PDF Instructions for Form it 214 Claim for Real Property Tax Credit for

What is the PDF Instructions For Form IT 214 Claim For Real Property Tax Credit For

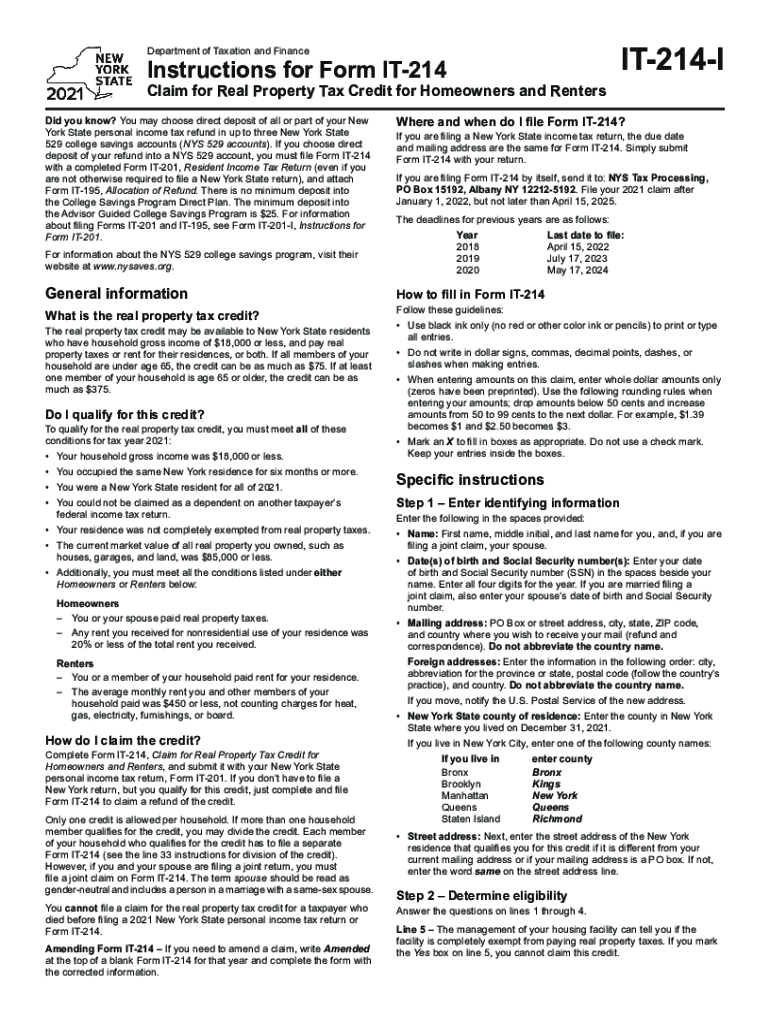

The PDF instructions for Form IT 214 serve as a comprehensive guide for individuals seeking to claim a real property tax credit in the United States. This form is specifically designed for property owners who wish to receive a credit based on their property taxes paid. The instructions outline the eligibility criteria, necessary documentation, and detailed steps required to complete the form accurately. Understanding these instructions is crucial for ensuring compliance and maximizing potential tax benefits.

Steps to Complete the PDF Instructions For Form IT 214 Claim For Real Property Tax Credit For

Completing the PDF instructions for Form IT 214 involves several key steps:

- Gather necessary documentation, including proof of property ownership and tax payment receipts.

- Review the eligibility criteria to ensure you qualify for the credit.

- Follow the detailed instructions provided in the PDF to fill out the form accurately.

- Double-check all entries for accuracy and completeness.

- Submit the completed form as directed, either online or through traditional mail.

Legal Use of the PDF Instructions For Form IT 214 Claim For Real Property Tax Credit For

The legal use of the PDF instructions for Form IT 214 is essential for ensuring that the submitted claims are valid and compliant with state tax laws. The instructions provide information on the legal requirements for eSignatures, documentation, and submission methods. Utilizing a reliable eSignature solution can help maintain the integrity of the submission process, ensuring that all legal standards are met.

Eligibility Criteria

To qualify for the real property tax credit outlined in Form IT 214, applicants must meet specific eligibility criteria. Generally, this includes being the legal owner of the property for which the credit is being claimed and having paid property taxes during the tax year in question. Additional requirements may vary by state, so it is important to consult the PDF instructions for detailed information on what qualifies an individual for the credit.

Required Documents

When completing the PDF instructions for Form IT 214, certain documents are required to support the claim. These typically include:

- Proof of property ownership, such as a deed or title.

- Receipts or statements showing property tax payments made during the applicable tax year.

- Any additional documentation specified in the PDF instructions that may pertain to specific eligibility criteria.

Filing Deadlines / Important Dates

Filing deadlines for Form IT 214 are critical to ensure timely submission and eligibility for the tax credit. Typically, the form must be submitted by a specific date, often aligned with annual tax filing deadlines. It is essential to refer to the PDF instructions for the exact dates and any potential extensions that may apply, as these can vary by year and jurisdiction.

Quick guide on how to complete pdf instructions for form it 214 claim for real property tax credit for

Complete PDF Instructions For Form IT 214 Claim For Real Property Tax Credit For effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow supplies all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage PDF Instructions For Form IT 214 Claim For Real Property Tax Credit For on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

How to modify and eSign PDF Instructions For Form IT 214 Claim For Real Property Tax Credit For without hassle

- Obtain PDF Instructions For Form IT 214 Claim For Real Property Tax Credit For and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information carefully and then click the Done button to save your changes.

- Choose how you want to send your form—by email, SMS, or invitation link—or download it to your computer.

Forget about lost or misfiled documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign PDF Instructions For Form IT 214 Claim For Real Property Tax Credit For and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the IT 214 instructions for using airSlate SignNow?

The IT 214 instructions for airSlate SignNow include a comprehensive guide on how to use our eSignature features effectively. It details the necessary steps for sending, signing, and managing documents digitally. Understanding these instructions will help streamline your document workflow.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, accommodating a range of business needs. Check our website for detailed pricing and the specific features included in each plan. With affordable options, airSlate SignNow provides great value considering the IT 214 instructions that simplify document management.

-

What features does airSlate SignNow offer?

airSlate SignNow offers a variety of features designed to enhance your document signing process. Key features include customizable templates, audit trails, and real-time notifications. With clear IT 214 instructions, you can make the most of these features to improve efficiency.

-

How do I integrate airSlate SignNow with other software?

Integrating airSlate SignNow with other software is straightforward thanks to our user-friendly API. You can connect easily with popular platforms such as Google Drive and Dropbox. Follow the integration steps provided in the IT 214 instructions to ensure a seamless experience.

-

Can airSlate SignNow help me with compliance requirements?

Yes, airSlate SignNow is built with compliance in mind, ensuring that your document signing processes meet legal standards. Our platform adheres to eSignature laws such as ESIGN and UETA. The IT 214 instructions provide guidance on maintaining compliance while using our services.

-

Is there a mobile app for airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile app that allows you to manage documents on the go. This mobile solution ensures that you can send and sign documents anywhere, enhancing productivity and flexibility. For instructions on mobile usage, refer to the IT 214 instructions.

-

What benefits can I expect from using airSlate SignNow?

Using airSlate SignNow streamlines your document signing process, saving you time and increasing efficiency. You can expect improved collaboration among team members and clients, as well as reduced paper usage. The IT 214 instructions highlight how to leverage these benefits for your business.

Get more for PDF Instructions For Form IT 214 Claim For Real Property Tax Credit For

Find out other PDF Instructions For Form IT 214 Claim For Real Property Tax Credit For

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement