4506 F Request 2021-2026

What is the 4506 F Request

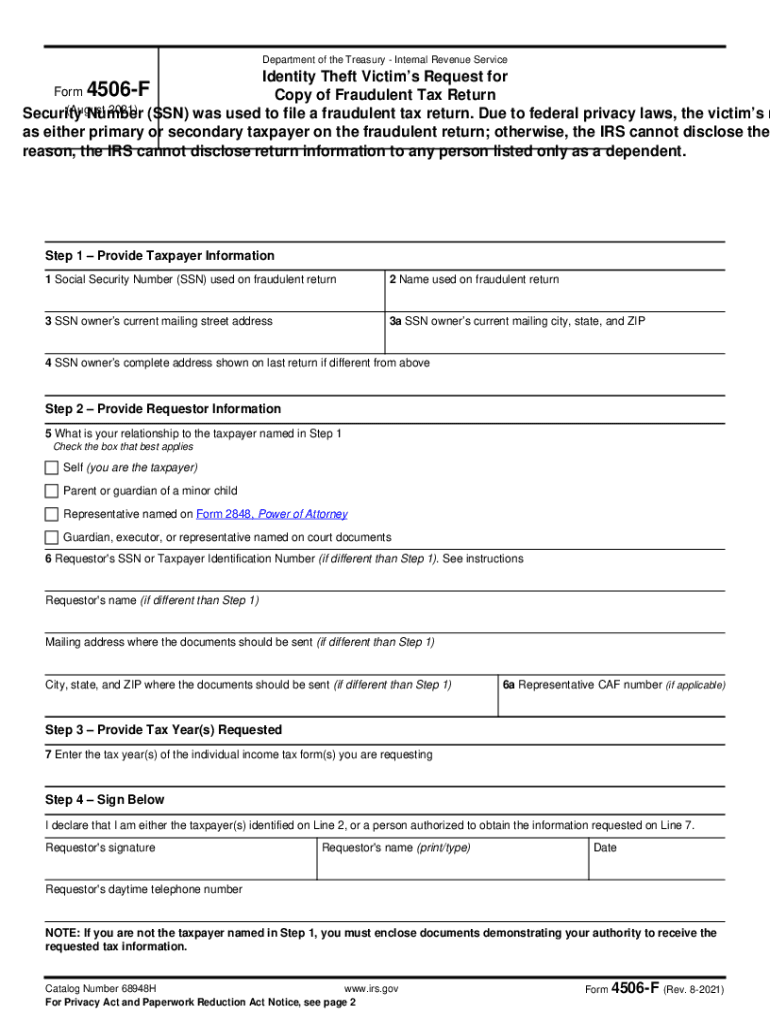

The 4506 F request is a form used to obtain a copy of a taxpayer's income tax return from the Internal Revenue Service (IRS). This form is essential for individuals and businesses needing to verify their income for various purposes, such as applying for loans, securing mortgages, or fulfilling other financial obligations. The IRS 4506 F request allows taxpayers to authorize the IRS to release their tax information to a third party, ensuring that the request is legitimate and compliant with federal regulations.

Steps to complete the 4506 F Request

Completing the 4506 F request involves several key steps to ensure accuracy and compliance. First, you need to download the form from the IRS website or access it through a reliable electronic document service. Next, fill in your personal information, including your name, address, and Social Security number. If you are requesting information for a business, include the business name and Employer Identification Number (EIN). Specify the tax years for which you need the information. Finally, sign and date the form, and provide any necessary authorizations for third-party requests.

How to obtain the 4506 F Request

The IRS 4506 F request can be obtained directly from the IRS website, where it is available as a downloadable PDF. Additionally, electronic document services like signNow offer features that simplify the process of filling out and signing the form digitally. This can enhance efficiency and ensure that all required information is accurately captured. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the requirements of the requesting party.

