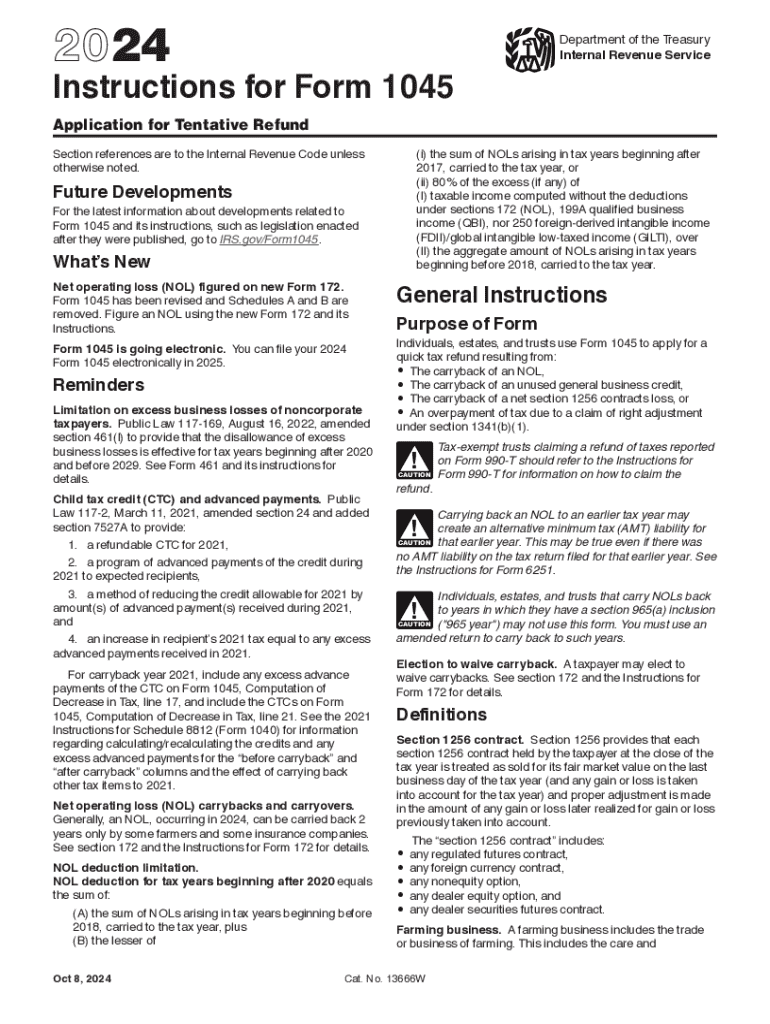

IRS Form 1045 Walkthrough Application for Tentative Refund 2024

What is the IRS Form 1045 for Tentative Refund?

The IRS Form 1045 is a tax form used by individuals and businesses to apply for a tentative refund of overpaid taxes. This form is particularly useful for taxpayers who have experienced a change in circumstances that affects their tax liability, such as a net operating loss. By filing Form 1045, taxpayers can expedite the refund process, allowing them to receive their money more quickly than through a standard tax return amendment.

Steps to Complete the IRS Form 1045

Completing the IRS Form 1045 involves several key steps:

- Gather Required Information: Collect all necessary documentation, including prior tax returns, income statements, and details of the loss or overpayment.

- Fill Out the Form: Carefully complete each section of the form, ensuring that all information is accurate and complete. Pay particular attention to the calculations of your tentative refund.

- Attach Supporting Documents: Include any required schedules or forms that support your claim for a refund, such as Form 1040 or Form 1040-SR.

- Review the Form: Double-check all entries for accuracy to avoid delays in processing.

- Submit the Form: File the completed Form 1045 with the IRS, either electronically or via mail, depending on your preference.

Eligibility Criteria for IRS Form 1045

To qualify for filing Form 1045, taxpayers must meet specific eligibility criteria. Generally, you must have incurred a net operating loss in the current tax year or have overpaid your taxes in a prior year. Additionally, the losses must be applied to the correct tax year, and the application must be submitted within the designated timeframe, typically within one year of the loss. Understanding these eligibility requirements is crucial for a successful refund application.

Filing Deadlines for IRS Form 1045

Timeliness is essential when submitting Form 1045. The IRS requires that this form be filed within twelve months of the end of the tax year in which the loss occurred. For example, if your loss occurred in the tax year 2020, you must submit your Form 1045 by December 31, 2021. Staying aware of these deadlines helps ensure that you do not miss the opportunity for a tentative refund.

Form Submission Methods for IRS Form 1045

Taxpayers have several options for submitting Form 1045. You can file the form electronically through the IRS e-file system, which is often the fastest method for processing. Alternatively, you may choose to print the completed form and mail it to the appropriate IRS address. Ensure that you check the IRS website for the latest submission guidelines and mailing addresses, as these can change.

Key Elements of the IRS Form 1045

Form 1045 consists of several critical components that must be completed accurately:

- Identification Information: This section requires your name, address, and Social Security number or Employer Identification Number.

- Income and Loss Details: Provide a detailed account of your income and the losses that justify your request for a refund.

- Refund Calculation: Include a thorough calculation of the tentative refund amount you are requesting, based on the information provided.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1045 walkthrough application for tentative refund

Create this form in 5 minutes!

How to create an eSignature for the irs form 1045 walkthrough application for tentative refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2020 instructions 1045 form?

The 2020 instructions 1045 form provides guidance on how to file for a refund of overpaid taxes. It outlines the necessary steps and requirements for taxpayers to follow when submitting their request. Understanding these instructions is crucial for ensuring a smooth filing process.

-

How can airSlate SignNow help with the 2020 instructions 1045 form?

airSlate SignNow simplifies the process of signing and sending the 2020 instructions 1045 form electronically. Our platform allows users to easily upload, eSign, and share documents securely, ensuring compliance and efficiency. This streamlines the filing process for taxpayers.

-

Is there a cost associated with using airSlate SignNow for the 2020 instructions 1045 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions provide access to features that enhance document management, including eSigning the 2020 instructions 1045 form. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer for handling the 2020 instructions 1045 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools make it easy to manage the 2020 instructions 1045 form efficiently. Users can also collaborate in real-time, ensuring all parties are on the same page.

-

Can I integrate airSlate SignNow with other applications for the 2020 instructions 1045 form?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow when dealing with the 2020 instructions 1045 form. This allows users to connect with tools they already use, streamlining the document management process.

-

What are the benefits of using airSlate SignNow for the 2020 instructions 1045 form?

Using airSlate SignNow for the 2020 instructions 1045 form provides numerous benefits, including increased efficiency and reduced turnaround time. Our platform ensures that documents are signed and sent securely, minimizing the risk of errors. Additionally, it enhances collaboration among team members.

-

Is airSlate SignNow user-friendly for completing the 2020 instructions 1045 form?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface makes it easy for anyone to navigate and complete the 2020 instructions 1045 form without extensive training. This accessibility ensures that users can focus on their tasks rather than struggling with the software.

Get more for IRS Form 1045 Walkthrough Application For Tentative Refund

- Australia review form

- Da form 5988 e example

- Tc 95 623 form

- Lic 701 spanish form

- Portsmouth leisure card form

- The complete recreational drugs handbook form

- 555 wright way carson city nv 89711 renosparksc form

- Standard and personalized professional fire fighter license plates may be issued for passenger vehicles light commercial form

Find out other IRS Form 1045 Walkthrough Application For Tentative Refund

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online