Fcatb Local Income Net Form

What is the FCATB Local Income Net

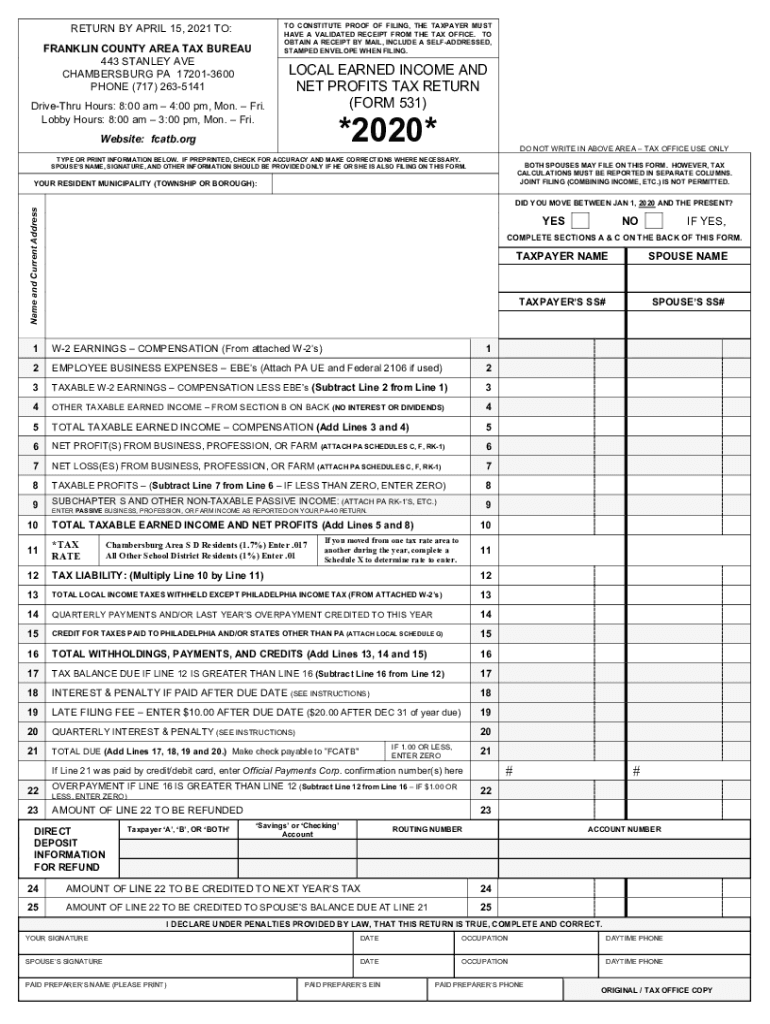

The FCATB Local Income Net refers to the income tax return required by the Franklin County Area Tax Bureau (FCATB) for residents and businesses operating within its jurisdiction. This form is essential for reporting local income earned, ensuring compliance with local tax regulations. The FCATB local income return helps determine the amount of local tax owed based on the income earned during a specific tax year. Understanding this form is crucial for accurate tax reporting and avoiding potential penalties.

Steps to Complete the FCATB Local Income Net

Completing the FCATB Local Income Net involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your total income, deductions, and any applicable credits. After completing the form, review it carefully for any errors or omissions before submitting it. It is advisable to keep a copy for your records.

Legal Use of the FCATB Local Income Net

The FCATB Local Income Net must be completed according to local tax laws to be considered legally valid. Electronic signatures are acceptable, provided they comply with the ESIGN Act and UETA regulations. It is important to use a reliable eSignature solution that offers an electronic certificate to ensure the document’s authenticity. This legal framework supports the use of digital forms, making it easier for taxpayers to file their returns securely and efficiently.

Filing Deadlines / Important Dates

Filing deadlines for the FCATB Local Income Net typically align with the federal tax deadlines. Generally, individual taxpayers must submit their returns by April 15 of the following year. However, it is essential to verify specific local deadlines, as they may vary. Late submissions can result in penalties and interest on unpaid taxes, so staying informed about these dates is crucial for compliance.

Required Documents

To accurately complete the FCATB Local Income Net, taxpayers need several documents. Key documents include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income sources

- Documentation of deductions, such as business expenses or charitable contributions

Having these documents on hand will facilitate a smoother filing process and help ensure all income is reported correctly.

Form Submission Methods

The FCATB Local Income Net can be submitted through various methods to accommodate different preferences. Taxpayers can file the form online using secure eSignature platforms, which provide a convenient and efficient way to submit documents. Alternatively, individuals may choose to mail their completed forms to the FCATB office or deliver them in person. Each submission method has its own advantages, so selecting the one that best fits your needs is important.

Quick guide on how to complete fcatb local income net

Complete Fcatb Local Income Net effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage Fcatb Local Income Net on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to alter and eSign Fcatb Local Income Net with no hassle

- Locate Fcatb Local Income Net and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Fcatb Local Income Net to ensure excellent communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is fcatb local income net?

The fcatb local income net refers to the net income calculations necessary for local tax purposes. Understanding this term is crucial for businesses to accurately report their income and comply with local regulations.

-

How does airSlate SignNow support my fcatb local income net reporting?

airSlate SignNow offers features that streamline the documentation process required for fcatb local income net reporting. With our secure eSignature solutions, businesses can easily manage and electronically sign the necessary documents to ensure compliance.

-

Are there any costs associated with using airSlate SignNow for fcatb local income net documentation?

Yes, airSlate SignNow has several affordable pricing plans designed to fit various business needs. By investing in our platform, you'll gain access to tools that streamline your fcatb local income net documentation process efficiently.

-

What features does airSlate SignNow offer for effective fcatb local income net management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure storage options that help manage fcatb local income net documentation. These tools simplify the often complex process of income reporting.

-

Can airSlate SignNow integrate with my existing accounting systems for fcatb local income net?

Absolutely! airSlate SignNow is designed to integrate seamlessly with most major accounting systems, allowing your team to manage fcatb local income net seamlessly. This integration saves time and reduces errors in income documentation.

-

What are the benefits of using airSlate SignNow for fcatb local income net processes?

Using airSlate SignNow for fcatb local income net processes provides numerous benefits, including enhanced efficiency and reduced turnaround time for document signing. This leads to faster reporting and better compliance with local income tax regulations.

-

Is airSlate SignNow secure for handling sensitive fcatb local income net data?

Yes, airSlate SignNow is committed to security, employing advanced encryption and compliance measures to protect sensitive fcatb local income net data. Your documents are secure throughout the signing process, ensuring confidentiality.

Get more for Fcatb Local Income Net

- Perm 64 form

- Relay for life luminaria form 5625085

- Advanced patient imaging form

- Logisticare standing order form

- Hrm dghs form

- Medicine schedule form

- Elementary progress report card grades 7 and 8 public an illustration of the template that schools are required to complete form

- Welcome to kindergarten at chps form

Find out other Fcatb Local Income Net

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement