Form NYC 210Claim for New York City School Tax Credit 2019

What is the Form NYC 210Claim For New York City School Tax Credit

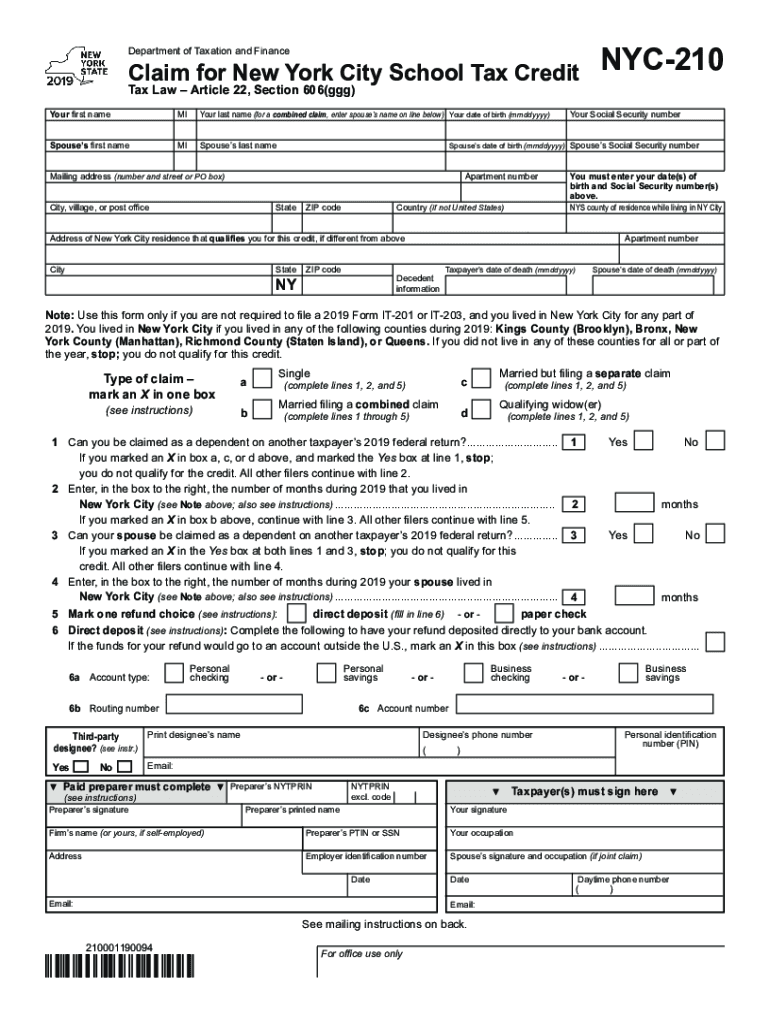

The Form NYC 210Claim is an essential document for residents of New York City seeking to apply for the School Tax Credit. This tax credit is designed to provide financial relief to eligible homeowners by reducing their property tax burden. The form requires specific information about the taxpayer, including details about the property and residency status. Understanding the purpose and requirements of this form is crucial for successful submission and obtaining the credit.

How to use the Form NYC 210Claim For New York City School Tax Credit

Using the Form NYC 210Claim involves several straightforward steps. First, gather all necessary documents, such as proof of residency and property ownership. Next, fill out the form accurately, ensuring all information aligns with the supporting documents. After completing the form, review it for any errors before submission. Utilizing digital tools can streamline this process, making it easier to fill out and sign the form securely.

Steps to complete the Form NYC 210Claim For New York City School Tax Credit

Completing the Form NYC 210Claim requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source, such as the official city website.

- Provide your personal information, including your name, address, and Social Security number.

- Detail your property information, including the address and tax identification number.

- Indicate your eligibility for the credit by answering relevant questions.

- Sign and date the form to certify its accuracy.

Legal use of the Form NYC 210Claim For New York City School Tax Credit

The legal use of the Form NYC 210Claim is governed by specific regulations set forth by the New York City Department of Finance. To be considered valid, the form must be completed accurately and submitted within the designated filing period. Additionally, it is essential to retain copies of all submitted documents for your records, as they may be required for future verification or audits.

