Arkansas Estimated Tax 2021

What is the Arkansas Estimated Tax

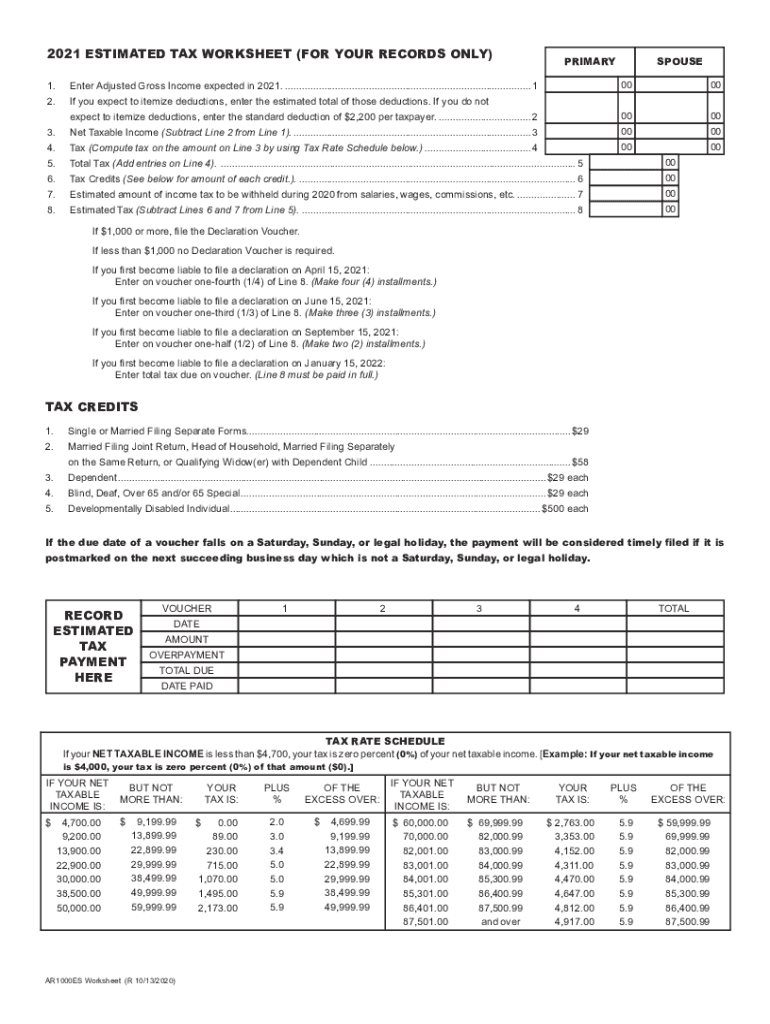

The Arkansas Estimated Tax is a payment method for individuals and businesses who expect to owe tax of $1,000 or more when they file their annual tax return. This tax is typically applicable to self-employed individuals, retirees, and those with significant income not subject to withholding. The purpose of the estimated tax is to ensure that taxpayers pay their tax liability throughout the year, rather than in a lump sum at the end of the tax year. Understanding this tax is crucial for effective financial planning and compliance with state tax laws.

Steps to Complete the Arkansas Estimated Tax

Completing the Arkansas AR1000ES form involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, calculate your expected income for the year and determine your tax liability based on Arkansas tax rates. Once you have this information, fill out the AR1000ES form by providing your personal information, estimated income, and the calculated tax amount. Finally, review the form for accuracy before submitting it either online or by mail.

Legal Use of the Arkansas Estimated Tax

The Arkansas Estimated Tax is legally binding when filed correctly and on time. To ensure compliance, taxpayers must adhere to the guidelines set by the Arkansas Finance Administration. This includes making payments on a quarterly basis if the estimated tax owed exceeds a specific threshold. Failure to comply with these regulations can result in penalties and interest charges. Utilizing a reliable eSignature solution can help ensure that your submissions are legally recognized and securely processed.

Filing Deadlines / Important Dates

Timely filing of the Arkansas Estimated Tax is essential to avoid penalties. The deadlines for submitting the AR1000ES form typically align with the quarterly payment schedule. Payments are generally due on the fifteenth day of April, June, September, and January for the following tax year. It is important to mark these dates on your calendar to ensure that you meet your tax obligations without incurring late fees.

Required Documents

To complete the Arkansas AR1000ES form, you will need several documents. These include your previous year’s tax return, income statements such as W-2s or 1099s, and any records of deductions or credits you plan to claim. Having these documents readily available will facilitate a smoother filing process and help ensure that your estimated tax calculations are accurate.

Who Issues the Form

The Arkansas AR1000ES form is issued by the Arkansas Department of Finance and Administration (DFA). This state agency is responsible for the administration of tax laws and the collection of state taxes. It is important to refer to the DFA’s official resources for the most current version of the form and any updates regarding filing procedures or requirements.

Penalties for Non-Compliance

Failure to file the Arkansas Estimated Tax on time can result in significant penalties. Taxpayers may incur a penalty of five percent of the unpaid tax for each month the payment is late, up to a maximum of 25 percent. Additionally, interest may accrue on any unpaid balance. To avoid these consequences, it is crucial to adhere to the filing deadlines and ensure accurate calculations when submitting the AR1000ES form.

Quick guide on how to complete arkansas estimated tax

Effortlessly Prepare Arkansas Estimated Tax on Any Device

Online document management has become increasingly favored by organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Arkansas Estimated Tax on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Arkansas Estimated Tax without hassle

- Find Arkansas Estimated Tax and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate issues of lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Arkansas Estimated Tax to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arkansas estimated tax

Create this form in 5 minutes!

People also ask

-

What is the Arkansas AR1000ES form?

The Arkansas AR1000ES form is a crucial document used for estimating and paying state income taxes in Arkansas. By filling out this form, taxpayers can calculate their estimated tax liability and ensure compliance with state tax regulations. Using the airSlate SignNow platform makes signing and submitting the Arkansas AR1000ES form easier for both individuals and businesses.

-

How can I use airSlate SignNow to fill out the Arkansas AR1000ES form?

With airSlate SignNow, you can easily upload the Arkansas AR1000ES form, fill it out digitally, and eSign it all in one place. Our platform simplifies the document completion process, ensuring all required fields are filled accurately. Plus, you can securely store and manage your documents directly within SignNow, making it a convenient choice.

-

Is there a cost associated with using airSlate SignNow for the Arkansas AR1000ES form?

Yes, there is a cost associated with using airSlate SignNow, but it offers a cost-effective solution for businesses and individuals. Our pricing plans cater to different needs, ensuring you can find the right fit for your document management process. With efficient features, the value you receive from using our platform exceeds the investment.

-

What are the key features of airSlate SignNow for managing the Arkansas AR1000ES form?

airSlate SignNow offers several key features for managing the Arkansas AR1000ES form, including easy document uploading, powerful editing tools, and secure eSigning. Users can also track the status of their documents in real-time and receive notifications once actions are taken. These features streamline the process, making tax reporting simpler.

-

Can I integrate airSlate SignNow with other tools for my Arkansas AR1000ES form?

Absolutely! airSlate SignNow provides integration capabilities with several popular tools and applications to enhance your workflow. This means you can seamlessly connect your existing systems with our platform for a more efficient experience while handling your Arkansas AR1000ES form. Check our integration options for a complete list of compatible platforms.

-

How does airSlate SignNow ensure the security of my Arkansas AR1000ES form data?

At airSlate SignNow, we prioritize the security and confidentiality of your documents and data, including the Arkansas AR1000ES form. Our platform utilizes advanced encryption protocols and complies with industry standards to protect your information. You can trust that your sensitive tax documents are safe while using our services.

-

What benefits do I get from using airSlate SignNow for the Arkansas AR1000ES form?

Utilizing airSlate SignNow for the Arkansas AR1000ES form offers numerous benefits, including time savings, enhanced accuracy, and improved document security. With our user-friendly interface, you can efficiently complete and sign your forms, reducing the risk of errors. Additionally, easy access to your documents helps you stay organized for tax season.

Get more for Arkansas Estimated Tax

- Wellcare dme authorization form

- Fictitious business name statement los angeles pdf form

- Renunciation of executor form

- Judicial title power of attorney form

- Application forms for preinatal chip form

- Oppenheimer funds change of beneficiary form

- Visa application form of the hong kong special administrative

- Communitrees program application treefolks treefolks form

Find out other Arkansas Estimated Tax

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form