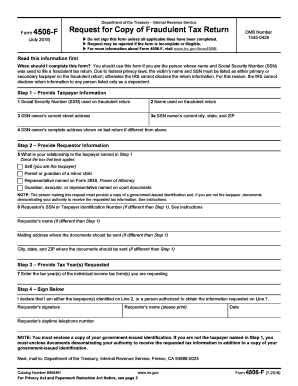

Form 4506 F 2016

What is the Form 4506 F

The Form 4506 F is an IRS document that allows taxpayers to request a copy of their tax return information. This form is particularly useful for individuals and businesses needing to verify income for various purposes, such as applying for loans or mortgages. The 4506 F is designed to streamline the process of obtaining tax records directly from the IRS, ensuring that the information is accurate and official.

How to use the Form 4506 F

Using the Form 4506 F involves filling out the required information accurately. Taxpayers must provide their personal details, including name, address, and Social Security number, as well as the tax years for which they are requesting information. It is essential to ensure that all information is correct to avoid delays in processing. Once completed, the form can be submitted to the IRS, which will then provide the requested tax return information.

Steps to complete the Form 4506 F

Completing the Form 4506 F requires careful attention to detail. Here are the steps to follow:

- Download the Form 4506 F from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the tax years for which you need the information.

- Indicate the purpose of your request, such as applying for a loan.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the IRS via mail or electronically, if applicable.

Legal use of the Form 4506 F

The Form 4506 F is legally recognized and must be used in compliance with IRS regulations. It serves as an official request for tax information, which can be critical for various financial transactions. Ensuring that the form is filled out correctly and submitted according to IRS guidelines is essential for maintaining its legal validity.

Required Documents

When submitting the Form 4506 F, certain documents may be required to verify your identity and the purpose of the request. Typically, you will need to provide:

- A copy of a government-issued ID, such as a driver's license or passport.

- Proof of address, such as a utility bill or bank statement.

- Any additional documentation that supports your request, depending on the purpose.

Form Submission Methods

The Form 4506 F can be submitted to the IRS in several ways. The most common methods include:

- Mail: Send the completed form to the appropriate IRS address based on your location.

- Online: Some taxpayers may have the option to submit the form electronically through the IRS website.

- In-Person: Visit a local IRS office, if available, to submit the form directly.

Eligibility Criteria

To use the Form 4506 F, taxpayers must meet specific eligibility criteria. Generally, you must be the individual or business entity that filed the tax return for which you are requesting information. Additionally, you should have the necessary identification and documentation to support your request. This ensures that sensitive tax information is only released to authorized individuals.

Quick guide on how to complete form 4506 f

Effortlessly Prepare Form 4506 F on Any Device

The management of online documents has gained traction among both organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Form 4506 F on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The easiest way to edit and electronically sign Form 4506 F with ease

- Locate Form 4506 F and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate the chances of losing or misplacing documents, tedious searches for forms, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 4506 F to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4506 f

Create this form in 5 minutes!

How to create an eSignature for the form 4506 f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4506 f and why is it important?

Form 4506 f is a request for the IRS to provide a copy of your tax return or a transcript of your tax data. This form is crucial for individuals who need to verify their income or financial information, especially when applying for loans or other financial services.

-

How can airSlate SignNow help with my form 4506 f submissions?

AirSlate SignNow streamlines the process of completing and signing form 4506 f by providing an intuitive eSigning platform. You can fill out the form quickly, share it securely with required parties, and obtain signatures without the hassle of printing or faxing.

-

Is airSlate SignNow a cost-effective solution for managing form 4506 f?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, making it a cost-effective solution for managing form 4506 f. With our competitive pricing, businesses can access advanced features without breaking the bank.

-

What features does airSlate SignNow offer for form 4506 f?

AirSlate SignNow provides features like template creation, automated workflows, and real-time tracking for form 4506 f. These features ensure that your documents are organized, easily accessible, and efficiently processed, saving you time and effort.

-

Can I integrate airSlate SignNow with other applications for form 4506 f?

Absolutely! AirSlate SignNow supports integrations with various applications, allowing you to easily connect your workflow with the tools you already use. This means you can streamline the management of form 4506 f alongside other essential business processes.

-

How secure is airSlate SignNow for handling sensitive documents like form 4506 f?

Security is a top priority for airSlate SignNow. We implement bank-grade encryption and robust security protocols to protect your sensitive documents, including form 4506 f, so you can sign and share them with confidence.

-

What are the benefits of using airSlate SignNow for form 4506 f over traditional methods?

Using airSlate SignNow for form 4506 f reduces paperwork and the time spent on document handling. Unlike traditional methods, our electronic signature solution allows for faster processing, improved tracking, and easier collaboration among multiple parties.

Get more for Form 4506 F

Find out other Form 4506 F

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT