Philadelphia Schedule Credit Print Form

What is the Philadelphia Schedule Credit Print

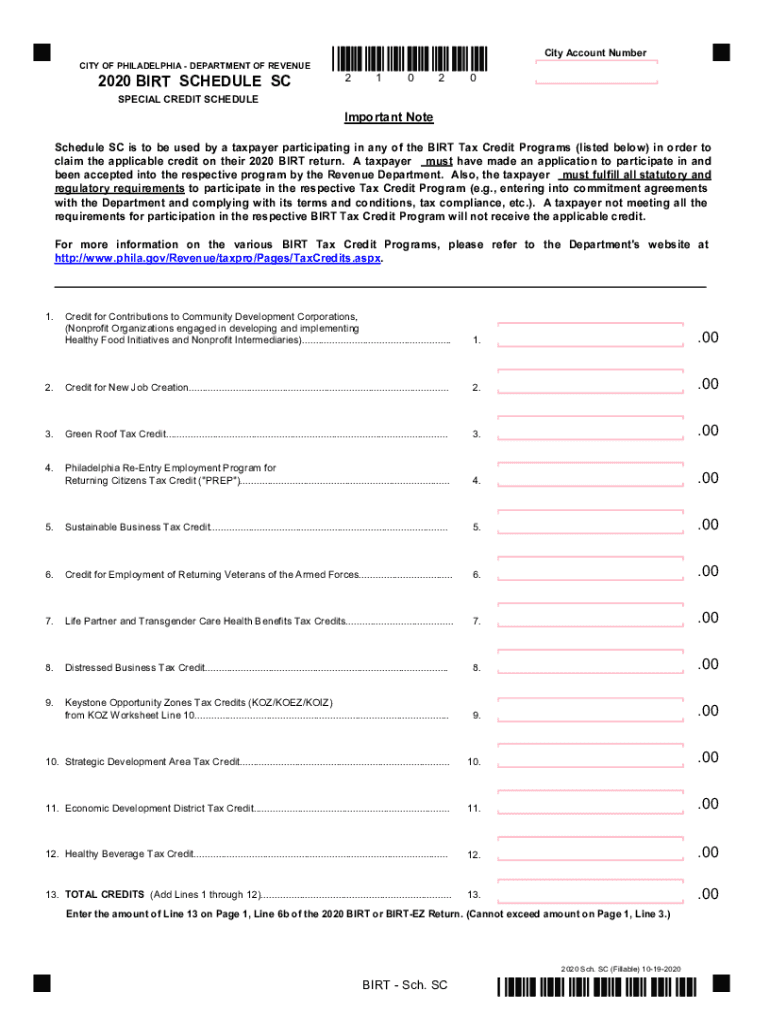

The Philadelphia Schedule Credit Print is a specific form used for reporting certain tax credits in Philadelphia. This form is essential for individuals and businesses seeking to claim credits that may reduce their overall tax liability. Understanding this form is crucial for accurate tax reporting and compliance with local regulations.

How to use the Philadelphia Schedule Credit Print

Using the Philadelphia Schedule Credit Print involves completing the form accurately to ensure that all eligible credits are claimed. Taxpayers should gather necessary information, such as income details and any supporting documentation related to the credits being claimed. Once the form is filled out, it can be submitted via the appropriate channels as outlined by the Philadelphia tax authorities.

Steps to complete the Philadelphia Schedule Credit Print

Completing the Philadelphia Schedule Credit Print requires several steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Fill out the form with accurate information, ensuring that all fields are completed as required.

- Double-check the entries for accuracy to avoid any potential errors that could delay processing.

- Submit the completed form either online, by mail, or in person, depending on the submission guidelines provided by the city.

Legal use of the Philadelphia Schedule Credit Print

The Philadelphia Schedule Credit Print is legally recognized for claiming specific tax credits. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the Philadelphia Department of Revenue. This includes understanding eligibility criteria and maintaining compliance with relevant tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Philadelphia Schedule Credit Print are crucial for taxpayers to observe. Typically, the form must be submitted by the same deadlines as the annual tax return. It is important to stay informed about any changes to these dates, as late submissions may result in penalties or the loss of credits.

Required Documents

When completing the Philadelphia Schedule Credit Print, certain documents are required to support the claims made on the form. These may include:

- Income statements, such as W-2s or 1099s.

- Documentation of any credits being claimed.

- Previous tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The Philadelphia Schedule Credit Print can be submitted through various methods. Taxpayers may choose to file online via the official tax portal, send the completed form by mail, or deliver it in person to the designated tax office. Each method has its own processing times and requirements, so it is advisable to select the one that best suits individual circumstances.

Quick guide on how to complete philadelphia schedule credit print

Effortlessly Prepare Philadelphia Schedule Credit Print on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a fantastic environmentally friendly substitute for traditional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without hiccups. Handle Philadelphia Schedule Credit Print on any device with the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

How to Edit and Electronically Sign Philadelphia Schedule Credit Print with Ease

- Locate Philadelphia Schedule Credit Print and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Philadelphia Schedule Credit Print and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the philadelphia schedule credit print feature in airSlate SignNow?

The philadelphia schedule credit print feature in airSlate SignNow allows users to effortlessly schedule and print documents for credit. It streamlines your workflow, ensuring that important documents are printed on time while maintaining the integrity of your signatures. This feature is especially beneficial for businesses needing to manage documents efficiently.

-

How does the philadelphia schedule credit print benefit my business?

Utilizing the philadelphia schedule credit print feature can signNowly enhance your business operations by saving time and reducing errors. It provides a reliable method for handling credit-related documents, ensuring compliance and accuracy in your transactions. Your team can focus on other critical tasks while enjoying the convenience of automated printing.

-

What are the pricing options for accessing the philadelphia schedule credit print feature?

airSlate SignNow offers competitive pricing for the philadelphia schedule credit print feature, catering to businesses of all sizes. You can choose from various plans that include this feature, allowing you to select one that fits your budget and needs. It’s advisable to visit the pricing page for detailed information and any current promotions.

-

Is the philadelphia schedule credit print feature easy to use?

Yes, the philadelphia schedule credit print feature is designed to be user-friendly, ensuring that you can seamlessly navigate the system. With its intuitive interface, users can easily schedule documents for printing with just a few clicks. Plus, comprehensive tutorials and customer support are available to assist you.

-

Can I integrate the philadelphia schedule credit print with other tools?

Absolutely! The philadelphia schedule credit print feature can be easily integrated with various third-party applications to enhance your document management workflow. This flexibility allows for smoother operations and ensures that you can use your preferred tools alongside airSlate SignNow effectively.

-

What types of documents can I manage with the philadelphia schedule credit print feature?

The philadelphia schedule credit print feature supports a wide range of document types, including contracts, agreements, and invoices. This versatility makes it an ideal solution for businesses needing to manage different credit documents. You can customize the documents according to your specific requirements before scheduling them for print.

-

Does the philadelphia schedule credit print feature support electronic signatures?

Yes, the philadelphia schedule credit print feature fully supports electronic signatures, ensuring that your documents are not only printed but also securely signed. This seamless integration of e-signatures enhances the reliability and legality of your documents. You can conveniently collect signatures before scheduling the print, streamlining the entire process.

Get more for Philadelphia Schedule Credit Print

Find out other Philadelphia Schedule Credit Print

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast