receipt Template EForms and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Habitat For Humanity Donation Receipt Template EForms and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct habitat for humanity donation receipt template eforms

Create this form in 5 minutes!

People also ask

-

What is the process for mail tax state documentation with airSlate SignNow?

With airSlate SignNow, you can easily prepare and send documents for mail tax state compliance. Our platform streamlines the process by allowing you to upload, eSign, and share documents securely. This reduces the hassle associated with paper trails, ensuring a faster and more efficient filing experience.

-

How does airSlate SignNow help with mail tax state compliance?

airSlate SignNow offers robust features designed to ensure your mail tax state documents meet compliance standards. With built-in templates and verification tools, you can be confident that your documents are accurate and complete. This minimizes the risk of errors that could lead to compliance issues.

-

What pricing options does airSlate SignNow offer for mail tax state services?

airSlate SignNow provides flexible pricing plans tailored to different business needs, including those focused on mail tax state operations. Our plans accommodate various usage levels, ensuring that you receive the features you need at a price that fits your budget. Explore our options to find the best fit for your organization.

-

Can I integrate airSlate SignNow with other software for handling mail tax state documents?

Yes, airSlate SignNow supports integrations with numerous software solutions, enhancing your ability to manage mail tax state documents seamlessly. Whether utilizing accounting software or customer relationship management tools, our platform can help centralize your workflow and improve efficiency.

-

What are the security measures for mail tax state documents in airSlate SignNow?

Security is a top priority at airSlate SignNow, especially for sensitive mail tax state documents. We employ advanced encryption and authentication protocols to protect your information from unauthorized access. Additionally, our audit trails ensure that all actions taken on your documents are tracked and recorded.

-

How can airSlate SignNow improve the speed of processing mail tax state documents?

By utilizing airSlate SignNow, businesses can signNowly reduce the time it takes to process mail tax state documents. Our platform allows for electronic signatures, which eliminate the delays associated with printing and mailing physical documents. This speeds up approvals and improves overall efficiency in your tax processes.

-

Is airSlate SignNow user-friendly for managing mail tax state paperwork?

Absolutely! airSlate SignNow is designed with user experience in mind, making it simple for anyone to manage mail tax state paperwork. Our intuitive interface guides users through each step, from document preparation to electronic signing, ensuring a hassle-free experience even for those new to eSigning.

Get more for Habitat For Humanity Donation Receipt Template EForms

- Fillable 2848 form

- Privacy impact assessment form

- Safety violation disciplinary action form

- Liquor tax form

- Md employee withholding exemption certificate form

- 548p reporting agent authorization 548p reporting agent authorization form

- Limited liability company registration form

- Articles of incorporation for a stock corporation form

Find out other Habitat For Humanity Donation Receipt Template EForms

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online