Town of Davie Business Tax ReceiptCertificate of Use 2024-2026

Understanding the Town of Davie Business Tax Receipt

The Town of Davie Business Tax Receipt, also known as a Certificate of Use, is a crucial document for businesses operating within the town. This receipt serves as proof that a business is legally permitted to operate in a specific location and complies with local regulations. It is essential for maintaining transparency and ensuring that businesses adhere to zoning laws and safety standards.

How to Obtain the Town of Davie Business Tax Receipt

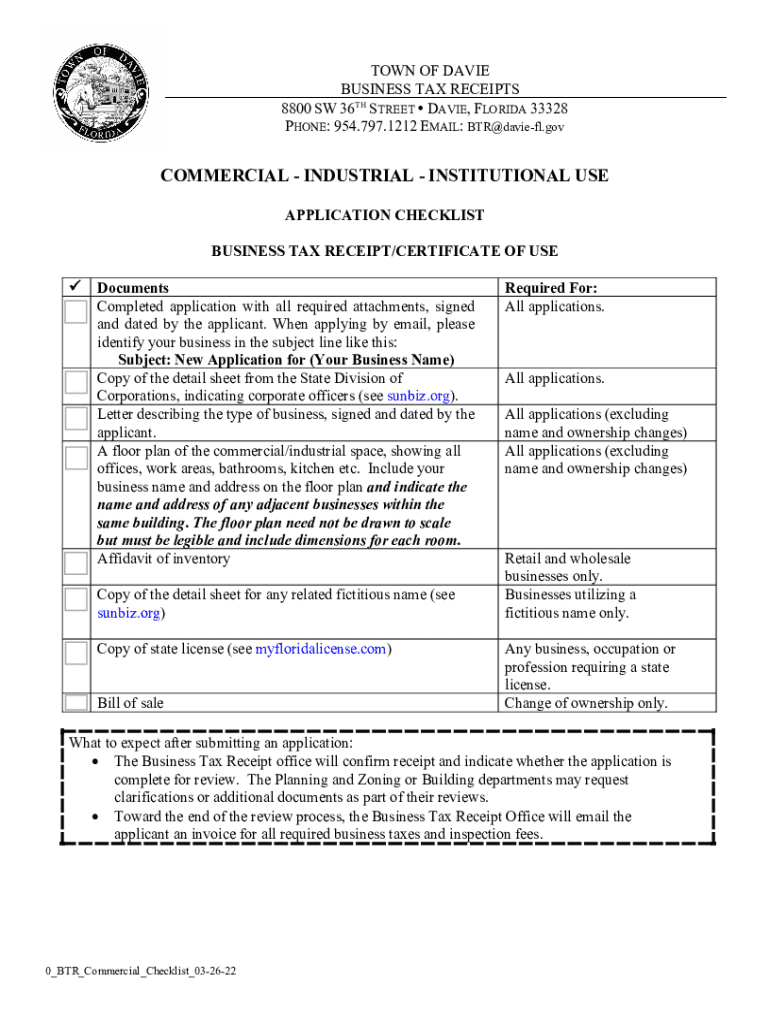

To obtain the Town of Davie Business Tax Receipt, businesses must complete an application process. This typically involves submitting the required documents, such as proof of ownership, identification, and any necessary permits related to the business operations. The application can often be submitted online, in person, or via mail, depending on the town's guidelines. It is important to check the specific requirements on the Town of Davie's official website or contact the local business office for detailed instructions.

Key Elements of the Town of Davie Business Tax Receipt

The Town of Davie Business Tax Receipt includes several key elements that validate its authenticity and purpose. These elements typically consist of:

- Business name and address

- Owner's name and contact information

- Type of business entity (e.g., LLC, corporation)

- Issuance date and expiration date

- Signature of the issuing authority

These details ensure that the receipt accurately reflects the business's legal status and compliance with local regulations.

Steps to Complete the Application for the Town of Davie Business Tax Receipt

Completing the application for the Town of Davie Business Tax Receipt involves several steps:

- Gather necessary documents, including identification and proof of business ownership.

- Fill out the application form accurately, ensuring all information is complete.

- Submit the application along with any required fees to the appropriate town office.

- Await confirmation from the town regarding the approval of the application.

- Receive the Business Tax Receipt upon approval, which must be displayed at the business location.

Following these steps helps ensure a smooth application process and compliance with local business regulations.

Legal Use of the Town of Davie Business Tax Receipt

The Town of Davie Business Tax Receipt is legally required for businesses operating within the town limits. It serves as a safeguard for both the business and the community, ensuring that all operations meet local health, safety, and zoning standards. Businesses must renew their receipts annually to maintain compliance and avoid penalties. Failure to possess a valid receipt can result in fines or legal action against the business.

IRS Guidelines Related to Business Tax Receipts

While the Town of Davie Business Tax Receipt is a local requirement, it is also important to consider how it relates to IRS guidelines. The IRS expects businesses to keep accurate records of all receipts and licenses, including business tax receipts, for tax reporting purposes. These documents can be essential when claiming deductions or during audits, as they demonstrate that the business is operating legally and within the framework of local laws.

Quick guide on how to complete town of davie business tax receiptcertificate of use

Prepare Town Of Davie Business Tax ReceiptCertificate Of Use effortlessly on any device

Online document administration has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can find the correct template and securely store it online. airSlate SignNow provides you with all the necessary resources to create, modify, and eSign your papers quickly without interruptions. Handle Town Of Davie Business Tax ReceiptCertificate Of Use on any platform with airSlate SignNow Android or iOS applications and ease any document-focused procedure today.

The easiest way to modify and eSign Town Of Davie Business Tax ReceiptCertificate Of Use without effort

- Find Town Of Davie Business Tax ReceiptCertificate Of Use and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or cover sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and eSign Town Of Davie Business Tax ReceiptCertificate Of Use and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct town of davie business tax receiptcertificate of use

Create this form in 5 minutes!

How to create an eSignature for the town of davie business tax receiptcertificate of use

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2024 business tax receipt?

A 2024 business tax receipt is an official document that verifies your business's tax obligations for the year 2024. It serves as proof of payment for taxes and is essential for maintaining compliance with local regulations. Businesses can easily generate and manage their tax receipts using airSlate SignNow.

-

How can airSlate SignNow help with my 2024 business tax receipt?

airSlate SignNow simplifies the process of creating and signing your 2024 business tax receipt. With our user-friendly platform, you can quickly generate tax receipts, ensuring they are legally compliant and professionally formatted. This saves you time and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that help you manage your 2024 business tax receipt efficiently. You can choose a plan that fits your budget and requirements, ensuring you get the best value for your investment.

-

Are there any integrations available for managing my 2024 business tax receipt?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, making it easier to manage your 2024 business tax receipt. These integrations allow for automatic data transfer, reducing manual entry and enhancing accuracy. This ensures that your tax receipts are always up-to-date and easily accessible.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features designed to streamline document management, including eSigning, templates, and secure storage. These features are particularly useful for handling your 2024 business tax receipt, allowing you to create, sign, and store documents all in one place. This enhances efficiency and organization for your business.

-

How secure is airSlate SignNow for handling sensitive documents like tax receipts?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your sensitive documents, including your 2024 business tax receipt. Our platform complies with industry standards to ensure that your data remains safe and confidential.

-

Can I access my 2024 business tax receipt from multiple devices?

Absolutely! airSlate SignNow is a cloud-based solution, allowing you to access your 2024 business tax receipt from any device with internet connectivity. This flexibility ensures that you can manage your documents on-the-go, making it easier to stay organized and responsive to your business needs.

Get more for Town Of Davie Business Tax ReceiptCertificate Of Use

Find out other Town Of Davie Business Tax ReceiptCertificate Of Use

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed