F 1120N R 01 24 TC 04 24 PDF 2024

Understanding the F-1120N Form

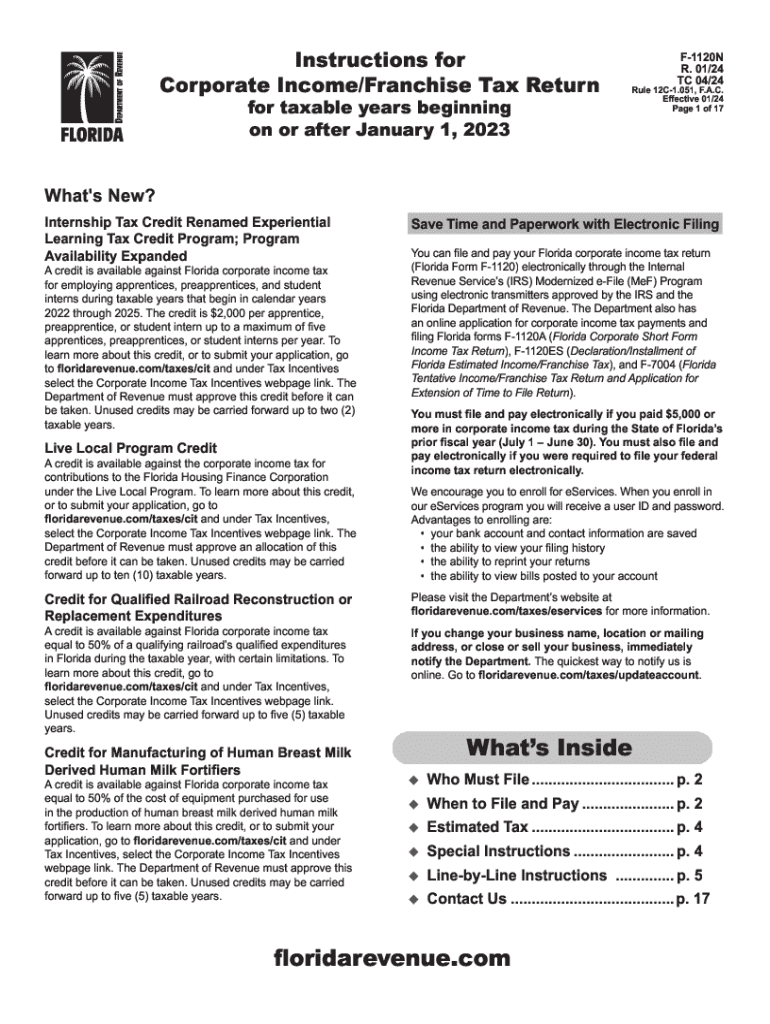

The F-1120N is a crucial tax form for businesses operating in Florida. This form is specifically designed for corporations that need to report their income and calculate their franchise tax obligations. It is essential for ensuring compliance with state tax regulations and can impact a company's financial standing. The F-1120N form must be filled out accurately to avoid penalties and ensure timely processing.

Steps to Complete the F-1120N Form

Completing the F-1120N involves several key steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill out the form with accurate information regarding your business income and deductions.

- Calculate the franchise tax based on the provided guidelines.

- Review the completed form for any errors or omissions.

- Submit the form by the designated filing deadline to avoid penalties.

Filing Deadlines and Important Dates

It is vital to be aware of the filing deadlines for the F-1120N form. Typically, the form must be filed by the first day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April fifteenth. Missing this deadline can result in late fees and interest charges, so timely submission is crucial.

Required Documents for Submission

To successfully submit the F-1120N form, you will need several documents, including:

- Income statements detailing your business revenue.

- Expense reports to substantiate deductions.

- Previous year's tax returns for reference.

- Any additional schedules or forms required by the Florida Department of Revenue.

Form Submission Methods

The F-1120N can be submitted through various methods to accommodate different preferences:

- Online Submission: Many businesses opt to file electronically through the Florida Department of Revenue's website.

- Mail: The form can also be printed and mailed to the appropriate address provided by the state.

- In-Person: Some businesses may choose to deliver the form directly to their local tax office.

Penalties for Non-Compliance

Failure to file the F-1120N form on time can lead to significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on any unpaid taxes, increasing the total amount owed.

- Potential legal action from the state if non-compliance persists.

Eligibility Criteria for Filing

Not all businesses are required to file the F-1120N. Eligibility typically includes:

- Corporations operating within Florida.

- Entities that meet specific income thresholds as defined by the Florida Department of Revenue.

- Businesses that have opted for S-corporation status may have different filing requirements.

Quick guide on how to complete f 1120n r 01 24 tc 04 24 pdf

Easily Prepare F 1120N R 01 24 TC 04 24 pdf on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage F 1120N R 01 24 TC 04 24 pdf on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Edit and eSign F 1120N R 01 24 TC 04 24 pdf Effortlessly

- Find F 1120N R 01 24 TC 04 24 pdf and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information, then click on the Done button to save your changes.

- Select how you wish to submit your form: via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced paperwork, tedious form searching, or inaccuracies that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign F 1120N R 01 24 TC 04 24 pdf to maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f 1120n r 01 24 tc 04 24 pdf

Create this form in 5 minutes!

How to create an eSignature for the f 1120n r 01 24 tc 04 24 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for businesses in 2012 Florida?

In 2012 Florida, airSlate SignNow provides a range of features including document eSigning, templates, and real-time collaboration. These tools help streamline the signing process, making it efficient for businesses to manage their documents. Additionally, the platform is user-friendly, ensuring that even those unfamiliar with digital tools can navigate it easily.

-

How does airSlate SignNow ensure document security for users in 2012 Florida?

Security is a top priority for airSlate SignNow, especially for users in 2012 Florida. The platform employs advanced encryption methods to protect sensitive information during transmission and storage. Furthermore, it complies with industry standards, ensuring that your documents are safe and secure.

-

What is the pricing structure for airSlate SignNow in 2012 Florida?

The pricing for airSlate SignNow in 2012 Florida is designed to be cost-effective for businesses of all sizes. There are various plans available, allowing users to choose one that fits their needs and budget. Each plan includes essential features, ensuring that you get the best value for your investment.

-

Can airSlate SignNow integrate with other software commonly used in 2012 Florida?

Yes, airSlate SignNow offers seamless integrations with various software applications that are popular in 2012 Florida. This includes CRM systems, cloud storage services, and productivity tools. These integrations enhance workflow efficiency, allowing businesses to manage their documents more effectively.

-

What are the benefits of using airSlate SignNow for document management in 2012 Florida?

Using airSlate SignNow for document management in 2012 Florida provides numerous benefits, including increased efficiency and reduced turnaround times. The platform simplifies the signing process, allowing businesses to focus on their core operations. Additionally, it helps reduce paper usage, contributing to a more sustainable business model.

-

Is airSlate SignNow suitable for small businesses in 2012 Florida?

Absolutely! airSlate SignNow is particularly well-suited for small businesses in 2012 Florida. Its user-friendly interface and affordable pricing make it accessible for companies with limited resources. Small businesses can leverage its features to enhance their document workflows without incurring signNow costs.

-

How can I get started with airSlate SignNow in 2012 Florida?

Getting started with airSlate SignNow in 2012 Florida is simple. You can sign up for a free trial on their website, allowing you to explore the platform's features without any commitment. Once you're ready, you can choose a pricing plan that best fits your business needs.

Get more for F 1120N R 01 24 TC 04 24 pdf

Find out other F 1120N R 01 24 TC 04 24 pdf

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors