Tax Statement Forms 1099

What is the Tax Statement Forms 1099

The Tax Statement Forms 1099 are a series of documents used to report various types of income other than wages, salaries, and tips. These forms are essential for tax reporting purposes and are provided by businesses and financial institutions to individuals and the Internal Revenue Service (IRS). The most common variant, Form 1099-MISC, is used to report payments made to independent contractors, while other variants cover different types of income, such as interest, dividends, and retirement distributions. Understanding the purpose and types of 1099 forms is crucial for accurate tax filing.

Steps to complete the Tax Statement Forms 1099

Completing the Tax Statement Forms 1099 involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary information, including the recipient's name, address, and taxpayer identification number (TIN). Next, accurately report the income amount in the appropriate box on the form. Ensure that all entries are clear and legible. After completing the form, review it for errors and ensure that it matches your records. Finally, submit the form to the IRS and provide a copy to the recipient by the designated deadline.

IRS Guidelines

The IRS provides specific guidelines for the use and completion of Tax Statement Forms 1099. These guidelines include instructions on who must file, the types of payments that require reporting, and the deadlines for submission. It is essential to follow these guidelines to avoid penalties and ensure compliance. The IRS also updates forms and requirements periodically, so staying informed about any changes is crucial for accurate tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for Tax Statement Forms 1099 are critical to ensure compliance with IRS regulations. Generally, forms must be submitted to the IRS by the end of January for the previous tax year. Recipients should also receive their copies by this date. Failure to meet these deadlines can result in penalties. It is advisable to mark your calendar with these important dates to avoid any issues with your tax filings.

Legal use of the Tax Statement Forms 1099

The legal use of Tax Statement Forms 1099 is governed by IRS regulations that outline when and how these forms should be used. These forms must accurately reflect the income paid to individuals and must be filed in accordance with federal tax laws. Misreporting or failing to file can lead to significant penalties. It is important for businesses and individuals to understand their obligations regarding these forms to maintain compliance and avoid legal issues.

Who Issues the Form

Tax Statement Forms 1099 are typically issued by businesses, financial institutions, and other entities that make payments to individuals or other businesses. This includes payments for services rendered, interest earned, dividends received, and other forms of income. The issuer is responsible for accurately completing the form and providing a copy to both the recipient and the IRS. Understanding who issues these forms is essential for both recipients and businesses to ensure proper reporting and compliance.

Quick guide on how to complete tax statement forms 1099

Effortlessly Prepare Tax Statement Forms 1099 on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Tax Statement Forms 1099 on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The Easiest Way to Modify and Electronically Sign Tax Statement Forms 1099 Without Effort

- Locate Tax Statement Forms 1099 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all details and click on the Done button to save your changes.

- Choose your delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Tax Statement Forms 1099 and maintain exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

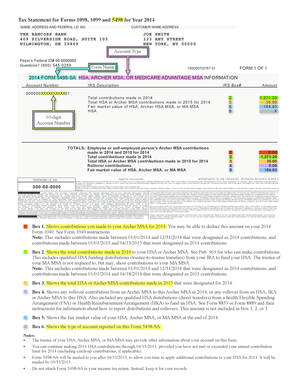

What are forms 1098 1099 5498, and why are they important?

Forms 1098, 1099, and 5498 are essential tax documents used by the IRS for reporting various types of income, mortgage interest, and contributions to individual retirement accounts. Understanding these forms is crucial for accurate tax filing and compliance. Businesses need a reliable solution like airSlate SignNow to manage these documents efficiently.

-

How does airSlate SignNow streamline the process of creating forms 1098 1099 5498?

airSlate SignNow simplifies the creation of forms 1098, 1099, and 5498 with user-friendly templates and customizable options. Users can easily input required data and generate compliant forms within minutes. This streamlining saves time and reduces errors associated with manual entry.

-

Is airSlate SignNow cost-effective for managing forms 1098 1099 5498?

Yes, airSlate SignNow offers a cost-effective solution for managing forms 1098, 1099, and 5498. With competitive pricing plans and a host of features included, users can efficiently handle their document workflow without breaking the bank. Businesses find that the time saved translates to signNow cost savings.

-

Can I integrate airSlate SignNow with other software for forms 1098 1099 5498?

Absolutely! airSlate SignNow supports integration with various accounting and tax software, making it easier to manage forms 1098, 1099, and 5498. By syncing data across platforms, users can ensure accuracy and streamline their workflow even further. This integration capability enhances productivity.

-

What features does airSlate SignNow offer for signing forms 1098 1099 5498?

airSlate SignNow includes robust features for eSigning forms 1098, 1099, and 5498, such as secure digital signatures and audit trails. These features provide confidence that documents are signed legally and efficiently. Users can sign and send forms from any device, enhancing convenience and flexibility.

-

How does airSlate SignNow ensure the security of forms 1098 1099 5498?

Security is a top priority for airSlate SignNow when handling forms 1098, 1099, and 5498. The platform utilizes encryption and complies with industry standards to protect sensitive data. Additionally, users can set permissions to control who has access to their documents, ensuring information remains confidential.

-

What support does airSlate SignNow offer for using forms 1098 1099 5498?

airSlate SignNow provides extensive support for users managing forms 1098, 1099, and 5498. The support team is available via various channels, including email, chat, and phone, and users also have access to a wealth of online resources such as tutorials and FAQs. This support is vital for ensuring users can maximize the platform's potential.

Get more for Tax Statement Forms 1099

- Respirator cleaning inspection log form

- Grade 9 science exam pdf form

- Grundlegendes zu algebra und funktionen selbstorganisiert erlernen form

- Osha dental office checklist form

- Mudra loan application form pdf

- Jesus christ gods revelation to the world chapt form

- Rate verification form

- Silk road virtual tour graphic organizer rubric form

Find out other Tax Statement Forms 1099

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online