Provider Version of Form 80 300 11 3 Estimated Tax 2024

What is the Provider Version of Form 80 300 11 3 Estimated Tax

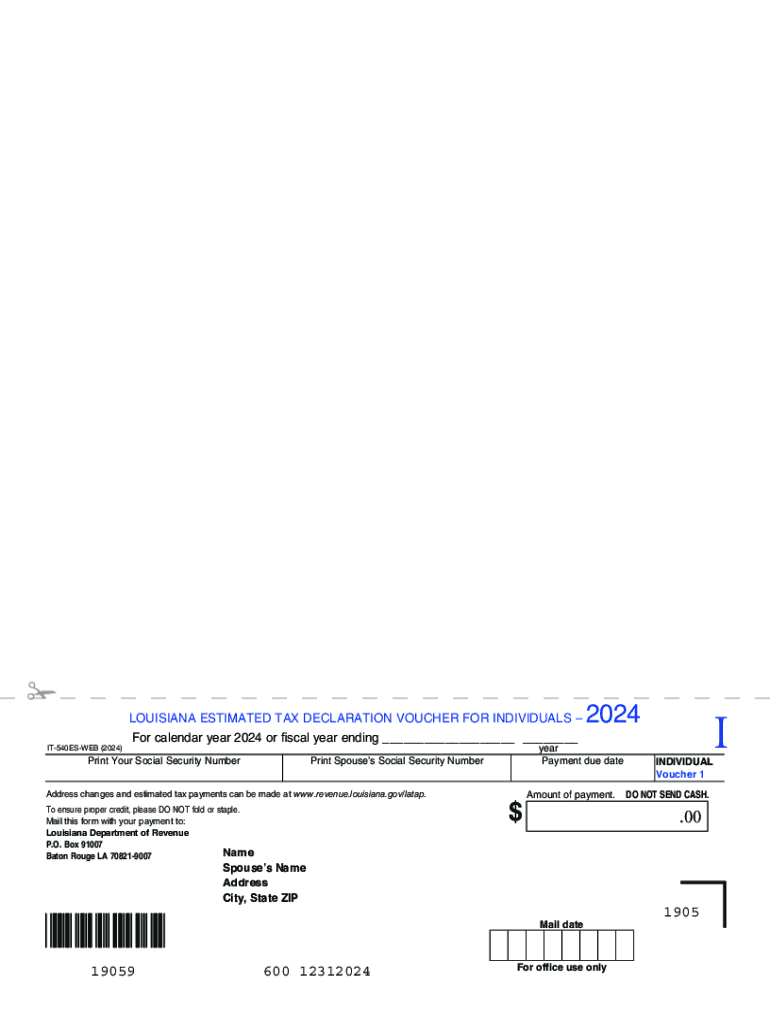

The Provider Version of Form 80 300 11 3 is a tax form used by residents of Louisiana to report and pay estimated taxes. This form is specifically designed for individuals and businesses that expect to owe tax of one thousand dollars or more when filing their annual tax return. It allows taxpayers to make periodic payments throughout the year, ensuring they meet their tax obligations and avoid penalties for underpayment.

Steps to Complete the Provider Version of Form 80 300 11 3 Estimated Tax

Completing the Provider Version of Form 80 300 11 3 involves several key steps:

- Determine your expected annual income and tax liability.

- Calculate your estimated tax payments based on your expected income. This may involve using the previous year's tax return as a reference.

- Fill out the form accurately, providing all necessary information, including your name, address, and Social Security number or Employer Identification Number.

- Submit the completed form along with your payment by the appropriate deadlines.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Provider Version of Form 80 300 11 3. Generally, estimated tax payments are due quarterly:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Failure to submit payments on time may result in penalties and interest on the unpaid amounts.

Required Documents

When preparing to complete the Provider Version of Form 80 300 11 3, gather the following documents:

- Your previous year's tax return, which provides a basis for estimating current year taxes.

- Any relevant income statements, such as W-2s or 1099s, to project your earnings accurately.

- Documentation of any deductions or credits that may affect your tax liability.

Penalties for Non-Compliance

Not adhering to the requirements associated with the Provider Version of Form 80 300 11 3 can lead to significant penalties. If you fail to make estimated tax payments, you may incur:

- Underpayment penalties, which are calculated based on the amount owed and the duration of the underpayment.

- Interest on unpaid taxes, which accrues from the due date of the payment until it is paid in full.

It is essential to stay compliant to avoid these financial repercussions.

Who Issues the Form

The Provider Version of Form 80 300 11 3 is issued by the Louisiana Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. It provides the necessary forms and guidance for residents to fulfill their tax obligations effectively.

Create this form in 5 minutes or less

Find and fill out the correct provider version of form 80 300 11 3 estimated tax

Create this form in 5 minutes!

How to create an eSignature for the provider version of form 80 300 11 3 estimated tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is LA estimated tax and why is it important?

LA estimated tax refers to the tax payments that individuals and businesses in Louisiana must make throughout the year based on their expected income. It's important because it helps taxpayers avoid penalties and interest charges by ensuring they pay their tax obligations on time.

-

How can airSlate SignNow help with LA estimated tax documents?

airSlate SignNow simplifies the process of sending and eSigning LA estimated tax documents. With our user-friendly platform, you can quickly prepare, send, and sign necessary tax forms, ensuring compliance and timely submissions.

-

What features does airSlate SignNow offer for managing LA estimated tax forms?

Our platform offers features such as customizable templates, secure eSigning, and real-time tracking for LA estimated tax forms. These tools streamline the document management process, making it easier for businesses to handle their tax obligations efficiently.

-

Is airSlate SignNow cost-effective for managing LA estimated tax?

Yes, airSlate SignNow is a cost-effective solution for managing LA estimated tax documents. Our pricing plans are designed to fit various business sizes and budgets, allowing you to save time and money while ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other accounting software for LA estimated tax?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your LA estimated tax documents alongside your financial records. This integration helps streamline your workflow and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for LA estimated tax?

Using airSlate SignNow for LA estimated tax offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, giving you peace of mind during tax season.

-

How does airSlate SignNow ensure the security of my LA estimated tax documents?

airSlate SignNow prioritizes the security of your LA estimated tax documents by employing advanced encryption and secure storage solutions. Our platform complies with industry standards to protect your sensitive information throughout the signing process.

Get more for Provider Version Of Form 80 300 11 3 Estimated Tax

Find out other Provider Version Of Form 80 300 11 3 Estimated Tax

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online