Eligibility Criteria

To qualify for the School Tax Credit through the Form NYC 210Claim, applicants must meet certain eligibility criteria. Generally, these criteria include:

- Being a resident of New York City.

- Owning a property that is your primary residence.

- Meeting income thresholds as defined by the city’s regulations.

It is important to review the specific eligibility requirements each year, as they may change based on city policies.

Form Submission Methods

The Form NYC 210Claim can be submitted through various methods to accommodate different preferences. Residents have the option to:

- Submit the form online through the New York City Department of Finance website.

- Mail the completed form to the appropriate city office.

- Deliver the form in person at designated city locations.

Choosing the right submission method can help ensure timely processing of your claim.

Quick guide on how to complete form nyc 2102019claim for new york city school tax credit

Complete Form NYC 210Claim For New York City School Tax Credit with ease on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed forms, as you can easily locate the correct document and securely store it digitally. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Form NYC 210Claim For New York City School Tax Credit on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

The easiest way to modify and electronically sign Form NYC 210Claim For New York City School Tax Credit without hassle

- Locate Form NYC 210Claim For New York City School Tax Credit and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that function.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your updates.

- Choose how you want to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form NYC 210Claim For New York City School Tax Credit and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form nyc 2102019claim for new york city school tax credit

Create this form in 5 minutes!

People also ask

-

What is Form NYC 210Claim For New York City School Tax Credit?

Form NYC 210Claim For New York City School Tax Credit is a tax form used by eligible homeowners in New York City to claim a school tax credit. This form helps reduce property taxes, making housing more affordable for residents. It's essential to complete the form accurately to receive the benefits.

-

How can airSlate SignNow help with Form NYC 210Claim For New York City School Tax Credit?

airSlate SignNow streamlines the process of completing and submitting Form NYC 210Claim For New York City School Tax Credit. Our platform provides easy-to-use eSignature tools and document templates, ensuring a smooth filing experience. Save time and minimize errors with our efficient features.

-

Is there a cost associated with using airSlate SignNow for Form NYC 210Claim For New York City School Tax Credit?

Yes, there is a subscription cost for using airSlate SignNow, but it's cost-effective, especially considering the time and resources saved. We offer flexible pricing plans to meet different needs, enabling users to manage Form NYC 210Claim For New York City School Tax Credit efficiently. Check our website for current pricing options.

-

What features does airSlate SignNow offer for completing tax forms like Form NYC 210Claim For New York City School Tax Credit?

airSlate SignNow offers a variety of features tailored for completing tax forms, including customizable templates, eSigning capabilities, and secure cloud storage. These features ensure that your Form NYC 210Claim For New York City School Tax Credit is completed accurately and securely. Plus, you can track document status in real-time.

-

Can I integrate airSlate SignNow with other software for managing Form NYC 210Claim For New York City School Tax Credit?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including popular accounting and tax software. This integration allows for a smoother data transfer and management of Form NYC 210Claim For New York City School Tax Credit, saving you time and effort during tax season.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation, including Form NYC 210Claim For New York City School Tax Credit, offers numerous benefits such as enhanced security, faster processing times, and reduced paperwork. Our platform facilitates collaboration, making it easier to gather necessary signatures and people’s input. Simplify your tax process with our user-friendly interface.

-

How secure is my data when using airSlate SignNow for Form NYC 210Claim For New York City School Tax Credit?

Your data security is our top priority at airSlate SignNow. We employ advanced encryption technology to protect all documents, including Form NYC 210Claim For New York City School Tax Credit. Furthermore, our compliance with industry standards ensures that your information is safe from unauthorized access.

Get more for Form NYC 210Claim For New York City School Tax Credit

- Images of employment applications for daycsare assistant form

- Optumrx dmr form

- Rita form 48 23516191

- Farm income and expense worksheet 367905401 form

- Iowa department of inspections and appeals annual gambling report form

- Application instructions for the licensee retail food form

- Northwestern state university a member of the university of louisiana system request for official academic transcript a minimum form

- Randolph county fair sponsorship package form

Find out other Form NYC 210Claim For New York City School Tax Credit

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors