Schedule F Form 1040 Profit or Loss from Farming 2024-2026

What is the Schedule F Form 1040 Profit Or Loss From Farming

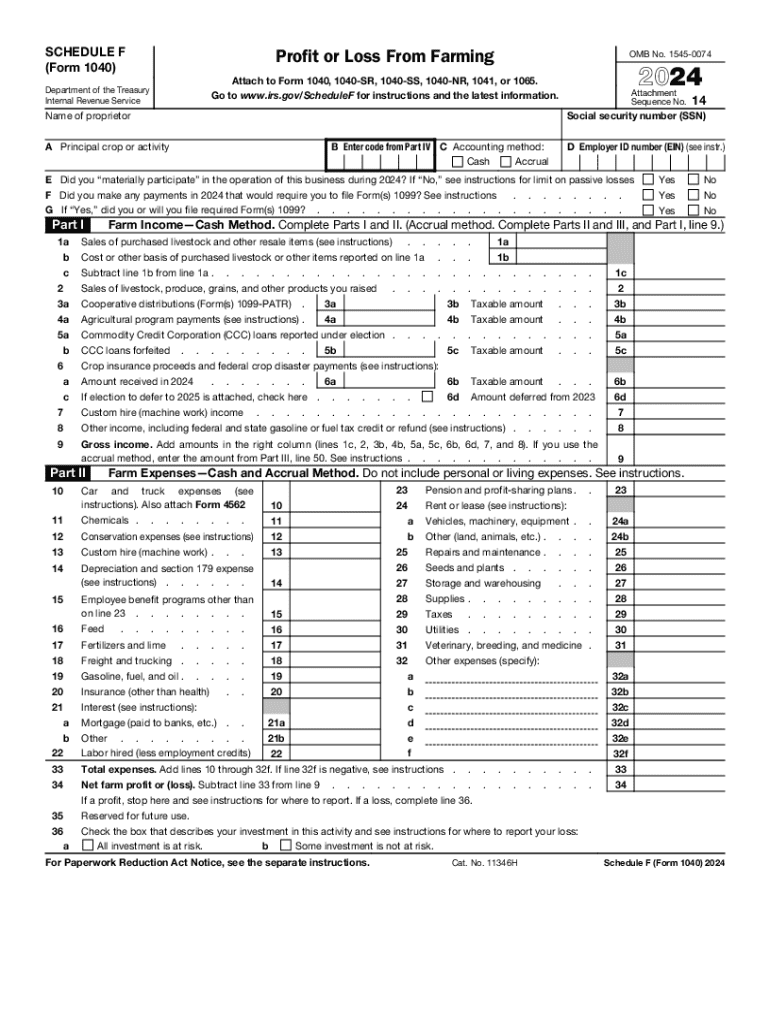

The Schedule F form is a tax document used by farmers to report income and expenses related to farming activities. This form is part of the IRS Form 1040 series and is essential for individuals who earn income from farming operations. It allows taxpayers to detail their profits or losses from farming, which can significantly impact their overall tax liability. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Schedule F Form 1040 Profit Or Loss From Farming

Using the Schedule F form involves several steps to ensure that all relevant income and expenses are accurately reported. Taxpayers should begin by gathering all necessary documentation, such as sales records, receipts for expenses, and any other relevant financial information. Once the form is obtained, individuals can fill it out by entering their income from farming and detailing various expenses, including costs for seeds, fertilizers, equipment, and labor. Properly completing this form is vital for determining taxable income and ensuring compliance with tax laws.

Steps to complete the Schedule F Form 1040 Profit Or Loss From Farming

Completing the Schedule F form requires careful attention to detail. Here are the steps to follow:

- Gather all financial records related to farming income and expenses.

- Obtain the Schedule F form from the IRS website or a tax professional.

- Begin filling out the form by entering your total income from farming activities.

- List all deductible expenses in the appropriate sections, ensuring accuracy in reporting.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Transfer the net profit or loss amount to your Form 1040.

- Review the completed Schedule F for accuracy before submission.

Key elements of the Schedule F Form 1040 Profit Or Loss From Farming

The Schedule F form includes several key elements that are essential for accurate reporting. These elements include:

- Income Section: Where taxpayers report all income generated from farming activities.

- Expenses Section: A detailed breakdown of all farming-related expenses, such as equipment costs, feed, and labor.

- Net Profit or Loss Calculation: This section summarizes the income and expenses to determine the overall profit or loss from farming.

- Signature Line: A place for the taxpayer to sign and date the form, certifying its accuracy.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule F form. It is important for taxpayers to familiarize themselves with these guidelines to ensure compliance. Key points include understanding which expenses are deductible, how to report income accurately, and the importance of maintaining thorough documentation. The IRS also outlines the eligibility criteria for using the Schedule F form, which primarily applies to individuals who engage in farming as a business.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule F form align with the general tax filing deadlines for individual taxpayers. Typically, the due date for filing Form 1040, including Schedule F, is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to be aware of these dates to avoid penalties and ensure timely submission of their tax returns.

Handy tips for filling out Schedule F Form 1040 Profit Or Loss From Farming online

Quick steps to complete and e-sign Schedule F Form 1040 Profit Or Loss From Farming online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a GDPR and HIPAA compliant solution for maximum efficiency. Use signNow to e-sign and send Schedule F Form 1040 Profit Or Loss From Farming for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct schedule f form 1040 profit or loss from farming

Create this form in 5 minutes!

How to create an eSignature for the schedule f form 1040 profit or loss from farming

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is schedule f in relation to airSlate SignNow?

Schedule F refers to a specific form used for reporting income and expenses for farmers and ranchers. With airSlate SignNow, you can easily create, send, and eSign Schedule F documents, ensuring compliance and accuracy in your financial reporting.

-

How can airSlate SignNow help me with my Schedule F documents?

airSlate SignNow streamlines the process of managing Schedule F documents by allowing you to create templates, send them for eSignature, and store them securely. This saves you time and reduces the risk of errors in your financial documentation.

-

What are the pricing options for using airSlate SignNow for Schedule F?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small farm or a large agricultural enterprise, you can find a cost-effective solution that allows you to manage your Schedule F documents efficiently.

-

Are there any features specifically designed for Schedule F users?

Yes, airSlate SignNow includes features tailored for Schedule F users, such as customizable templates and automated workflows. These features help ensure that your Schedule F documents are completed accurately and promptly.

-

Can I integrate airSlate SignNow with other tools for managing Schedule F?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, making it easy to manage your Schedule F alongside other business operations. This integration enhances your workflow and keeps your documents organized.

-

What benefits does airSlate SignNow offer for Schedule F document management?

Using airSlate SignNow for Schedule F document management provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You can track the status of your documents in real-time, ensuring that your Schedule F is always up to date.

-

Is airSlate SignNow user-friendly for those unfamiliar with Schedule F?

Yes, airSlate SignNow is designed to be user-friendly, even for those who may not be familiar with Schedule F. The intuitive interface guides you through the process of creating and managing your documents, making it accessible for everyone.

Get more for Schedule F Form 1040 Profit Or Loss From Farming

Find out other Schedule F Form 1040 Profit Or Loss From Farming

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement