Form Dr 14

What is the Form Dr 14

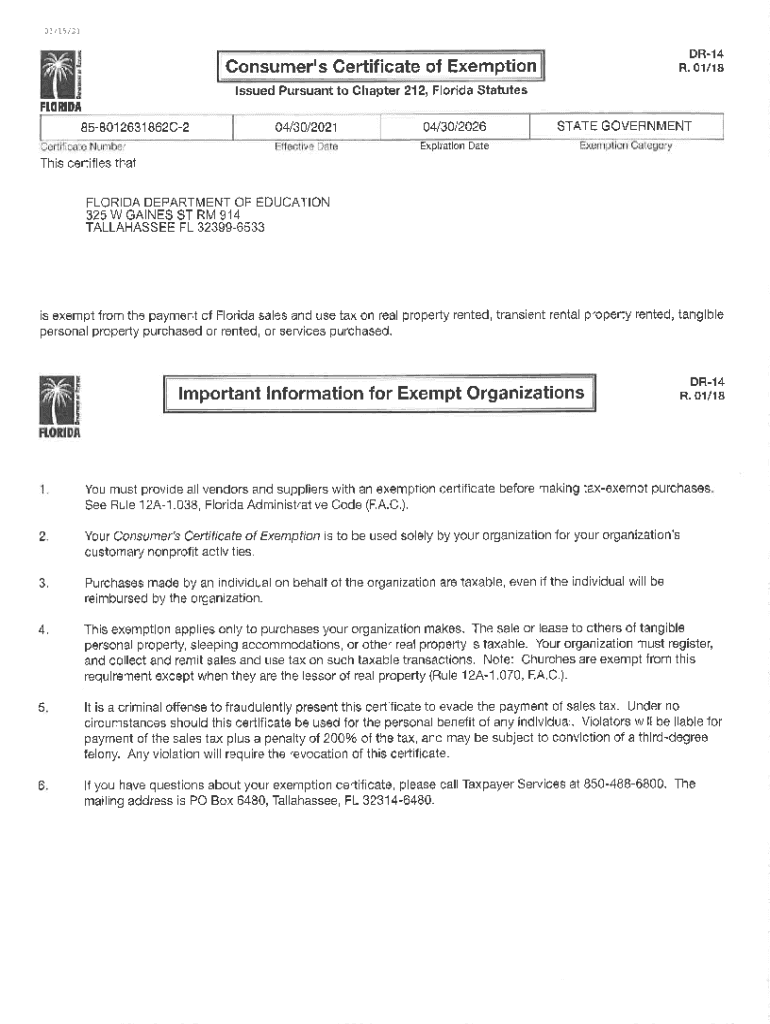

The Form Dr 14, also known as the Florida Consumer's Certificate of Exemption, is a crucial document for businesses and individuals seeking to claim exemption from sales tax in Florida. This form is primarily used by entities that qualify for specific exemptions, such as those engaged in certain types of non-profit activities or government entities. By completing and submitting the Dr 14 form, eligible parties can avoid paying sales tax on qualifying purchases.

How to use the Form Dr 14

Using the Form Dr 14 involves several key steps. First, ensure that you meet the eligibility criteria for exemption. Next, download the form from an authorized source and fill it out with accurate information, including your name, address, and the nature of your exemption. After completing the form, present it to the vendor from whom you are purchasing goods or services. This will allow the vendor to process the transaction without charging sales tax.

Steps to complete the Form Dr 14

To complete the Form Dr 14, follow these steps:

- Download the form from an official source.

- Provide your full name and address in the designated fields.

- Indicate the specific exemption category that applies to your situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the vendor at the time of purchase.

Legal use of the Form Dr 14

The legal use of the Form Dr 14 is governed by Florida sales tax laws. It is essential that the form is used only by those who qualify for the exemptions stated. Misuse of the form can lead to penalties, including fines or back taxes owed. To ensure compliance, keep a copy of the completed form for your records, as it may be requested by the Florida Department of Revenue during audits or reviews.

Key elements of the Form Dr 14

Key elements of the Form Dr 14 include:

- Exemption Categories: Clearly state the specific exemption you are claiming.

- Signature: The form must be signed by the individual or authorized representative.

- Accurate Information: All fields must be filled out accurately to avoid delays or issues.

- Date: The date of completion is crucial for record-keeping and compliance.

Required Documents

When submitting the Form Dr 14, it is important to have supporting documents that verify your eligibility for the exemption. These may include:

- Proof of tax-exempt status, such as a letter from the IRS.

- Documentation that supports your specific exemption category.

- Any additional forms or certificates that may be required by the vendor.

Form Submission Methods

The Form Dr 14 can be submitted in several ways, depending on the vendor's policies. Common submission methods include:

- In-Person: Present the completed form directly to the vendor at the time of purchase.

- Mail: Some vendors may accept the form via mail; check their specific requirements.

- Online: If the vendor has an online system, you may be able to upload the form electronically.

Quick guide on how to complete form dr 14

Complete Form Dr 14 seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily find the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Handle Form Dr 14 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Form Dr 14 effortlessly

- Find Form Dr 14 and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that function.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Decide how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form Dr 14 and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form dr 14 and how is it used?

Form dr 14 is a document utilized for various compliance and reporting needs. It is essential for businesses to ensure proper handling and submission, and airSlate SignNow makes it easier to manage this form electronically.

-

How can airSlate SignNow help with the completion of form dr 14?

airSlate SignNow allows you to easily fill out form dr 14 digitally. Its intuitive interface simplifies the process of completing and eSigning the document, helping you save time and reduce errors.

-

Is there a cost associated with using airSlate SignNow for form dr 14?

Yes, airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses handling form dr 14. The cost-effective solution ensures that you can manage your documents efficiently without breaking the bank.

-

What features does airSlate SignNow offer for managing form dr 14?

airSlate SignNow includes a variety of features to enhance your workflow with form dr 14, such as easy document sharing, customizable templates, and in-app collaboration tools. These features streamline the signing process and improve overall efficiency.

-

Can I integrate airSlate SignNow with other applications while using form dr 14?

Yes, airSlate SignNow seamlessly integrates with many applications, allowing you to access and manage form dr 14 alongside other tools. This functionality helps centralize your workflows and boost productivity.

-

What are the benefits of using airSlate SignNow for form dr 14?

Using airSlate SignNow for form dr 14 offers numerous benefits, including faster processing times, enhanced security features, and reduced paper usage. The platform ensures that your documents are handled efficiently and securely.

-

Is it easy to get started with airSlate SignNow for form dr 14?

Absolutely! airSlate SignNow provides a user-friendly setup process that allows you to quickly get started with managing form dr 14. The platform also offers tutorials and customer support to assist you along the way.

Get more for Form Dr 14

- Royal mail grievance form

- Tamilnadu veterinary council form

- Internship application template form

- Cell membrane bubble lab answers pdf form

- Federal drug testing custody and control form 48186583

- Schedule f form 1040 profit or loss from farming

- Proposed collection requesting comments on forms w 2

- About form 1099 div dividends and distributions

Find out other Form Dr 14

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template