Legal use of the 4506 F Request

The legal use of the 4506 F request is governed by IRS regulations, which stipulate that the form must be completed accurately and submitted by the taxpayer or an authorized representative. This ensures that sensitive tax information is only disclosed to legitimate parties. Compliance with the relevant laws, such as the Privacy Act and the Freedom of Information Act, is crucial to protect taxpayer information. Utilizing a secure electronic signature platform, like signNow, can further enhance the legal validity of the submitted request.

Form Submission Methods (Online / Mail / In-Person)

The IRS 4506 F request can be submitted through various methods, depending on your convenience and the requirements of the third party requesting the information. You can submit the form online through an electronic document service, which often allows for faster processing. Alternatively, you can print the completed form and mail it directly to the IRS at the address specified for your state. In-person submissions are generally not available for this form, as it is primarily processed through mail or electronic channels.

Required Documents

When submitting the 4506 F request, certain documents may be required to verify your identity and support your request. Typically, you will need to provide a valid form of identification, such as a driver's license or passport, along with any additional documentation that may be specified by the requesting party. If you are requesting information on behalf of a business, you may also need to include proof of your authority to act on behalf of the business, such as a corporate resolution or power of attorney.

Quick guide on how to complete 4506 f request

Easily create 4506 F Request on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can locate the suitable form and securely store it online. airSlate SignNow provides all the tools you need to generate, modify, and electronically sign your documents quickly without any delays. Manage 4506 F Request on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign 4506 F Request effortlessly

- Obtain 4506 F Request and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign 4506 F Request and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4506 f request

Create this form in 5 minutes!

People also ask

-

What is the purpose of the 4506 f form?

The 4506 f form is used to obtain tax return information from the IRS. This document is crucial for verifying income when applying for loans or financial assistance. With airSlate SignNow, you can easily send and eSign the 4506 f form securely.

-

How does airSlate SignNow simplify the 4506 f signing process?

airSlate SignNow streamlines the signing process for the 4506 f by allowing users to eSign documents electronically. This eliminates the need for printing or mailing forms, saving time and resources. Our platform ensures that your 4506 f forms are securely signed and delivered.

-

What are the pricing options for using airSlate SignNow for 4506 f forms?

airSlate SignNow offers several pricing plans that cater to different business needs when dealing with 4506 f forms. Our plans are competitively priced, ensuring a cost-effective solution for electronic signing. You can choose a plan based on the number of documents you send and sign each month.

-

Can I integrate airSlate SignNow with other applications for handling 4506 f forms?

Yes, airSlate SignNow integrates seamlessly with various applications, making it easy to manage your 4506 f forms along with other business processes. This integration streamlines workflows and improves efficiency by allowing users to eSign documents directly from their preferred platforms.

-

What are the benefits of using airSlate SignNow for 4506 f?

Using airSlate SignNow for your 4506 f forms provides numerous benefits, such as speed, security, and ease of use. The platform ensures that your documents are legally binding and securely stored. Additionally, customers can track the status of their 4506 f forms at any time.

-

Is airSlate SignNow compliant with legal standards for 4506 f eSignatures?

Absolutely, airSlate SignNow complies with all legal standards regarding eSignatures, including those required for the 4506 f form. This compliance guarantees that your electronically signed documents are valid and enforceable in a court of law. Trust us to keep your signing process secure and legitimate.

-

How can I get started with airSlate SignNow for my 4506 f needs?

Getting started with airSlate SignNow for handling 4506 f forms is easy. Simply sign up for an account and you’ll have access to our user-friendly interface. From there, you can upload your 4506 f forms, start the signing process, and streamline your document workflows.

Get more for 4506 F Request

- Idaho small estate affidavit itd 3413 idaho small estate affidavit itd 3413 itd idaho form

- Rental application pdf 100058104 form

- Sp1230 form

- Application for volunteer services baltimore county public schools bcps form

- Oppenheimer advisor change form gbs advisors

- Checksoft templates form

- Omb no 0938 0008 form

- In conjunction with the cbtu 47th international convention form

Find out other 4506 F Request

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free