1120 Tax for 2024-2025 Form

What is the 1120 Tax Form?

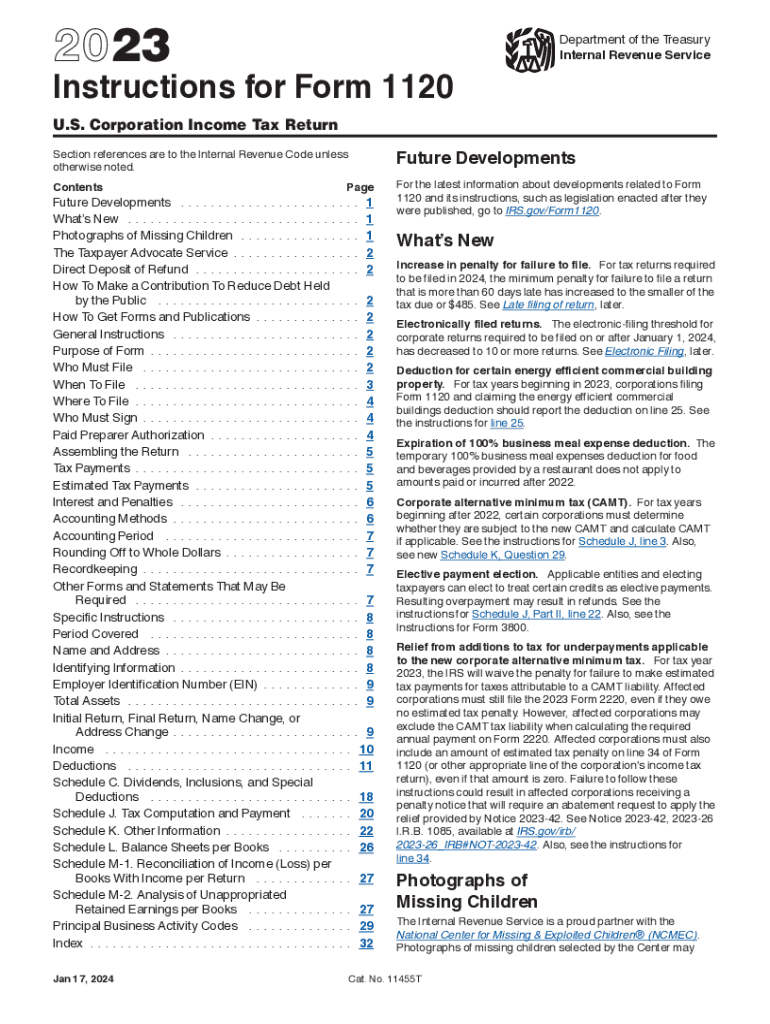

The 1120 tax form, officially known as the U.S. Corporation Income Tax Return, is a federal tax document that corporations in the United States must file annually with the Internal Revenue Service (IRS). This form is used to report the income, gains, losses, deductions, and credits of a corporation. It is essential for determining the corporation's tax liability. Corporations must complete this form accurately to comply with federal tax laws.

Key Elements of the 1120 Tax Form

The 1120 tax form includes several critical components that corporations must fill out. These elements include:

- Income: Corporations must report all sources of income, including sales revenue and investment income.

- Deductions: Corporations can deduct various business expenses, such as salaries, rent, and utilities, which reduce taxable income.

- Tax Calculation: The form requires corporations to calculate their tax liability based on their taxable income and applicable tax rates.

- Signatures: The form must be signed by an authorized officer of the corporation, affirming the accuracy of the information provided.

Steps to Complete the 1120 Tax Form

Completing the 1120 tax form involves several steps to ensure accuracy and compliance:

- Gather financial records, including income statements and expense reports.

- Fill out the income section, detailing all sources of revenue.

- List all allowable deductions to determine taxable income.

- Calculate the tax owed based on the corporation's taxable income.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the IRS by the designated deadline.

Filing Deadlines for the 1120 Tax Form

The filing deadline for the 1120 tax form is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due on April fifteenth. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also apply for an extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

IRS Guidelines for the 1120 Tax Form

The IRS provides specific guidelines for completing and filing the 1120 tax form. These guidelines include instructions on what information to report, how to calculate taxes owed, and the required documentation to accompany the form. It is crucial for corporations to refer to the latest IRS instructions to ensure compliance with current tax laws and regulations. Failure to adhere to these guidelines may result in penalties or audits.

Penalties for Non-Compliance

Corporations that fail to file the 1120 tax form on time or provide inaccurate information may face penalties imposed by the IRS. These penalties can include:

- Failure-to-File Penalty: A penalty may be assessed for each month the return is late, up to a maximum amount.

- Accuracy-Related Penalty: If the IRS determines that the corporation has underreported income or claimed excessive deductions, additional penalties may apply.

It is essential for corporations to file accurately and on time to avoid these financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct irs 1120

Related searches to businesses used 1120

Create this form in 5 minutes!

How to create an eSignature for the corporate income tax calculator

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask taxes 1120 online

-

What is the 1120 tax form for?

The 1120 tax form is used by corporations to report their income, gains, losses, deductions, and credits. It is essential for businesses to accurately complete this form to ensure compliance with IRS regulations. Understanding the 1120 tax form for your corporation can help you avoid penalties and maximize your tax benefits.

-

How can airSlate SignNow help with the 1120 tax form for my business?

airSlate SignNow provides a streamlined solution for sending and eSigning the 1120 tax form for your business. With our platform, you can easily manage document workflows, ensuring that all necessary signatures are obtained promptly. This efficiency can save you time and reduce the stress associated with tax season.

-

What features does airSlate SignNow offer for managing the 1120 tax form for corporations?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically designed for the 1120 tax form for corporations. These tools help ensure that your documents are completed accurately and efficiently. Additionally, our platform allows for easy collaboration among team members.

-

Is airSlate SignNow cost-effective for handling the 1120 tax form for small businesses?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing the 1120 tax form for their tax filings. Our pricing plans are designed to fit various budgets, allowing you to choose the best option for your needs. By using our platform, you can save on printing and mailing costs associated with traditional document handling.

-

Can I integrate airSlate SignNow with other software for the 1120 tax form for my business?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage the 1120 tax form for your business. This seamless integration allows you to import data directly into your tax forms, reducing the risk of errors and saving you time during the filing process.

-

What are the benefits of using airSlate SignNow for the 1120 tax form for my corporation?

Using airSlate SignNow for the 1120 tax form for your corporation provides numerous benefits, including enhanced security, faster processing times, and improved accuracy. Our platform ensures that your documents are securely stored and easily accessible. Additionally, the eSigning feature speeds up the approval process, allowing you to file your taxes on time.

-

How does airSlate SignNow ensure the security of the 1120 tax form for sensitive information?

airSlate SignNow prioritizes the security of your documents, including the 1120 tax form for sensitive information. We utilize advanced encryption methods and secure cloud storage to protect your data. Our compliance with industry standards ensures that your information remains confidential and secure throughout the signing process.

Get more for 1120 taxes

Find out other 2018 1120

- eSignature Oklahoma Car Dealer Promissory Note Template Computer

- eSignature New Hampshire Charity Business Letter Template Safe

- How To eSignature New Hampshire Charity Business Letter Template

- eSignature Oklahoma Car Dealer Promissory Note Template Mobile

- How Do I eSignature New Hampshire Charity Business Letter Template

- Help Me With eSignature New Hampshire Charity Business Letter Template

- How Can I eSignature New Hampshire Charity Business Letter Template

- How To eSignature Oklahoma Car Dealer Promissory Note Template

- Can I eSignature New Hampshire Charity Business Letter Template

- eSignature Oklahoma Car Dealer Promissory Note Template Now

- How Do I eSignature Oklahoma Car Dealer Promissory Note Template

- eSignature Oklahoma Car Dealer Promissory Note Template Later

- eSignature Oklahoma Car Dealer Job Description Template Online

- eSignature Oklahoma Car Dealer Job Description Template Computer

- Help Me With eSignature Oklahoma Car Dealer Promissory Note Template

- eSignature Oklahoma Car Dealer Job Description Template Mobile

- eSignature Oklahoma Car Dealer Job Description Template Now

- How Can I eSignature Oklahoma Car Dealer Promissory Note Template

- eSignature Oklahoma Car Dealer Promissory Note Template Myself

- eSignature Oklahoma Car Dealer Job Description Template Later