1040a Form

What is the 1040A?

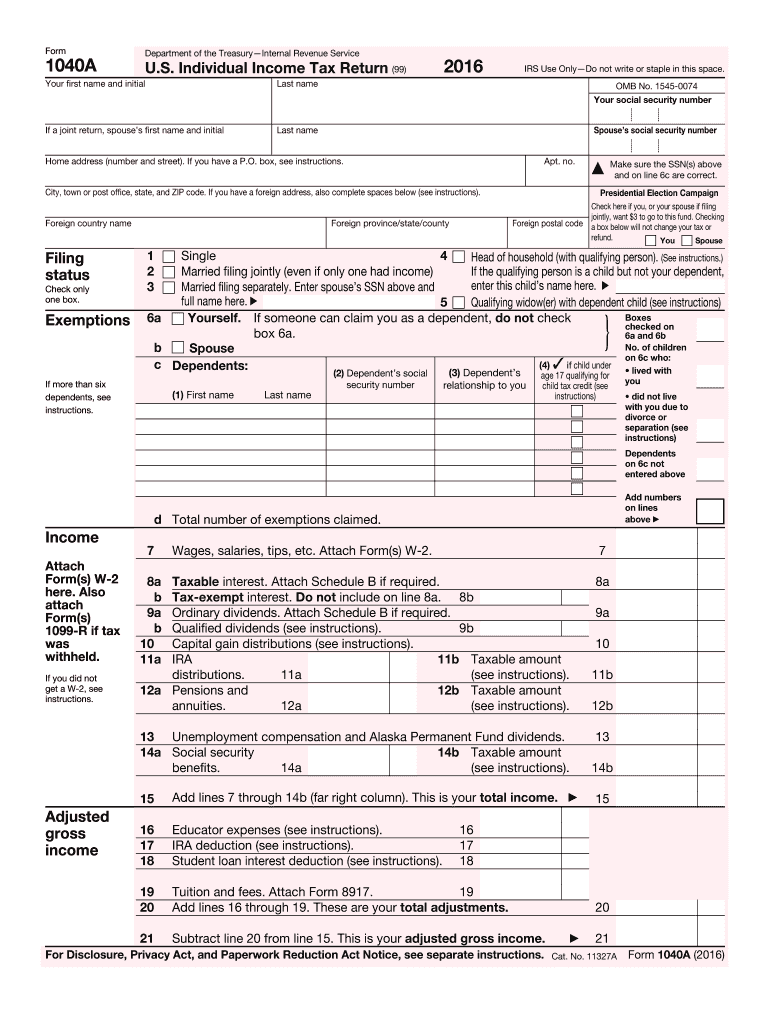

The 1040A is a simplified version of the IRS Form 1040, designed for taxpayers with straightforward financial situations. This form allows individuals to report their income, claim deductions, and calculate their tax liability. It is often used by those who do not itemize deductions and have income from wages, salaries, and certain pensions. The 1040A 2014 specifically refers to the version of this form used for the tax year 2014, which includes specific instructions and guidelines relevant to that year.

Steps to Complete the 1040A

Completing the 2A involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill in your personal information, such as your name, address, and Social Security number.

- Report your income by entering the amounts from your income statements in the appropriate sections.

- Claim any eligible deductions, such as the standard deduction or specific credits, including the Schedule EIC 2014 for earned income credit.

- Calculate your total tax liability and any refund or amount owed.

- Sign and date the form, ensuring all information is accurate before submission.

How to Obtain the 1040A

The 1040A form 2014 can be obtained directly from the IRS website or through various tax preparation services. Taxpayers can download a printable version of the form, which includes the necessary instructions for completion. Additionally, many tax software programs offer the ability to fill out and file the IRS 1040A 2014 electronically, streamlining the process for users.

Legal Use of the 1040A

Filing the IRS 1040A is legally binding when completed accurately and submitted on time. To ensure compliance, taxpayers must adhere to the IRS guidelines and provide truthful information. Any discrepancies or fraudulent claims can result in penalties or legal consequences. Utilizing a reliable eSignature solution can enhance the legal standing of the digitally signed form, ensuring it meets all necessary legal requirements.

Filing Deadlines / Important Dates

The deadline for filing the 2A was typically April 15, 2015. Taxpayers who missed this deadline could request an extension, but they would still be responsible for any taxes owed by the original due date to avoid penalties. It is important to keep track of any changes in tax deadlines for future filings, as they can vary year by year.

Required Documents

To complete the 1040A 2014, taxpayers need to gather several key documents:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any deductible expenses

- Social Security numbers for dependents

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting income and claiming deductions.

Quick guide on how to complete irs 1040a 2014 form

Complete 1040a effortlessly on any gadget

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage 1040a on any device using airSlate SignNow's Android or iOS applications and simplify any document-centered process today.

The easiest way to edit and eSign 1040a with minimal effort

- Locate 1040a and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal standing as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to send your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and eSign 1040a and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can you tell whether you should file an IRS Form 1040a or 1040ez?

For the current filing season, 2018, form 1040-EZ and 1040-A have been discontinued.If you are talking about filing recent prior year returns, form 1040-EZ was for if you are reporting wages, interest interest income under $1,500, and/or unemployment compensation and pretty much nothing else. You cannot report dependants on a 1040-EZ.1040-A if for when you have interest income over $1,500 and/or have dependants.Neither forms allow you to itemize deductions. There are other things to know as well. You can review the instructions at these links:About Form 1040-EZ | Internal Revenue ServiceAbout Form 1040-A | Internal Revenue Service

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

Do un-contracted workers have to fill out IRS W4 form?

I have no idea what an “un-contracted worker” is. I am not familiar with that term.Employees working in the U.S. complete a Form W-4.Independent contractors in the U.S. do not. Instead, they usually complete a Form W-9.If unclear on the difference between an employee or an independent contractor, see Independent Contractor Self Employed or Employee

Create this form in 5 minutes!

How to create an eSignature for the irs 1040a 2014 form

How to make an electronic signature for the Irs 1040a 2014 Form in the online mode

How to generate an electronic signature for the Irs 1040a 2014 Form in Chrome

How to make an eSignature for signing the Irs 1040a 2014 Form in Gmail

How to create an electronic signature for the Irs 1040a 2014 Form from your smartphone

How to make an eSignature for the Irs 1040a 2014 Form on iOS

How to generate an eSignature for the Irs 1040a 2014 Form on Android devices

People also ask

-

What is the 1040a form, and how can airSlate SignNow help with it?

The 1040a form is a simplified version of the IRS Form 1040, designed for taxpayers with straightforward tax situations. airSlate SignNow can help you eSign and submit your 1040a form quickly and securely, streamlining the entire process to ensure you meet your tax deadlines without hassle.

-

Is airSlate SignNow suitable for filing 1040a forms?

Absolutely! airSlate SignNow is an excellent choice for individuals and businesses looking to manage their 1040a forms efficiently. With our user-friendly interface, you can easily upload, sign, and send your 1040a documents, all while maintaining compliance with IRS regulations.

-

What are the pricing options for using airSlate SignNow for 1040a forms?

airSlate SignNow offers flexible pricing plans tailored to your needs, including options for individual users and businesses. Whether you're filing a single 1040a form or managing multiple documents, our cost-effective solutions ensure you get the best value without compromising on quality.

-

Can I integrate airSlate SignNow with tax software for 1040a submissions?

Yes, airSlate SignNow integrates seamlessly with various tax software applications to facilitate 1040a submissions. This integration allows you to manage your documents in one place, ensuring a smooth workflow from preparation to eSigning.

-

What features does airSlate SignNow offer for managing 1040a forms?

airSlate SignNow offers a range of features for managing 1040a forms, including customizable templates, secure eSigning, and document tracking. These tools make it easy to prepare, send, and receive completed forms, enhancing your overall tax filing experience.

-

How does airSlate SignNow ensure the security of my 1040a forms?

Security is a top priority at airSlate SignNow. We employ industry-leading encryption and compliance measures to protect your sensitive information while handling your 1040a forms, ensuring that your data remains confidential and secure throughout the process.

-

Can I access airSlate SignNow from mobile devices when working on my 1040a?

Yes, airSlate SignNow is fully accessible from mobile devices, allowing you to work on your 1040a forms anytime, anywhere. Our mobile-friendly platform ensures you can easily upload, sign, and share your documents on the go.

Get more for 1040a

- Please circle one csea pef uup employee bi weekly timesheet form

- Housing preference form

- Stark state form

- App fee waiver info beginning fall 21 appsdoc form

- Application for first year undergraduate admission form

- Fillable online form oisss 115 request for a social security

- Ss1 form

- Immunization form for new students health immunization vaccination records

Find out other 1040a

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document