Maryland Form Annual

What is the Maryland Form Annual?

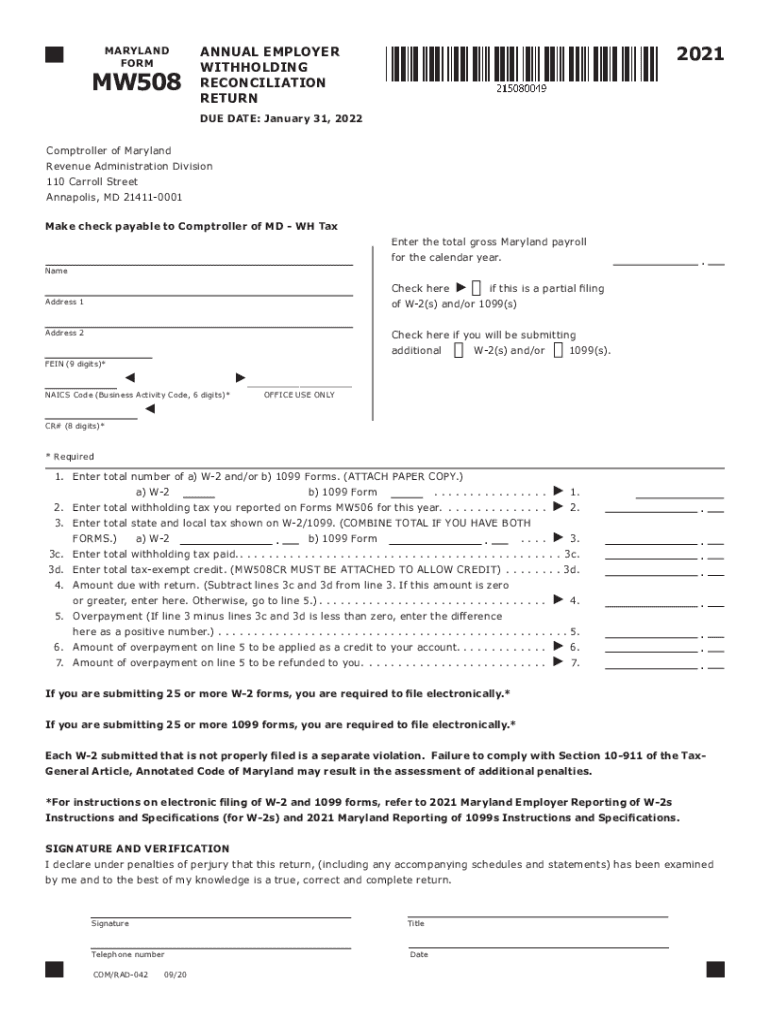

The Maryland Form Annual, specifically the, is a crucial document used for annual employer reconciliation and annual withholding reconciliation in the state of Maryland. This form is essential for employers to report the total amount of income tax withheld from employees throughout the year. It ensures compliance with state tax regulations and provides the necessary information for the Comptroller of Maryland to verify that withholding amounts are accurate and properly reported.

Steps to complete the Maryland Form Annual

Completing the Maryland Form involves several key steps:

- Gather all relevant financial records, including employee wages and tax withholding details for the year.

- Access the fillable version of the form, ensuring it is the 2021 edition to maintain accuracy.

- Fill in the required fields, including employer information, total wages paid, and total tax withheld.

- Review the information for accuracy, as errors can lead to penalties or delays in processing.

- Submit the completed form to the Comptroller of Maryland by the designated deadline.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Maryland Form. Employers must submit this form by the last day of February following the end of the tax year. For the 2021 tax year, the deadline is February 28, 2022. Timely submission helps avoid penalties and ensures compliance with state tax laws.

Required Documents

When preparing to complete the Maryland Form, certain documents are necessary to ensure accurate reporting:

- W-2 forms for each employee, detailing wages and withholding amounts.

- Payroll records that summarize total wages paid throughout the year.

- Any previous correspondence with the Comptroller regarding tax withholding.

Legal use of the Maryland Form Annual

The Maryland Form is legally binding when completed accurately and submitted on time. It must comply with the regulations set forth by the Maryland Comptroller's office. The form serves as an official record of tax withholding and is essential for both employer and employee tax compliance. Failure to submit the form or inaccuracies can result in penalties or legal repercussions.

Who Issues the Form

The Maryland Form 508 is issued by the Comptroller of Maryland. This state agency is responsible for overseeing tax collection and ensuring compliance with Maryland tax laws. Employers can obtain the form directly from the Comptroller's website or through official state tax publications.

Quick guide on how to complete maryland form annual

Effortlessly Prepare Maryland Form Annual on All Devices

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it in the cloud. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents quickly and without delays. Manage Maryland Form Annual on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The Easiest Way to Edit and Electronically Sign Maryland Form Annual

- Obtain Maryland Form Annual and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to share your form: via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form navigation, and errors that require printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Maryland Form Annual while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 508 2021 compliance in eSignature solutions?

The 508 2021 compliance ensures that electronic signatures are accessible to all users, including those with disabilities. airSlate SignNow adheres to these accessibility standards, allowing businesses to meet legal requirements while providing an inclusive user experience.

-

How does airSlate SignNow support the 508 2021 standards?

airSlate SignNow provides features that enhance accessibility for users, including text-to-speech support and keyboard navigation. Our platform is designed to align with the 508 2021 regulations, ensuring that all signers can easily access and complete documents.

-

What pricing plans are available for using airSlate SignNow?

airSlate SignNow offers various pricing plans starting with a free trial that allows users to explore features relevant to 508 2021 compliance. Paid plans include advanced features for larger teams and enterprises, providing value and support for businesses needing comprehensive eSignature solutions.

-

What features make airSlate SignNow a top choice for ensuring 508 2021 compliance?

Key features of airSlate SignNow include customizable templates, in-app collaboration, and robust security measures. These tools not only facilitate compliance with 508 2021 but also streamline the signing process, improving overall workflow efficiency.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications such as Google Drive, Salesforce, and more. This flexibility helps businesses keep their operations aligned with 508 2021 compliance while utilizing their existing tools.

-

How can airSlate SignNow benefit my business in terms of 508 2021 compliance?

Using airSlate SignNow can enhance your business's commitment to inclusivity by ensuring that all users can participate in the signing process. By achieving 508 2021 compliance, you not only fulfill legal requirements but also build trust with your clients and stakeholders.

-

What customer support does airSlate SignNow offer for users concerned about 508 2021?

airSlate SignNow provides dedicated customer support to assist users with questions about 508 2021 compliance. Our team is available to guide customers through the platform's features, ensuring they can fully utilize our solution to meet accessibility standards.

Get more for Maryland Form Annual

- Vs 16 3 form

- Chapter 4 biology test answer key form

- Ups policy book form

- Wellness profile herbalife form

- Temporary event notice crawley borough council form

- Renewal form for ttc wheel trans support person assistance card fill

- Faller trainee weekly training plan and bcforestsafe org form

- Elementary progress report card grades 7 8 progress report card public version form

Find out other Maryland Form Annual

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors